Almost a decade ago, Texas surprised everyone by surpassing the king of wind, California. Texas now has over 18,000 megawatts of wind power installed, compared to just 6,100 megawatts or so for California, coming from behind and quickly tripling California’s installed capacity. Could this same story unfold for solar power in the coming decade?

California remains the king of solar for now, with a comfortable lead. It has about 8,000 megawatts of utility-scale solar and about 4,000 megawatts of behind-the-meter solar, for a total of about 12,000 megawatts, according to this recent GTM article.

Texas has a paltry 600 megawatts or so of solar currently installed at the utility scale and an indeterminate amount installed behind the meter.

According to GTM's rankings, Texas fell from 8th place in 2014 to 12th in Q1 2016. But its installed solar capacity is on track to grow dramatically in 2016, so this ranking will change for the better by the end of the year.

With Texas actually dropping in the rankings in recent years, how could Texas go from small potatoes to market leader in solar? The market is set to ramp dramatically in 2016, with some forecasters projecting a sixfold increase to about 3,000 megawatts in 2016.

My crystal ball was quite good back in 2014 when I projected that Texas solar was due for a boom. 2016 is the proof in the pudding for that prediction. I wrote then:

The Texas solar market is still developing, but reliable evidence suggests that it is at the beginning of a boom period. And given Texas’ potential for solar power development, it is conceivable that Texas could surpass California as the nation’s biggest solar state, as it did with wind power a few years ago.

The Solar Energy Industries Association (SEIA) projects an installed capacity in Texas of 4,612 megawatts by 2020. This is still well shy of California’s current 12,000 megawatts, and even further shy of the growth in California that is expected through 2020 and later (much of the state’s 2020 33 percent RPS requirement is expected to come from new solar). In fact, a 2015 Union of Concerned Scientists report projected that California will achieve about 17 gigawatts of total solar by 2024 under current RPS requirements -- about 5 gigawatts more than is already installed. I’ll round up, to take into account uncertainties and the growth in behind-the-meter solar, and use 20 gigawatts as the figure for Texas to reach in order to surpass California on solar in the next decade.

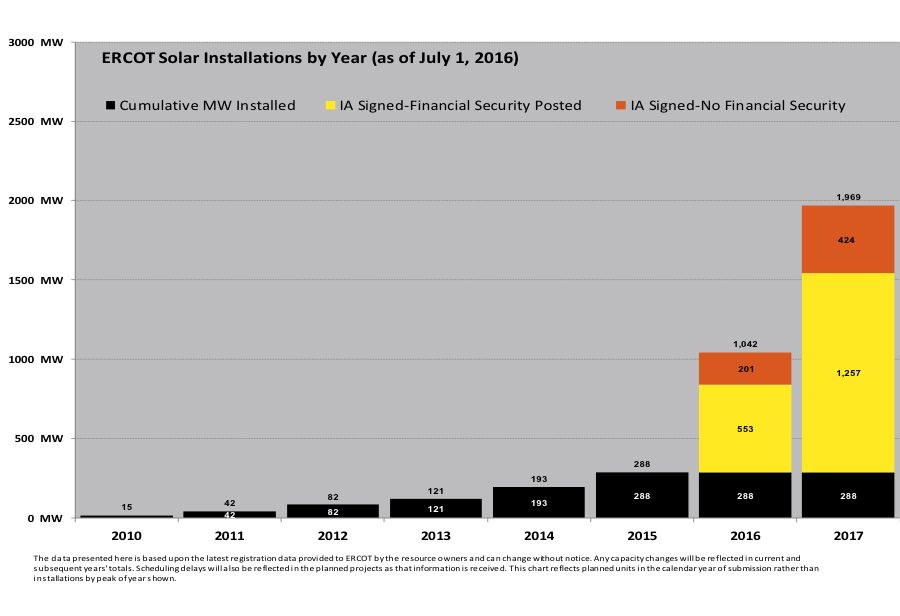

We can see how Texas might possibly catch California before too long when we examine the current interconnection queues. The queue of ERCOT, Texas’ primary grid operator, contains 8,117 megawatts for solar projects at various stages of the interconnection process, as of July. All of this won’t be built, of course, but it is a good indicator of what the future holds.

There are some projects in the interconnection queues for areas of Texas that aren’t in ERCOT -- but the large majority of solar projects are in ERCOT territory, so we’ll focus on ERCOT in this piece.

