Elon Musk, Tesla Motors’ CEO and pitchman, planned to call Tesla’s first affordable electric vehicle the Model E. You know, alongside the Model S and Model X. And the Model Y was to come later. But Ford ruined this adolescent fun by suing Tesla over the use of the Model E name, so the name was changed to the rather unsexy “Model 3.”

But while the name may not be particularly sexy anymore, the car itself, revealed on March 31 for the first time, is indeed a sexy car. And it is sexy not only because of its curvaceous lines, but also because of its likely impact on the world and our environment.

Figure 1: Tesla’s New Pre-Production Model 3

This article will explore the implications of the Model 3 and how it fits in with national and international goals to reduce carbon emissions and wean ourselves from fossil fuels. The one-line conclusion: The Model 3 will likely go down in history as a product as important or even more important than Ford’s Model T, first offered in 1908.

Ford’s Model T was the first affordable automobile. It was a vehicle that came in just one color for most of its 20-year production run (black), and it had a top speed of about 45 miles per hour. But as unflashy as the Model T was by today’s standards, it was incredibly flashy in terms of its impact on our how we move people and goods, and on our culture more generally. It made cars ubiquitous, ending the age of horse-drawn carts and other premotorized forms of transportation, and at its sales height, it made up half of the car market in the U.S.

Figure 2: Ford’s 1908 Model T

A brief history of the electric car

It is a little-known fact that EVs were the most popular type of vehicle at the dawn of the vehicle era, before the Model T came along. In 1899, more EVs were sold than gasoline-powered cars. Although the numbers were small (about 1,500 EVs were sold in that year), EVs were nonetheless the dominant technology for at least a decade in the very early era of the private automobile. But in the next decade, Mr. Ford came along with his Model T and ensured the ascendancy of petroleum-powered cars for the next century.

There were a number of fits and starts in the EV industry, with new companies and new models appearing every couple of decades, but at no point were EVs anywhere near as dominant as they were at the dawn of the automobile transportation revolution. Most adults living now are aware of GM’s EV1 and the tawdry history of that vehicle in the 1990s. But that phase of the EV revolution also died. There was even a movie made about it: Who Killed the Electric Car?

Figure 3: Thomas Parker’s 1884 Electric Vehicle Design

It seems, nevertheless, that the latest phase in the development of EVs, beginning in 2008 with the introduction of Tesla’s Roadster and continuing in 2010 with the introduction of the Nissan Leaf and Chevy Volt, is likely to be a lot more than a blip in automotive history. EVs have come on strong in the last five years, with dozens of EV designs either on the market today or soon to be. Sales are picking up quickly, albeit from a very modest starting point. Global sales topped the 1 million mark in 2015.

Musk’s Model 3 is not even in production yet, but it holds the realistic promise of becoming far and away the biggest-selling pure EV to date. The Model 3 already has over 325,000 preorders, requiring a $1,000 refundable deposit (I’m one of them; can’t wait to get my mitts on that spaceship steering wheel).

It seems very likely, considering that over 325,000 preorders occurred in the first week of the announcement, that preorders will break the 500,000 mark before production of the vehicle starts in late 2017 -- and perhaps far more. Even at the current number of preorders, this will, if a reasonable number convert into sales, be the biggest product launch in history in terms of dollar value.

At 325,000 preorders, and an average cost of $42,000 per vehicle (Musk’s estimate for the average option level over the base $35,000 price), Tesla has the potential for sales exceeding $13.5 billion in just meeting preorders. At 500,000, this figure rises to $21 billion, which is about two-thirds of the current market capitalization for Tesla.

The best-selling pure EV thus far has been the Nissan Leaf, a highly functional little car loved by owners but with a limited range of around 90 miles or less per charge, and just over 200,000 global sales by the end of 2015. The Leaf has been available since late 2010, and the 2016 model now has a range of 107 miles. Based on Model 3 preorders so far and the general reception of the Model 3, it seems that the Model 3 will far outsell the Leaf, perhaps even in its first year of full production.

If we include hybrid electrics in the EV category, however, the Prius will be hard to beat. Toyota has sold over 5 million Prius (Prii?) models to date. The Prius is a real sales phenomenon that receives far too little attention. Will the Model 3 catch the Prius? It’s impossible to say yet, but if the Model 3 is anywhere near as good a car as it seems to be from details available, and if Tesla can ramp up as rapidly as it plans to get to 500,000 vehicles per year, it has a good chance of passing the Prius in the fast lane. But that will probably take a decade or longer to happen.

