Privately held fuel cell builder Bloom Energy has shared little about its technology and finances over the last decade, but one thing is certain: the company keeps adding big names to its list of marquee customers.

CenturyLink, the third-largest telecommunications firm (and second-largest colocation company) in the U.S., just announced that it is deploying a 500-kilowatt "mission-critical" Bloom installation at its Irvine, Calif. colocation and cloud service data center.

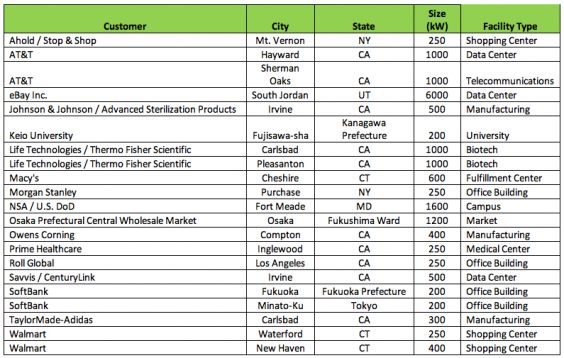

CenturyLink joins data center heavyweights Apple and eBay in the stable of Bloom clients that includes FedEx, AT&T, Wal-Mart, Google, NASA, Verizon, Ikea, Staples and Coca-Cola. We expect more Bloom customer announcements next week.

Why are these Fortune 500 companies buying fuel cells and power from Bloom?

"Mission-critical"

We spoke with Drew Leonard, VP of Global Colocation at CenturyLink. He said, "Obviously, the biggest cost in the data center is energy consumption," adding that a service provider "must control that cost as much as possible." Peter Gross, VP of mission critical systems at Bloom, suggested that Bloom's fuel cells allow data centers and cloud service providers to have "alternative solutions that will meet both their reliability and sustainability goals.”

CenturyLink purchased the fuel cells outright, as did Ikea.

Leonard told GTM that primary power is provided by the fuel cell, with the grid as backup and a diesel gen-set as further backup. He added, "We buy power from the utility through a combination of hedging and contract buys."

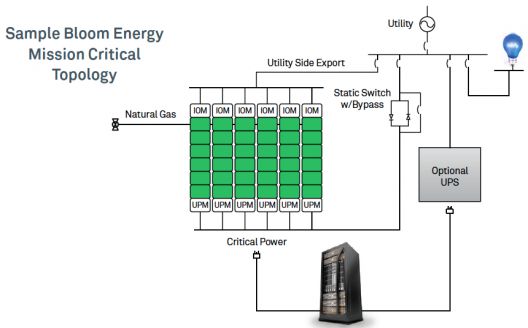

Bloom's mission-critical group claims its on-site primary power generation system is "grid-independent" and "more reliable, cleaner, and a cost-effective alternative" to the traditional electric grid. Bloom also says its "new data center topology...greatly simplifies the architecture and eliminates the need for many legacy components," such as diesel generators, switchgear, and transfer switches, and "reduces the need for high-voltage interconnection infrastructure."

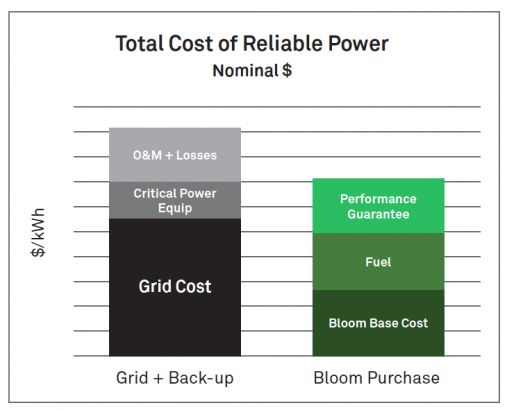

The metric that Bloom applies to these mission-critical applications is "total cost of reliable power."

Below is a power generation topology deployed at eBay. Each 200-kilowatt Bloom fuel cell contains six modules that provide a level of independent operation and redundancy, according to the firm.

Figure: Bloom's "Mission-Critical" Topology

Source: Bloom Energy

EBay's energy usage is driven by its data center and online commerce operations. In 2013, eBay deployed 6 megawatts (30 Bloom units) at its Salt Lake City, Utah data center for primary on-site power. Here's a white paper on eBay's data center which finds that the fuel-cell configuration is more reliable, more efficient, and has a smaller carbon footprint. Apple has deployed a 10-megawatt fuel cell installation for its data center in North Carolina.

The VP of CenturyLink noted, "If gas supply shuts down, we move to electrical." He added, "With the 500 kilowatts, we get some decreased reliance on the grid -- but it also allows us to evaluate the overall technology as part of our critical infrastructure."

Looking at fuel-cell costs

The U.S. is increasingly burning cheap natural gas -- but centralized power generation, transmission and distribution has a high rate of loss. The conversion efficiency of a gas-fired power plant to a residential wall plug is about 35 percent, according to Lawrence Livermore National Laboratory's "spaghetti chart." Making electricity from gas, close to the user, has the potential to be cheaper and more efficient than centralized gas-fired power.

According to the EIA, 1,000 cubic feet of natural gas produces 99 kilowatt-hours of electricity (based on some assumptions about the generator and fuel use). So natural gas that costs $3.00 to $4.00 per unit and is converted at a fuel-cell efficiency of roughly 50 percent yields electricity at about 3 cents to 4 cents per kilowatt-hour -- much cheaper than the national average of 12.1 cents per kilowatt-hour.

Without using actual numbers, Bloom suggests that it can supplant the grid and provide a cheaper solution than a grid-plus-backup configuration. Bloom also contends that its solution is cost-effective and allows customers to lock in the price of natural gas for the long term.

In the current wave of cheap natural gas, Bloom wins on fuel prices. But Bloom has not revealed its capex costs, nor its fuel-cell stack reliability data. Bloom's challenges include the volatility of the natural-gas market, loss of state-level subsidy regimes, and stack rebuild costs.

These unknowns loom large in the mystery that surrounds Bloom.

But one thing is certain -- a long list of global customers see the value in the Bloom fuel cell.

Figure: Announced Bloom Energy Customer Sites With Systems Deployed in Uninterruptible Power Format

Source: Bloom Energy

We've reported on Bloom's spectacularly negotiated deal with Delaware utility Delmarva Power. We've covered the debatable "greenness" of the Bloom fuel cell. We've profiled the fuel-cell industry as a whole. Last year, Bloom took in $50 million from The New Zealand Superannuation Fund, while Exelon, the Chicago-based competitive energy provider, agreed to finance 21 megawatts of Bloom's fuel-cell deployments in any state with a favorable subsidy regime. Investors in the firm include KPCB, NEA, Advanced Equities, Goldman Sachs, DAG, GSV Capital, Apex Venture Partners, Mobius Venture Capital, Madrone Capital and SunBridge Partners. Board members include John Doerr of KP, AOL founder Steve Case, and former U.S. Secretary of State Colin Powell.