We can’t extrapolate this current queue data with great confidence into the future other than to say that solar in Texas is clearly booming and will, given the continued price declines for solar power, very likely continue to boom into the future. We can, however, look at possible growth rates and see what may happen based on known future growth.

Figure 2: Expected Texas ERCOT Solar Installations

Source: ERCOT GIS report, July 2016

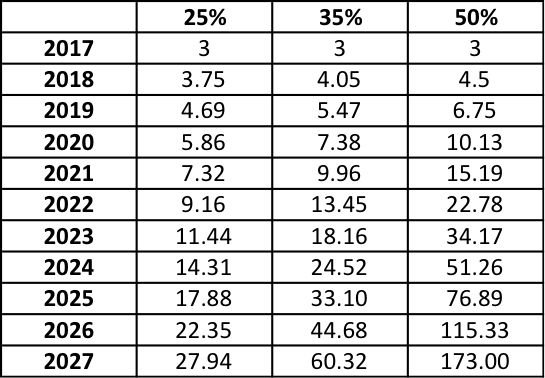

If we assume conservatively that Texas (including ERCOT and other areas) reaches 3 gigawatts installed, for both utility-scale and commercial solar, by the end of 2017 and a 50 percent average annual growth for the next 10 years, we reach a massive 173 gigawatts by 2027. But even at the more conservative and more realistic sustained growth rate of 25 percent, Texas still reaches 28 gigawatts by 2027, which would be more than enough to catch California.

Figure 3: Possible Texas Solar Growth

Source: Tam Hunt

Texas’ Competitive Renewable Energy Zones

A major reason for the Texas wind miracle is the degree to which Texas proactively invested in transmission line improvements to accommodate more wind power from the state’s windiest areas to the state’s population centers. This effort was focused on creating Competitive Renewable Energy Zones (CREZ) to facilitate wind power development beyond the state’s already impressive achievements in the first decade of this century.

Texas' wind resources are mostly in West Texas and the Panhandle, and most of its large cities are in East Texas. It made sense, given the growth of low-cost wind power in Texas, for ERCOT and state policymakers to invest heavily in the transmission grid to allow more low-cost wind power to reach population centers. Texas invested about $7 billion in transmission line upgrades to transport power from the largely undeveloped western part of the state to the developed eastern portions.

Interestingly, a very similar dynamic is unfolding now for solar, with the state’s solar resource far better in West Texas and the Panhandle than in the state’s more populated areas. Solar power can benefit, however, from the fact that Texas has already invested heavily in transmission line buildouts and solar power will increasingly be competing with wind power and other resources for available transmission capacity to wheel power from the sunniest areas of the state to the largest population centers.

We are already seeing most solar development in the state take place in West Texas, giving a strong clue about the pattern for future growth.

Sources of uncertainty for Texas solar

As is generally the case, a major hurdle for solar development is obtaining a power-purchase agreement (PPA) to sell power at a cost that makes the project financially viable. The biggest market for solar currently in Texas is the large municipal-owned utilities, like Austin Energy and CPS Energy (which serves San Antonio).

Another PPA option for Texas solar that avoids the RFP process is obtaining a PURPA contract at the utility’s “avoided cost” of power. This 1978 law was a major impetus for the early success of solar and wind in California in the 1980s and 1990s, and it remains in effect today in some states, though in far weaker form than it once was.

The avoided cost is too low, however, in most of Texas to provide a financially viable price for Texas solar. For example, the avoided cost for Xcel Energy in the Texas Panhandle is just 1.9 cents to 3.5 cents per kilowatt-hour. Even with very low costs for solar in Texas, this is too low to allow a profitable project.

At least one company has decided to forgo a PPA entirely and sell power directly into the Texas wholesale power market. First Solar’s Barilla Solar project was developed for wholesale transactions in 2014 but it’s not clear from the available data whether this project has been profitable under this model. I suspect it hasn’t been, because wholesale prices have stayed so low since 2014.

Obtaining a viable revenue stream from solar facilities will probably remain the largest hurdle for solar in Texas, and it is the biggest factor that may lead to substantial bottlenecks for robust solar development.

In sum, despite the current and future hurdles for solar in Texas, it is more than plausible that Texas could surpass California on solar, as it has done with flying colors for wind, in the next decade.