Recent reports detailed TSMC’s decision to exit the solar manufacturing business. Another thin-film company gone.

What happened to all the thin film hoopla when First Solar was the world’s No. 1 solar company a few years ago? First Solar was the first to $1.00 per watt, first with 1 gigawatt of production, and the first to costs of $0.90 per watt, $0.80 per watt, $0.70 per watt, $0.60 per watt -- you get the idea. At that time, forecasts almost unanimously proclaimed that thin film was the future of solar.

So what happened? Were we all wrong? The answer is no.

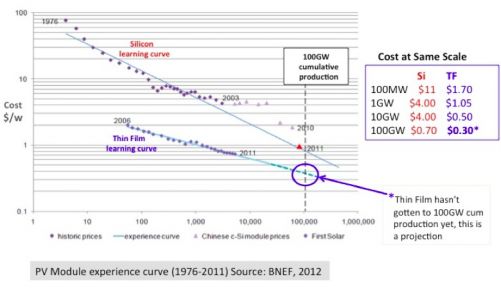

The slide below shows what happened. This is the famous solar industry learning curve (our version of Moore’s law), but with one twist: it breaks out thin film versus silicon technology and shows cost versus total cumulative production.

What is really clear is that at every level of production, thin film is significantly cheaper than silicon. So how did silicon solar producers succeed at pushing so many thin film companies, including TSMC, out of the business? The answer is simple: they just added 40 gigawatts (or more) of capacity and relentlessly drove silicon costs down the volume curve. Thin film couldn’t catch up.

But what if someone just did for thin film what China did for silicon? What if someone drove thin-film costs relentlessly down the volume curve to beat China at its own game, but with a far superior technology? This is what TSMC wasn’t able to do. The company chose the right material with CIGS, but it licensed a decade-old technology from Stion that is slow and expensive. Developed in the old megawatt era of solar, this technology was just not able to scale as needed in today’s gigawatt market. TSMC’s own explanation agrees with this, stating its “lack of economies of scale led to a substantial cost disadvantage.”

So what is needed for thin film to meet its cost leadership destiny? It’s clear: massive scaling. The industry, the government, or some company needs to invest in a thin-film technology developed for the current gigawatt era of solar. Unfortunately, most thin-film companies (nearly 100 percent) have developed small-scale pilot lines of 20 megawatts to 40 megawatts in capacity, lacking the proper economy of scale.

The only thing the companies can prove with these pilot lines is that they are not economical. Unfortunately, most of the companies on GTM’s famous list of deceased solar companies have proven just that.

To compete with the substantial lead that silicon has developed, we should be thinking about a pilot line with 10 times the capacity of current pilot lines -- 200 megawatts to 400 megawatts is appropriate. Detailed economic cost models show that such a pilot line could achieve module costs between $0.25 and 0.35 per watt (depending on location and other conditions). If the thin film industry could rally around and execute such a concept, earlier predictions of thin film’s ascendency could come true. We just have to do what TSMC Solar didn’t do: achieve scale.

***

Brad Mattson is the CEO of Siva Power and author of The Solar Phoenix. (Follow him on Twitter here.)