Big ripples

The biggest impact of the Model 3 will not, however, be direct. Rather, the biggest impact will probably come from the many competitors to the Model 3 that its success will motivate. Tesla has already had a strong influence on EV development in its 10-year lifespan, starting with the Roadster in 2008. Tesla led the way in showing that EVs could be cool and sexy, all part of Musk’s “master plan” to get to the Model 3. There are now 16 pure EVs on the U.S. market, and many more on the way, up from zero before the Roadster. Adding plug-in hybrids (gas and electric drive, like BMW’s i3 or the Chevy Volt), we get 30 models available today and dozens more on the way.

The Chevy Bolt, Chevy’s version of an affordable EV with over 200 miles of range, is planned for release later this year. Chevy isn’t taking preorders, so it’s hard to know what the demand will be for what appears to be a solid but unflashy long-range EV hatchback. My best bet is that Bolt sales will be decent but far from the hundreds of thousands a year that Tesla is hoping will materialize for the Model 3.

A number of manufacturers have announced plans to electrify their fleets by offering electric versions of all or most of the cars they make, including BMW over the next 10 years, Mercedes, with 10 new plug-in models by 2017, Volvo by 2019, and VW with 20 electric models by 2020.

Those are some big ripples.

Are these ripples big enough to make a difference?

As impressive as Tesla has been so far, and as promising as EV sales have been so far, we are still at a point where EV and hybrid sales are a relatively tiny part of the total car market. And if EVs are to live up to their promise of ushering in a world free from fossil fuels and catastrophic climate change, we need to see fuel-efficient cars jump dramatically in sales.

U.S. EV and PHEV sales in 2015 reached the key point of about 1 percent of total car sales. As I’ve described in recent columns, however, this is halfway to ubiquity in terms of the required doublings, under Kurzweil’s law of exponential returns. The law is mathematically true, but there’s nothing inevitable about the annual growth rates at issue and thus the time periods required for each doubling. EV and hybrid sales in the U.S. actually slowed in 2015, showing a negative rate of growth, which has alarmed me and many other EV advocates. Globally, however, EV sales have continued to grow.

