California is leading the nation on energy storage procurement, as is often the case when it comes to energy and environmental issues. While there is still much debate about the proper role and costs of energy storage on our grid, California’s policymakers have made their preference clear: they want to see utilities making prudent investments in this new set of technologies with the goal of transforming the market in the next decade.

A key feature of California’s approach to energy storage procurement is a legislative requirement that all storage that is procured must be cost-effective. AB 2514, the relevant law here, doesn’t specify exactly what this means. What's more, the California Public Utilities Commission (CPUC), tasked by the legislature to implement this law, also punted on the issue of defining cost-effectiveness. The CPUC instead gave the utilities a large amount of discretion to determine their own notion of cost-effectiveness, but with CPUC review and accountability after the fact. Most essentially, cost-effectiveness requires that the benefits of new storage facilities outweigh the costs. But exactly how this accounting is to be done is what has been left to utility discretion.

Given the utilities’ longstanding wariness about procuring any resources that may cause an increase in rates, the risk in this new situation seems to be that the utilities will be overly hawkish on cost issues, rather than dovish, but time will tell.

While AB 2514 was passed in 2012, the CPUC just finished implementing the new procurement process by approving in a final decision the utilities’ proposed procurement programs. D.14-10-045, issued by CPUC on October 23, gave the final seal of approval to these programs.

The utilities must procure 1.325 gigawatts of new storage by 2024, with four biennial procurement periods that are slated to start this December. The new program ramps up slowly, however, because the CPUC recognizes that this is a new market and costs are likely to come down considerably over time with scale and technology improvement. The first biennial period will include only 16 megawatts of new storage for SDG&E, 80.5 megawatts for PG&E and at least 16.3 megawatts for SCE (but SCE has stated its intent to procure more if it receives attractive offers).

SCE will also procure 50 megawatts of energy storage through another program (the Long-Term Procurement Plan process that went live in December 2013).

The Self-Generative Incentive Program is another California program that provides rebates for behind-the-meter storage systems.

The CPUC’s new energy storage procurement framework

The first request for proposals under the new energy storage procurement framework, finalized with the recent CPUC decision (D.14-10-045), will hit the street in December of this year. The bar for entry won’t be low, however. Interconnection requirements, for SCE in particular, will be stringent. SCE is requiring that a Phase I study or its equivalent be completed prior to making a bid. PG&E is requiring that an application for interconnection be made prior to being shortlisted, but it may also increase its requirements.

The point of requiring some completion of interconnection work before a bid is submitted is to give the utility more insight into the viability of the proposed project before approving it. The downside of this kind of approach is that any company wishing to even bid into the program (let alone win a contract) will have to spend a lot of money and time just to make a bid. As I discussed in my last article, this is far too often the case, and policymakers often overlook the economic benefits of a more egalitarian energy policy.

Importantly, the final CPUC decision required that each utility specify the megawatts they’ll be requiring for each type of storage ahead of time. This wasn’t required previously.

The utilities will require bids sometime early in 2015, and the CPUC has allowed them up to a year to determine their shortlists from the initial bids. The CPUC is also allowing utilities to defer up to 80 percent of their required procurement until a later period if the utility can demonstrate that it has received no cost-effective bids.

In order to prove this, the utility must use its proprietary (i.e., not public) evaluation protocol to determine cost-effectiveness. It must also use a Common Evaluation Protocol (CEP), which is public and standard among all three utilities, but despite its name, won’t actually be used to evaluate bids. Rather, the CEP will be used only to benchmark and report on bids received, which will provide some transparency for bidders and others after the fact.

The CPUC will then check the utility’s determinations against each utility’s proprietary protocol and determine if deferment is warranted -- or, if the utility is seeking approval of bids, whether that approval is warranted.

In sum, the energy storage RFP process will be a long one and not for the faint of heart. While California’s policymakers have made it clear that they plan to develop the storage market in California in the next decade, it’s going to start out slowly and the program has many offramps to protect ratepayers from any net costs.

This new program is certainly a big opportunity for companies seeking to tap into the coming tsunami of energy storage in the U.S. and around the world -- but it won’t be an easy target to hit.

Do we need storage?

