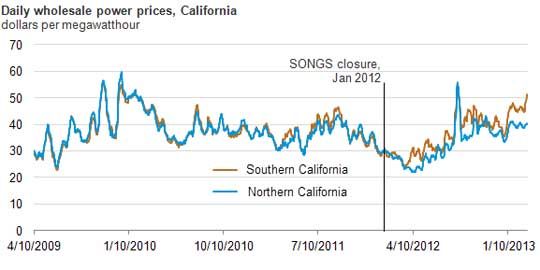

Prices in Southern California have risen in the past year due to the outages at both units of Southern California Edison’s San Onofre Nuclear Generating Station (SONGS).

The outage has lead to higher prices for the southern part of the state compared to the north, which traditionally track pretty closely. But for 2012, Southern California saw prices jump 12 percent higher than Northern California, according to new data from the U.S. Energy Information Administration.

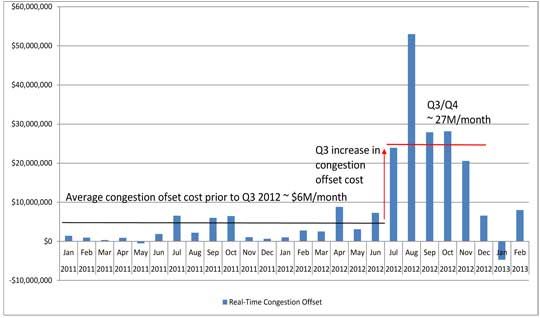

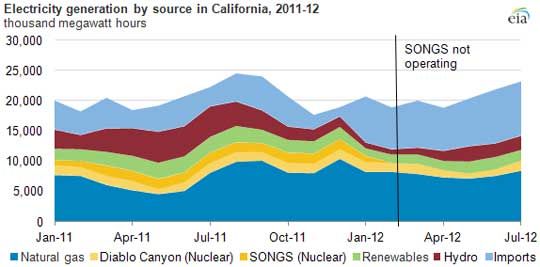

With SONGS offline, Southern California has relied on more natural gas, but also on imports from nearby regions. The cost increases, however, are due not only to bringing in other energy sources or paying for more expensive local ones, but also to transmission constraints.

Recently, the California Independent System Operator Corporation filed a request with the Federal Energy Regulatory Commission to reduce the price point at which the ISO relaxes the transmission operating limit and allows more electricity to flow on the lines. Currently, the price is set at $5,000, but CAISO wants to bring it down to $1,500 per megawatt-hour.

Rule changes and local, distributed generation are two solutions (although the chart below shows that renewables, for instance, did not greatly influence available generation when SONGS went offline). In addition, advanced controls for easing transmission constraints will have to become more widely deployed not just in California, but across the country.

The Department of Energy’s Advanced Research Projects Agency-Energy (ARPA-E) has put nearly $40 million into its Green Electricity Network Integration (GENI) program, aimed specifically at technologies to “modernize the way electricity is transmitted in the U.S."

Some of the funding is going to very early-stage projects, like DOE’s Oak Ridge National Laboratory, which is working on magnetic amplifiers for power flow control. Varentec, which has funding from ARPA-E and venture capital investors like Khosla Ventures, says it has a solution that can be wrapped into the existing grid and control the real and reactive power flow.

Another startup, with Battelle backing, is Gridquant, which has software that can calculate power flows with far more accuracy than the models the used currently, some of which are based on the same models used when the grid was built.

Smart Wire Grid, also a recipient of ARPA-E funds with VC backing, is working with Tennessee Valley Authority and Southern Company to apply its technology, which essentially valves the transmission line in order to allow power to be rerouted in a more flexible and cheaper way than current technologies.

Southern California is not the only region that needs solutions for power flow and transmission constraint. Texas grid operator ERCOT has already implemented a new transmission analysis tool to improve the accuracy of transmission limits, which allows the operators to use more wind than they would have been able to in the past.

In California, as well as in other regions, the barriers are not only technological but also regulatory with regards to transmission upgrades, along with outdated market mechanisms.

In the Pacific Northwest Demonstration Project, the DOE is testing transactive control to help the region’s balancing authority integrate and balance all of the wind being produced in the area based on pricing signals. PJM announced $2 billion in transmission upgrades to help solve constraint issues as coal plants retire and more under-used gas plants come on-line, along with more renewables and demand response.

Even if the Nuclear Regulatory Commission approves the SONGS plant to come back on-line later this spring, the issues surrounding transmission constraint will continue to grow, and not just in California.