While editorials are entitled to an opinion, in this case an opinion has been mixed with unsubstantiated rumor and a lack of fact checking. I wish I could say it doesn’t meet the standard of the WSJ, but it isn’t the first time the opinion page has played fast and loose with facts to make a splash. In just the latest example, my letter to the editor of the Wall Street Journal yesterday in response to their editorial was titled to suggest I was debating the success or failure of the government funding of Range, when in fact I was trying to challenge the accuracy of the WSJ reporting and the less than ethical, in my view, tactics they use.

Regarding certain “facts” in the editorial, “The Range Fuels Fiasco” (Review & Outlook, Feb. 10):

The WSJ persists in mischaracterizing my relationship to a company called “Cello.” I have never publicly uttered the word “Cello,” nor classified it as a “great cellulosic hope.” I have never owned any shares in Cello. I have never evaluated the technology directly or indirectly. A company backed by a fund I invested in paid Cello a relatively small amount for a non-equity relationship to buy blind “insurance,” a tiny amount compared to our biofuels portfolio. This has been widely misreported in the press. An earlier story in the WSJ chose to report “that I was an investor in Cello”[1] despite receiving a statement to the contrary in writing from me prior to publication. It makes me wonder about the ethics of some of WSJ’s reporters. In fact, the WSJ Dallas region editor offered to publish an apology after the fact, which I declined. A paper company called P&W was the principal backer of Cello, but the WSJ refused to report that, as it was not sensational enough. It seems that facts don’t get in the way of any “proof” that supports bigoted opinions of the WSJ editorial staff since they continue to use erroneous “facts” with large doses of innuendo (like “superrich,” political venture capitalist, taxpayer tragedy, etc.). But it gets them sensationalism and readership, so who cares?

Others have claimed without attribution that I invested in E3 Biofuels, which I have never done either. Few have mentioned the successful IPOs in biofuels that I have invested in. Makes me wonder whether reporting or opining is the goal of many of these reporters. Others often make the mistake of attributing the opinions of the companies in which I invest to me, as if I control them. Most have multiple investors and independent management teams with their own opinions.

The Range Fuels editorial also passed judgment on the success or failure of the Range Phase 1 with the DOE without material data available to them. Range did not receive $76 million from the DOE as the WSJ reporting implies. Only about half of the DOE grant was used to build phase 1 of the project, roughly as projected in the original grant application. The company voluntarily chose not to take the rest of the money as Phase II as originally defined was superseded by new technology developments (as explained below). The goal was never 100 million gallons for $150 million project -- those numbers would make it less capital-intensive than corn ethanol projects -- not a figure Range ever planned. WSJ or somebody else misinterpreted those facts. 100 million gallons was the target for the site eventually when a commercial plant was built, not the DOE phase of the project. Phase 1 was completed mostly as planned with a 60+ percent equity match by Range, in spite of the financial crisis of 2008-2009, which affected everyone, making equity hard to come by, slowing down projects and increasing costs as a result.

The project was the only one of the six DOE grants that has been built and mostly met its goals, in my view. The biggest failure was, I am told by the company, in fact caused by problems in the “routine” wood handling supplied by Metso, not the new technology! Whether that is accurate or not, much was learned in this project and clearly some directions were changed because of the failure or success of certain pathways. The Range chemical catalysis was superseded by the rapid progress at companies like Coskata and Lanza and other biofuels production technologies. Those technologies, in conjunction with Range, seem to pencil out as economic but it is hard to be certain until actual plants have been built. When Khosla Ventures makes several bets it expects some to succeed and others to fall behind or specialize more narrowly. If chemical catalysis was certain to succeed, we would not need the DOE at all. The purpose of the grant program was to assist high-risk technologies. It is often impossible to tell which is which a priori.

A significant portion of the investment in Range was spent on the gasifier, the front end of the biofuels project. This gasifier is valuable, and can be used with newer biofermentation-based backend processes, an advancing technology that has superseded the chemical catalysis backend originally planned by Range. Range is in active discussions with other biofuels companies to use their gasification facilities with biochemical syngas catalysis and other technologies (deals which may or may not happen -- that is for the Range board to decide, which I don’t control). We should applaud the continued progress, and that entrepreneurs iterate as superior technology becomes available.

This is how innovation happens, but the WSJ does not really understand innovation. In the end, success is never assured in new technology areas, except, of course, it seems, in the ivory tower of the WSJ, which is full of people who don’t understand technology and prefer to live in their bigoted walled world of pontification without reality checks.

Meanwhile, the editorial opinion fails to critique the heavily subsidized fossil oil business on its access to sub-market-rate royalties, drilling tax credits, and other direct and indirect subsidies, nor the over $7 trillion spent over 30 years on carrier groups in the Middle East to protect our oil lanes! This is a version of incumbency capitalism, where incumbents and their lobbyists have tilted the playing field away from innovation capitalism. Creating competition for fossil oil through biofuels or alternatives like electric cars should be treated as a vital strategic goal for the country, and in the case of biomass, a critical rural jobs engine.