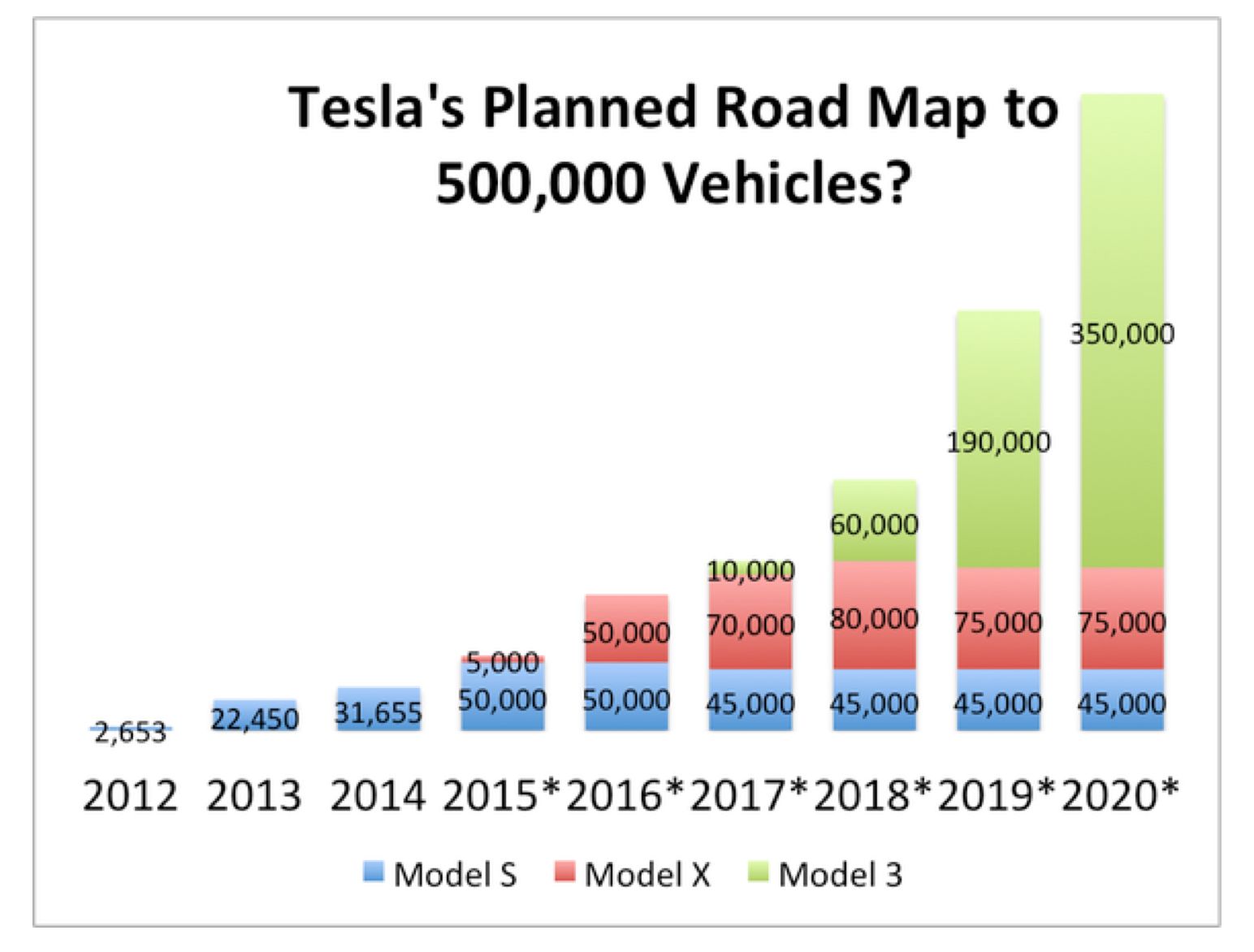

Let’s look to the future to see if we can shed any light on what we can reasonably expect in terms of EV sales. In doing so, we must necessarily engage in broad speculation and offer some possible sales scenarios for analysis. Let’s agree, for argument’s sake, that Tesla does reach 500,000 EVs sold by 2020, including a mix of Model 3s, Xs and Ss (and maybe Ys?). The sales chart could look like this, as Motley Fool analyst Daniel Sparks reasonably calculated in 2015:

Figure 4: Possible Tesla Sales Growth by 2020

Source: Motley Fool

Sparks makes the insightful point that sales growth projections for the Model 3 should look to the Model S alone as examples, because the S and X are the only long-range EVs on the market today. The Model X is brand-new, so sales figures aren’t really helpful in seeing the future just yet. But the Model S has been on the market since 2012 and has seen strong sales growth each year except for 2013, when it dropped 5 percent. It was the world’s best-selling EV in 2015, somewhat surprisingly, given that its average sale price is around $100,000. Sales growth has averaged 44 percent for the last two years and is up in the first three months of the year -- 36 percent from 2015’s first quarter.

And, importantly, keeping in mind that Tesla has been production-constrained rather than demand-constrained in its sales thus far, reaching 500,000 total Tesla sales by 2020 seems entirely plausible if Tesla can build the necessary infrastructure. The Gigafactory is operational already, but not at full production, and Tesla’s Fremont factory previously produced 500,000 vehicles a year for General Motors, its former owner, lending some weight to these projected sales figures.

Let’s assume that two-thirds of 500,000 vehicles are sold here in the U.S. Based on the growth in EV models and sales more generally, it seems reasonable to suggest that we’ll see a total U.S. EV market at least four times the size of Tesla’s market share. (Tesla’s market share for pure electrics in the U.S. in 2015 was about 25 percent.)

Four times 333,000 is about 1,333,000, which will be about 8 percent of the 2020 U.S. total car market. We can expect about the same number of plug-in hybrid (PHEV) sales, bringing our total in 2020 to about 15 percent of the total U.S. car market. Over the course of the next decade, until 2030, it is not unreasonable to expect that EV and PHEV sales will reach 50 percent of the total market, particularly as battery prices continue to decline and cars continue to get lighter, thus extending their range farther and farther.

The U.S. EV market currently accounts for less than 20 percent of the global market. We can expect similar market dynamics to unfold around the world from 2020 onward, and my view is that we may well see around half of the global car market be made up of EVs and PHEVs by 2030. We would then be well on our way to getting off oil in transportation.

