Nowhere is investor interest in energy solutions more apparent than at the grid edge.

2014 saw a dramatic increase in venture capital and private equity investment in companies developing innovative solutions, particularly energy storage, demand-side management and energy data analytics technologies. Though the amount of investment hasn’t quite returned to the peak reached in 2011, the number of deals and the number of vendors receiving funding is higher than ever.

In the process of writing the newly released M&A and VC at the Grid Edge report, we looked at which startups have received the most funding since 2010. It’s true that money doesn’t guarantee the success of a grid-edge startup. After all, Better Place raised around $850 million before closing up shop. But strong support from the VC community is an indication of a technology and business model that have real potential -- assuming those VCs have done their homework.

Energy storage and fuel cells

The two outliers in this category are Boston-Power and Bloom Energy. Boston-Power has raised up to $450 million for its lithium-ion battery technology over the past five years. But the company has combined investment and grants in official press releases, so that total is a ceiling rather than an exact figure. Fuel-cell vendor Bloom Energy isn’t far behind, having raised a reported $410 million since 2010, though the company has been officially silent on recent investments (leaving reporters to sift through emails from fund managers).

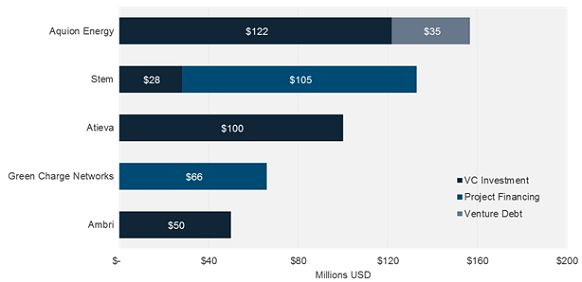

Beyond the outliers, many of the 50-some startups developing grid storage technologies have closed on significant financing. The top five are shown in the following chart.

Figure: Five Top-Funded Energy Storage Startups, 2010-2014

Source: GTM Research Grid Edge 100: M&A and VC at the Grid Edge

The comparison isn’t exactly apples to apples. Stem and Green Charge Networks are competing over C&I customers looking to manage their energy bills, which requires project financing to allow the two companies to offer energy storage systems at no upfront cost. Atieva has initially focused on the EV market. Aquion and Ambri have both landed large deals in the process of commercializing novel battery technologies, though Aquion’s two-year age advantage makes a direct funding comparison with Ambri difficult.

Demand-side management

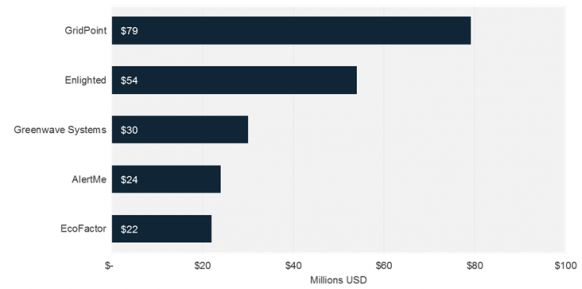

As the demand response market consolidates, there’s a high level of investment activity among home and building energy management providers. Nest was a leader in investment raised, having closed three rounds prior to its acquisition, one of which was disclosed at $80 million. Here’s the next tier among the nearly 50 energy management providers receiving funding over the past five years.

Figure: Top-Funded Home and Building Energy Management Startups, 2010-2014

Source: GTM Research Grid Edge 100: M&A and VC at the Grid Edge

As the oldest of the group, GridPoint has raised an exceptional amount of capital over an exceptional amount of time. The C&I energy management company has disclosed well over $200 million in investment since its founding in 2003. Enlighted has also raised significant capital as it has broadened its solution from lighting controls to a more comprehensive set of building energy management applications. On the residential side, Greenwave Systems and AlertMe have made energy management a central component of their connected home platforms. EcoFactor has focused exclusively on residential demand response and energy efficiency.

Soft grid

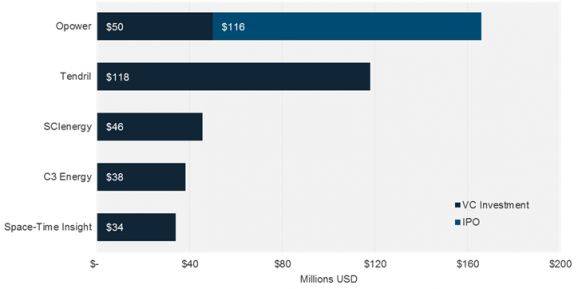

It’s cheaper to commercialize software than hardware. The average venture deal size for soft grid, or data analytics, startups was less than half of the same for grid-edge hardware startups. Even so, several of the 40 companies receiving funding since 2010 have raised notable amounts of capital.

Figure: Top-Funded Soft Grid Startups, 2010-2014

Source: GTM Research Grid Edge 100: M&A and VC at the Grid Edge

Prior to its public offering in 2014, Opower raised a $50 million C round in 2010 for its consumer energy-use data analytics and reporting. Competing provider Tendril, which has shifted its focus from energy management hardware to software, has continued to bring in new funding. SCIenergy recently re-emerged from stealth with new funding for software to streamline financing for commercial energy efficiency projects. C3 has raised at least $38 million since 2010 for data analytics covering both sides of the meter. And Space-Time Insight, which visualizes grid data for utilities, has closed two deals worth well above the average for soft-grid vendors.

A word of caution

It’s important to note that analyzing VC investments is an imperfect science. Companies may keep deals confidential, may announce them late or may keep the amounts invested under wraps. Other companies avoid VC investment entirely to insulate themselves from the expectations of outside investors. Still, the available data allows us to draw conclusions about the emergence and consolidation of different markets serving grid needs.

***

Andrew Mulherkar is an associate grid analyst at GTM Research.

For more insight into the evolving grid-edge investment landscape, see the new M&A and VC at the Grid Edge report.