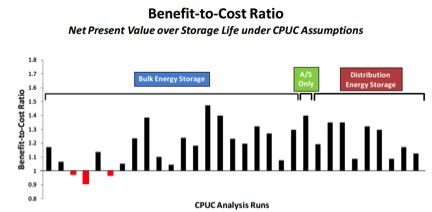

As noted, there is still an ongoing debate about the appropriate role of storage on our grid. Almost everyone acknowledges that storage costs are still higher than they should be. However, a major reason that the CPUC opted for this new procurement program stems is the findings of two reports it commissioned as part of the energy storage proceeding (R.10-12-007) from the Electric Power Research Institute and DNV KEMA. Both reports found under the cost assumptions used that storage would probably be cost-effective in almost all scenarios examined. This was the case because these studies included figures for a number of revenue streams that are feasible from energy storage devices. So a full accounting of the various costs and benefits of energy storage by these two entities found that energy storage could be cost-effective today. Figure 1 shows a summary of EPRI’s findings. Only the red columns were found not to be cost-effective.

FIGURE 1: EPRI Findings on Cost-Effectiveness of Energy Storage, 2013

Source: Electric Power Research Institute

The cost figures come from a database maintained by the Department of Energy’s Sandia National Labs and from surveys of energy storage companies. These figures may surely be optimistic or even aspirational. And that’s why the CPUC has focused on ensuring cost-effectiveness as part of its new procurement system: it’s not simply relying on assurances from the DOE or storage companies.

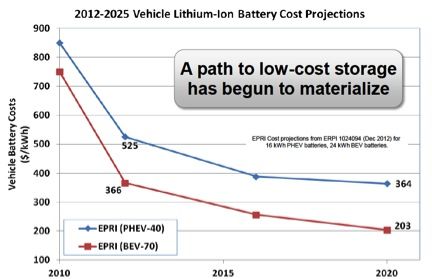

The EPRI report includes cost projections from its own late 2012 analysis of the vehicle energy storage market, concluding that cost will drop by 40 percent by 2020. I haven’t seen an update to this 2012 report, but it is likely that cost projections would be even more optimistic now, given the rapid increase in energy storage technologies around the world.

FIGURE 2: EPRI Projections for Battery Storage Costs, 2012

Source: Electric Power Research Institute

My own (perhaps aspirational) hope is that the rapid advances in vehicle battery storage will transfer readily to the stationary storage market. They’re often different technologies, of course, but the similarities seem significant enough to allow for some substantial transfers of knowledge and attendant cost declines. The EV battery storage market is bigger than the stationary storage market for now, so the learning curve that comes from scale in the EV battery storage market should be at least in part transferable to the stationary market.

The concerns about storage and its proper role are almost entirely mitigated under AB 2514’s cost-effectiveness requirement, and much of the debate about storage seems to revolve around an assumption that it won’t be cost-effective. We’ll see how the process unfolds in California, but it’s looking for now like the risk is utilities' long-established tendency to exhibit hawkishness with respect to cost rather than dovishness.

In terms of whether storage is required, most observers would agree that storage isn’t required until renewable energy penetration is far higher than it is in the U.S. and elsewhere. A recent study of Germany, for example, found that storage wouldn’t be required to balance that grid’s renewable energy for ten to twenty years, and that there are many lower-cost options available before storage would be required.

However, in jurisdictions like California that have large amounts of solar already on the grid, storage could be very beneficial at the current juncture. This is because the California grid is already having a hard time absorbing all the solar power going on to the grid during peak production times. Rather than curtail this production, as is currently happening, it may be more cost-effective to absorb that power in batteries or other storage media and use it later.

EV storage is already here today in large amounts, and it is growing steadily. The CPUC is currently working (in proceeding R.13-11-007) on new rules that would incentivize owners to let grid operators use “smart charging” to absorb excess solar power and other grid stabilization functions. Using this existing storage resource renders moot the debate about costs of procuring new storage, and the new CPUC procurement program includes a behind-the-meter component for EV storage and other technologies.

Storage is very much here already, particularly with the EV revolution happening now, but it seems that the stationary storage market that the CPUC has implemented with AB 2514 will be a slow burn and more evolutionary than revolutionary.

***

Tam Hunt is the owner of Community Renewable Solutions LLC, a renewable energy project development and policy advocacy firm based in Santa Barbara, California and Hilo, Hawaii.