EVs are no panacea

EVs are far better for the environment and our climate than today’s internal combustion engines or even today’s hybrids, but there is a counterintuitive effect of very fuel-efficient cars: some people drive more when they feel less guilt from their new mode of transportation. This is known as the “rebound effect.”

The real promise of the EV revolution, however, is that it can, in principle, completely decarbonize transportation. Electrification of transportation can take place not just in cars, but also in trains, buses and even in airplanes (though electrifying large passenger planes may always remain out of reach). If our electricity system is completely renewable, it won’t matter, at least from a climate perspective, if some people drive more from guilt-free travel; other impacts will, of course, still occur because no energy sources are impact-free, even renewable energy sources, so we can’t forget about these impacts even if our grid is completely based on solar, wind, etc.

China is now pioneering the EV revolution, taking the top spot for EV sales in 2015 away from the U.S. The leader in per-capita sales, however, is still far and away Norway, where Teslas sell as easily as mulled wine on a winter day.

But no matter how stellar EV sales are from 2020 onward, it is clear that to reach national and international climate-mitigation goals, we’ll need a very strong dose of conservation with increased walking, bike-riding, carpooling, buses and train travel. China and India alone will, if they reach parity with Western income standards, demand cars far in excess of all the vehicles on the roads around the world today. That’s not very sustainable, no matter what the fuel source is for those cars.

What could go wrong?

Caveats are in order in making any predictions about future sales. A great many things could go wrong. At the very least, Tesla has a record of multi-year delays in reaching full production of its vehicles, so it will be no surprise if the Model 3 is delayed until 2018 or even later.

The Nissan Leaf, first available in 2010, provides a cautionary tale about unbounded optimism; however, on a much smaller scale. Nissan received over 20,000 preorders for the Leaf in 2010 but ended up only selling about 10,000 units through 2011 and about the same in 2012. Clearly, many of the deposits did not convert into purchases.

This may not be a good indication of what is in store for Tesla, however, for a few reasons. Even if half of all Model 3 preorders are canceled, it is very likely that the 500,000 or so preorders, reduced by half to 250,000, will still be far too many for Tesla to produce in the first year or even two years of production. Second, the Leaf never had the sex appeal that Teslas have, and that kind of brand sexiness is very important in converting preorders into sales. For better or worse, Tesla is the Apple of cars, and people really (I mean, really) love their Teslas. Third, the range anxiety that might have lead many Leaf preorders to disappear won't be present for the Model 3.

There is also some concern about federal tax credits and state rebates for the Model 3 running out. The federal $7,500 tax credit (not a deduction, a credit) is a large incentive for EVs and it is cut in half after the first 200,000 vehicles sales by each manufacturer. The fear with the Model 3 is that Model S and X sales will ramp up by 2018 such that much if not all of the full credit will be exhausted by the time Model 3 sales begin.

This possibility is real, but it seems more likely that a good number of the 325,000 reserved Model 3s will enjoy the full tax break, or at least half of the credit, because the tax credit actually goes to half of the $7,500 amount in the calendar quarter after the 200,000 sales mark is reached, and then for the next two quarters goes to 50 percent of the amount, and for the two quarters after that goes to 25 percent. This will give an additional year for reservations to be met with at least some of the credit available to those buyers.

The degree to which Model 3 owners will enjoy the full credit, or half or 25 percent will, accordingly, depend entirely on Tesla’s ability to meet its announced production schedule.

Some states, like California, have a state rebate in addition to the federal tax credit. The California rebate is $2,500 for a pure EV like the Model 3, and there are no plans to phase this out. The federal tax credit plus the state rebate bring the sticker price of the Model 3 to a very affordable $25,000. However, wealthy individuals and families may no longer qualify for this rebate, because it was amended in 2015 to prevent the rebate from going to those deemed to be able to afford an EV without state help.

In closing, the Model 3 is set to be a transformative vehicle. The degree to which it achieves true transformation of the car market and our culture more generally will depend on how well Tesla executes its ambitious vision in the next few years.

•••

Tam Hunt is a lawyer and owner of Community Renewable Solutions LLC, a renewable energy project development and policy advocacy firm based in Santa Barbara, California and Hilo, Hawaii, co-founder of Solar Trains LLC, and author of the new book, Solar: Why Our Energy Future Is So Bright. Disclosure: Hunt owns some Tesla shares.