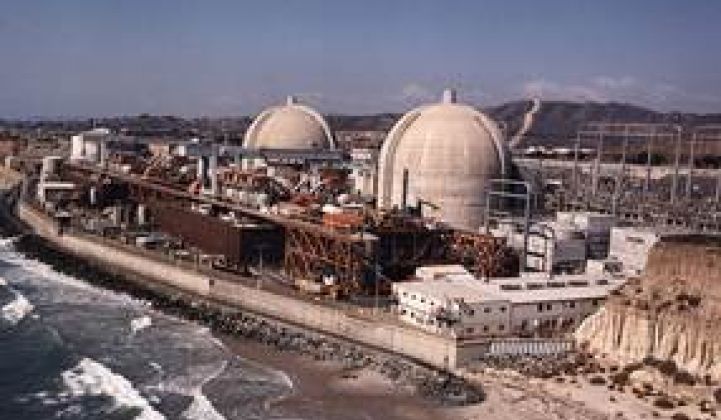

Southern California Edison (SCE) is a subsidiary of Edison International (EI), and EI's Q2 financials have been hit by the shutdown of the 2,300-megawatt San Onofre Nuclear Generating Station (SONGS).

And when the California Public Utilities Commission (CPUC) postponed its decision on whether to investigate SCE’s operation of SONGS, it was not giving SCE a pass; it was putting the utility on notice.

The CPUC’s responsibility, Chair Michael Peevey warned, is “ensuring that the lights stay on both this summer and in the years to come, if this unit ever operates again.” But it was too soon to act on Commissioner Michael Florio’s call for an Order Instituting Investigation (OII), Peevey said.

What initially appeared to be maintenance issues at SONGS Units Two and Three in January have kept both offline ever since. SCE, a 78 percent owner of the facility, and San Diego Gas and Electric (SDG&E), the major co-owner, have scrambled ever since.

Along with the California Independent System Operator (the ISO), the utilities have brought retired facilities back, inaugurated new transmission, and hardened demand response capabilities. In the shadow of the massive blackouts in India, all parties are bracing for peaking electricity loads during the heat of August and September.

“Core earnings of $0.32 per share,” reported EI CEO Theodore F. Craver, were “below last year's $0.56 per share.” This 43 percent drop, he went on, includes “continued inspection and repair costs related to the outage at the San Onofre Nuclear Generating Station.”

On November 1, Chair Peevey said that in deferring the decision to act now, “SCE is required to file notice pursuant to Section 455.5 of the Public Utilities Code. This is the state law that sets up a procedure if a power plant is out of operation for nine months -- and it requires this Commission to institute an investigation within 45 days.”

If SONGS is not in service by November 1, Peevey said, the CPUC is required by law to issue the OII and “consider all the costs and reliability issues presented by the SONGS outage.”

_540_449_80.jpg)

The U.S. Nuclear Regulatory Commission (NRC), which is responsible for licensing nuclear facilities, determined that “faulty computer modeling inadequately predicted conditions in the steam generators and manufacturing issues contributed to excessive wear of the components,” Craver reported. “The excessive wear arose from tube-to-tube contact caused by vibration in the tubes.”

The NRC, Craver added, “has identified a number of outstanding issues that it is still reviewing.”

SCE, Craver said, is working with Mitsubishi Heavy Industries, which designed and manufactured the retrofitted SONGS steam generators in 2010, as well as other industry experts and steam generator manufacturers, to analyze causes and find fixes. But “to date,” he admitted, “the inspection and repair effort is focused on a substantial amount of technical analysis work and preventative plugging of tubes.”

In reply to speculation that SCE is hurrying to restart one of the units, Craver said SONGS “will not be restarted until SCE determines that it is safe to do so and when startup has been approved by the NRC.”

What that essentially means, Commissioner Florio noted, is that the CPUC “will be proceeding with the investigation, just not today.”

Section 455.5 states that, if the CPUC investigates a facility, “rates associated with that facility are subject to refund from the date the order instituting the investigation was issued.”

Several nuclear industry watchers, including Geesman and Dickson Partner John Geesman, formerly of the California Energy Commission, told GTM this could be a potentially significant financial hit for SCE.

Edison Mission Energy (EME), the other major EI subsidiary, is already in deep financial trouble.

“EME will not have sufficient liquidity to repay the $500 million in unsecured debt due in June 2013,” Craver reported. If that debt cannot be restructured, “EME would need to be reorganized under new ownership.”

_540_449_80.jpg)

SCE’s annual revenue requirement for SONGS, according to EI CFO W. James Scilacci, is $650 million. A Section 455.5-initiated investigation could force SCE to write off all or part of that, Geesman said.

Craver said he expects a “reasonableness review” by the CPUC to relieve SCE of such a burden. An expert in utility matters who requested anonymity called Craver’s conclusion “retroactive ratemaking” and “illegal.”

Craver also said EI would go to Nuclear Electric Insurance Limited (NEIL) for cost recovery. “We have placed NEIL on notice of potential claims, although insurance recoveries remain uncertain.”

They are uncertain, Geesman said, because NEIL is less an insurance company than an industry pool, and it is unclear what its resources or responsibilities are.

Geesman agreed with Craver’s assessment of losses recoverable from Mitsubishi. Its obligation, Craver reported, is “limited to $137 million.” That is, Geesman said, nowhere close to SCE’s cost for the outage and repairs.

Everyone interviewed on and off the record for this story agreed that Unit Three is unlikely to be back on-line in the foreseeable future.

Even if SCE brings Unit Two back before an investigation is triggered, Geesman estimated from EI’s financials and other public statements that the total cost for the last seven months would be greater than $190 million.

And, Geesman noted, “If you bring Unit Two back on-line just for a brief time, have you reset the nine-month clock? And I want to emphasize this company is notorious for shenanigans.”

It appears Southern Californians will be paying more to keep the electricity flowing this year.