What do America’s municipal utilities really want out of the smart grid?

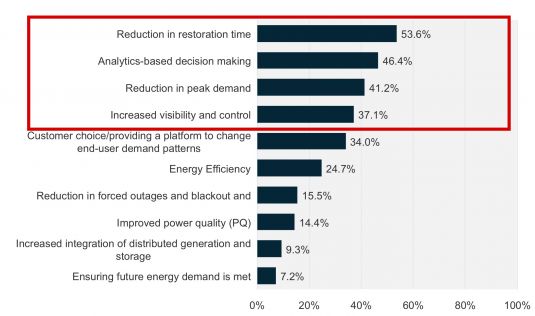

Here’s one snapshot answer to that question, courtesy of GTM Research, which polled 97 muni executives and managers on what they see as the top three benefits of implementing smart grid technologies. The responses may surprise you:

This list represents an opportunity and challenge for smart grid vendors and system integrators trying to break open the U.S. municipal utility market. Big, investor-owned utilities have accounted for the majority of U.S. smart grid spending to date, and have also driven the growth in the latest generation of smart meters (AMI), distribution automation (DA) equipment and communications networks in the field today.

The roughly 1,500 or so city-owned utilities in the country, which serve about 13 percent of the country’s power customers, have been less quick to spend on smart grid, though they haven’t been standing still either. GTM Research estimates that municipal utilities will spend $4.5 billion to $9 billion from now until 2017 on smart grid technologies, with AMI and DA deployments leading the list of projects, followed by demand response and consumer-facing services.

The list of benefits that municipal utilities want out of the smart grid, on the other hand, represents a list of functions that aren’t necessarily going to be delivered by individual smart grid systems in isolation, Zach Pollock, GTM Research smart grid analyst, said in a Wednesday interview.

For instance, AMI deployments do deliver core operational benefits and cost reductions (i.e., fewer meter readers) that lie outside the scope of the survey’s answers, he said. But for AMI systems to help out with the top benefit these municipal utilities are after -- reduction in restoration time -- will require utilities to integrate features like outage and restoration notification, or power quality measurement, to play a role, he said.

Likewise, the second-highest priority for municipal utilities, analytics-based decision making, implies a long list of potential projects, ranging from better customer communications and marketing, to tapping smart meter and grid sensor data to predict the health of transformers or plot the cost-benefit figures for future upgrades.

We’ve seen some bigger AMI projects turn on features like these, but it’s far from the rule. But, as Pollock put it, “you’ve got to have these operational interties” to allow AMI, DA and other systems being installed to play a role in these tasks.

It’s important to remember that municipal utilities have different priorities and different challenges than their investor-owned counterparts. For one, city utilities are beholden to city voters and elected officials, rather than to state regulators and rate-making procedures.

For another, municipal utilities can’t guarantee a rate of return on capital projects as many IOUs can, making them a potentially better target for smart-grid-as-a-service offerings. We’ve seen a host of product and platforms on this front, ranging from big systems integrators like General Electric, SAIC and Lockheed Martin, to smart grid contenders including Silver Spring Networks, Aclara, and Calico Energy, and most recently, AT&T.

We’ve seen some examples of municipal utilities taking on cutting-edge smart grid projects, such as Austin Energy and Sacramento Municipal Utility District (SMUD). But other munis have struggled with their smart grid deployments, which could be another reason for smart grid services to gain traction.