One of the few remaining drivers for the growth of renewables is the individual state mandate, called a Renewable Energy Standard (RES) or a Renewable Portfolio Standard (RPS), requiring utilities and other load serving entities (LSEs) to obtain a specific portion of their power from renewables by a specific date.

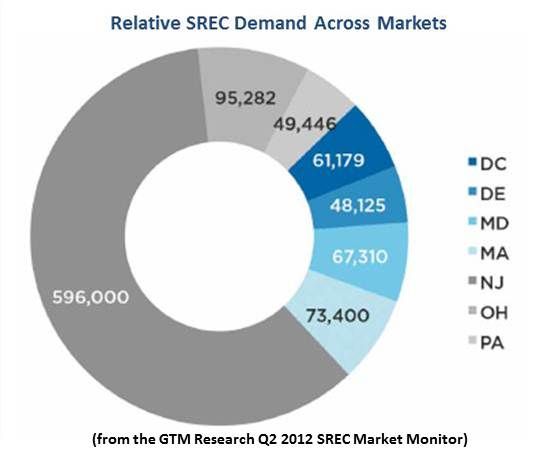

Some states allow LSEs to meet a portion of their obligation with renewable energy credits (RECs), and REC trading markets are emerging. Sixteen states and D.C. have specified a portion of the renewable requirement for solar alone. Seven of those states have markets specifically aimed at the trading of solar RECs (SRECs).

“The intent of the RPS legislation,” explained Reznick Think Energy President Mark Crowdis, “is to promote the installation of new solar systems. Buying and selling of SRECs supports that.”

Reznick Think Energy works with renewables investors and developers. Its interest is not in playing SREC markets, which can seem risky and complicated, but in seeing that solar builders get the additional economic benefit of SRECs.

According to SRECTrade and GTM Research’s Q2 2012 SREC Market Monitor, “the SREC model as a mechanism to promote solar growth has become a major part of solar finance [and] will continue to have a significant impact.”

In states with SREC markets, Crowdis said, solar developers currently have four primary revenue sources: The 30 percent investment tax credit, accelerated depreciation, the sale of electricity, and SRECs.

Crowdis, who has been involved with renewable energy since 1997, was involved in a 42-kilowatt project on a big-box retail store in Pennsylvania in 1999, possibly the first SREC sale. “It was extremely small,” he laughed, “but at the time that was the largest PV system east of the Mississippi.”

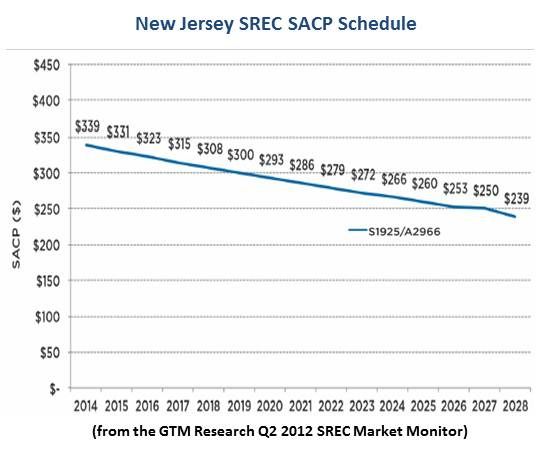

More than 30 states have mandates, Crowdis explained, but many don’t have an alternative compliance payment (ACP), which, he said, “is a cornerstone.” It is the penalty LSEs must pay if they don’t meet the solar requirement by building new solar generation or purchasing SRECs.

If the ACP is so low an LSE “can just pay the penalty or they have no penalty cost,” Crowdis said, “utilities and others are not incented to buy.” The ACP, Crowdis added, “sets the top of the market, the high price for the market. If somebody tries to sell SRECs at a higher price, people will just pay the ACP.”

If the market is undersupplied, Crowdis said, “the SREC value will increase close to the ACP. And if the market is oversupplied, the price will remain low until there is demand. The way we see it,” he explained, “the market will be just like natural gas: the market gets undersupplied and the price goes up. People build out natural gas facilities, they oversupply the market, the value of natural gas decreases and the cycle starts over again.”

Each of the seven states that has an SREC market has a different market structure. “It’s sort of like the Articles of Confederation, where every state decides to do their own approach,” Crowdis said, “but the whole SREC market approach is new. States are still grappling with it.”

New Jersey’s SREC program, GTM Research noted, was what drove it past California to become the largest U.S. retail solar market.

Crowdis likes the New Jersey model, he said, because “it is an active market mechanism” and “is going to interact with supply and demand.” Four things, he explained, make it good.

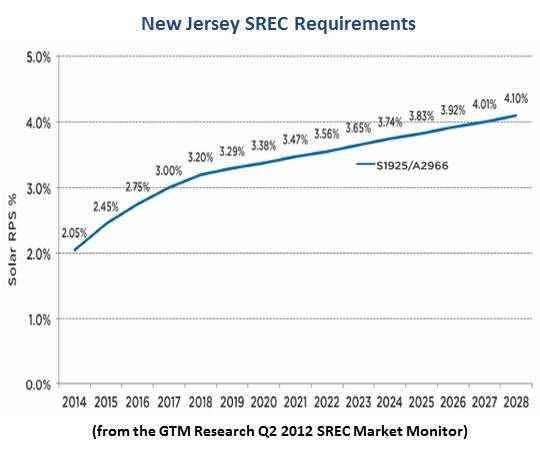

“One is they have a schedule for SREC compliance over a long period. Another is they have a schedule for ACP through 2028.”

Third, he said, “they have a significant amount of solar set aside. If the market is too small, people are not going to buy. The solar requirement is about 2 percent of energy in the year 2014 and it goes up to 4.1 percent in the year 2028.”

Fourth, he said, recent legislation requires LSEs to get approval from the state Board of Public Utilities (BPU) for large projects. “If utilities just build large systems, they can flood the market and there is no opportunity for anybody to get anything built.” The new legislation, he said, allows the BPU to manage that.

“He's right that you have a long-term ACP schedule,” agreed GTM Research Vice President Shayle Kann, who guided GTM Research’s Q2 report, “but you also have an extremely volatile market with no correction mechanisms built in. The Massachusetts model has self-adjustment clauses, limits large systems and excludes other states. That said, it doesn't go out as far.” Kann also likes auction-based SREC procurement programs like that of Delaware.

“Over the long term,” Crowdis said of New Jersey’s market, “it will be much more stable. It was up to $600 per megawatt-hour, and now they are down to less than $90 per megawatt-hour. As the supply of solar matches the requirement, the market will normalize.”

Ohio and Pennsylvania, Crowdis noted, allow people to import SRECs from other states. “What has happened, especially in Pennsylvania,” he said, is they have flooded the market, the prices are extremely low, and they can’t get systems built. If they had closed off the state, like New Jersey, they would have been able to maintain higher prices.”

Going forward, existing SREC markets “will evolve, and other states will create SREC legislation,” Crowdis said. “This SREC approach is going to continue to grow. The big question is how much states will try to manage it.”

For more information on the SRECTrade/GTM Research SREC Market Monitor, visit http://www.greentechmedia.com/research/srec-market-monitor.