AMSC (NASDAQ:AMSC), still struggling against international and domestic economic and political headwinds, has taken steps to cut costs and increase liquidity.

China’s Supreme People’s Court heard one of the AMSC copyright infringement cases against Sinovel on October 26. It is one of the smaller of AMSC’s efforts at legal recourse in China following Sinovel’s alleged abrogation of contracts and criminal violations of AMSC intellectual property (IP) rights. That the Chinese court heard the case at all could be a sign the wheels of justice are rolling. However, almost a month later, no decision has been rendered.

AMSC cut its workforce by 25 percent and is consolidating office space to lower operating costs and enhance liquidity. The changes will cut into AMSC's wind and grid business operations and be imposed across all its international locations. AMSC expects the moves to reduce annual expenses by approximately $10 million; total expenses will fall to less than $58 million by the fiscal quarter ending June 30, 2013.

"While the long-term prospects for renewable energy remain bright, conditions in the sector today are challenging," AMSC President/CEO Dan McGahn said. "Financing and cash flow among wind farm developers and wind turbine manufacturers have been constrained, which has impacted growth plans for some of our Windtec™ Solutions partners.”

AMSC will delay shipment to customers of Windtec wind turbine electrical control systems.

The impact of Sinovel’s actions have been profound. AMSC's revenues -- over $180 million in 2008 and over $350 million in 2010 -- fell to just below $80 million for fiscal 2011. At the end of fiscal year 2010, the company had over 800 employees. At the end of fiscal year 2011, there were 400 left. With the layoffs just announced, that number has fallen to 340.

For Q2 2012, AMSC delivered on its targets, McGahn reported recently. Revenues were $20.9 million, just better than Q2 2011’s $20.8 million. Its net loss was $15.9 million ($0.31 per share), versus a Q2 2011 net loss of $51.7 million ($1.02 per share). Thanks to the new austerity measures imposed to address its Q3 difficulties, AMSC now expects its third-quarter 2012 revenues to exceed $20 million and its net loss to be less than $24 million ($0.46 per share).

Sinovel led China's 2008-to-2010 wind industry explosion. AMSC provided turbine designs and power electronics and controls. With China’s unprecedented growth, AMSC found itself facing, by 2011, the hard job of diversifying away from a customer demanding 70 percent of its business capacity without letting new Sinovel orders go.

In March 2012, AMSC was still working at diversifying when Sinovel unexpectedly refused delivery of contracted shipments of wind turbine core electrical components. Sinovel told the Chinese media it refused the AMSC shipment because of a “failure to perform,” alleging that AMSC had provided “backward technology.”

Subsequently, an Austrian court found a former AMSC employee guilty of taking money from Sinovel for surreptitiously transferring proprietary computer codes for that supposedly “backward technology.” Evidence for conviction of the employee included emails containing the bribe offer, the technology transfer, and the money transfer, as well as proof the stolen technology is being used in a Sinovel customer’s turbines.

AMSC is pursuing recompense in Chinese courts. The October 26 hearing is about one of four cases, requesting a total of $1.2 billion in losses and damages, working their way through the Chinese legal system. The outcome is likely to set an historical precedent for what intellectual property protections are available to foreign companies in China.

AMSC’s present difficulties are aggravated by setbacks in the wind industry internationally.

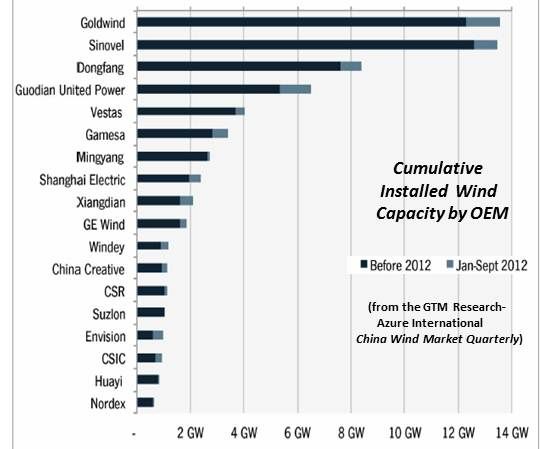

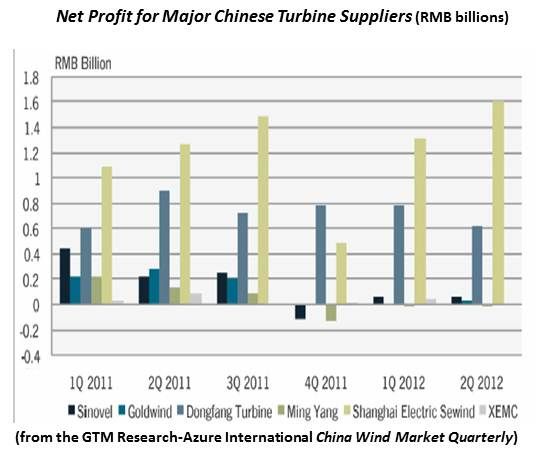

Source: The GTM Research-Azure International 3Q 2012 China Wind Market Quarterly

Indicative of troubles in China, described by a new quarterly assessment from GTM Research and Azure International as “the best of times and the worst of times,” are the uniformly discouraging 3Q financials from Goldwind, Ming Yang (NYSE:MY) and Sinovel, its three biggest players.

Goldwind announced a Q3 year-on-year operating revenue drop of 41.73 percent from Q3 2011 and a year-on-year net profit drop of 117.62 percent. In the first three quarters of 2012, company operating revenue dropped 36.88 percent year-on-year and net profit fell 93.74 percent year-on-year.

Ming Yang announced a Q3 year-on-year drop in wind power project output of 58.9 percent from Q3 2011, a year-on-year total revenue drop of 58.6 percent, a gross profit year-on-year drop of 55.1 percent, and a total income drop of 94.4 percent from Q3 2011.

Sinovel will lay off 350 workers following its announced Q3 2012 loss of 280 million yuan as compared to a Q3 2011 242 million yuan profit and an 82 percent drop in Q3 2012 operating income as compared to Q3 2011.

As causes for their difficulties, the Chinese turbine manufacturers cited issues that have impeded growth in the entire Chinese domestic wind market, including the structural obstacle of inadequate transmission and the economic obstacle of undispersed subsidies from the Chinese central government.

The China market slowdown, the collapse of the 2013 U.S. market due to the political impasse preventing renewal of the vital production tax credit (PTC), and the slowing of the European wind market due to the ongoing economic and fiscal downturn combined to impede AMSC’s efforts to grow its business and provoked the new cutbacks.

.

.

Source: The GTM Research-Azure International 3Q 2012 China Wind Market Quarterly