I believe that promoting energy independence is far more important than our efforts in Iraq and deserves resources. We’ve spent trillions protecting our oil interests, it seems reasonable to spend a tiny fraction of that on technologies that help end our oil addiction. We cannot achieve that with a 100 percent guarantee of success, just as we cannot guarantee that our policies in Afghanistan will be successful. We must take risks: that entails course corrections and even failures, and we have to be tolerant of that.

In fact, government support aims to fill the commercialization gap in many nascent industries. About $100 billion was used to support the nuclear industry as it was getting started, another WSJ favorite industry, support that continues through subsidized loan guarantees, insurance subsidies, fuel processing and decommissioning funds. Government support of nascent industries drives more innovation capitalism, creates competition, and ensures global competitiveness. Though most legislation is imperfect, let’s not throw the baby out with the bath water and throw out all government efforts. There are abuses, and as an example I have written against continuing corn ethanol and even wind subsidies. There is a balanced position between “support every green thing” and the WSJ bigotry of “government shouldn’t do anything.”

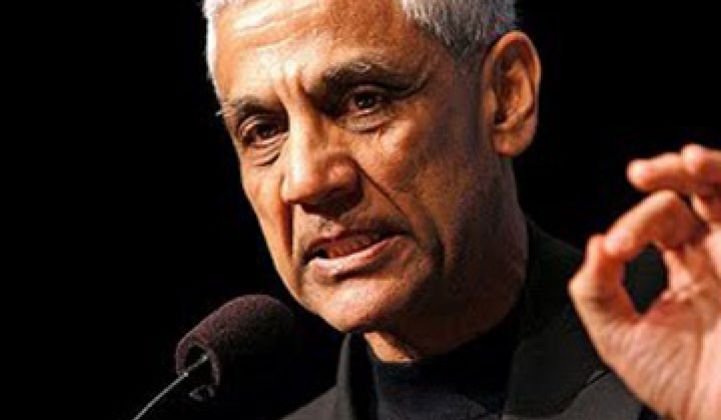

The editorial complains that “the result has not been another Google.” Unfortunately, not every venture is a Google, and as President Kennedy said, “only those who dare fail greatly can ever achieve greatly.” Range’s original formulation may not have been successful, but such risk-taking deserves applause, not derision. I invested more in Range than the DOE or anyone else, because I believed in the technology. I may be wrong often, but over the last twenty-five years my efforts have generated about $14 billion in profits from less than $1 billion investor dollars. In biofuels we have generated hundreds of millions in profits for our limited partners. I started in this country with less than $300 in my bank account and no other support; I would like to compare this record with the WSJ editor’s accomplishments before he chooses to trash my efforts and classify me derisively as the "superrich." I will keep taking large risks and shoot to solve large problems.

I wonder if the WSJ would use derisive terms like “the superrich” or "political” or “opportunistic” to describe its bosses, who probably hobnob much more politically and I suspect has numerous lobbyists, something I have not done. Aside from an occasional trip to DC, I have not hired lobbyists but have directly and openly simply advocated for technology neutral and innovation friendly approach to policy. The biggest competitive imbalance we have in this nation is towards incumbency capitalism perpetuated by the rules incumbents’ lobbyists have helped enact, and away from innovation capitalism of level playing fields that will move our country forward… the editorial board of the WSJ would apparently like to keep the current status quo.

This latest attack isn’t all that different from a WSJ article in 2008, attributing corn ethanol subsidies to a “Khosla conspiracy,” which is interesting because I have never supported corn ethanol subsidies (or biodiesel and wind subsidies for that matter). The author then stated “Mr. Khosla now claims that corn ethanol is merely a springboard for the cellulosic varieties, which don't draw on food stocks.” First I have always stated corn ethanol is just a springboard and always maintained corn ethanol producers will eventually go out of business when cellulosic biofuels show up. Second, I have never stated, “corn ethanol does not draw on food stocks.” Made-up facts seem to be a regular feature of the opinion columns. And WSJ implied we were collecting these corn ethanol subsides (“dole”), which no Khosla Ventures company has ever done! A further fact is in the pro versus con battle on green technologies, one can find enough “facts, opinions and studies” to quote from either the pro or con point of view. And if one is not available, unfortunately, proponents can get one fabricated.

When we first invested in biofuels I expected up a 70 percent to 90 percent chance of failure (and went on record saying so), and today I’m pretty confident that 50 percent to 60 percent of the technologies will succeed. Those are better odds than wildcatting for oil. Intelligent dialogue about when government support is for the social good and when it is a gravy train is necessary.

But bigotry only shuts down intelligent dialogue.

***

Read Khosla's biofuels primer here.

Khosla Ventures offers venture assistance, strategic advice and capital to entrepreneurs. The firm helps entrepreneurs extend the potential of their ideas in breakthrough scientific work in clean technology areas such as solar, battery, high-efficiency engines, lighting, greener materials like cement, glass and bio-refineries for energy and bioplastics, and other environmentally friendly technologies, as well as traditional venture areas like the Internet, computing, mobile and silicon technology arenas. Vinod Khosla founded the firm in 2004 and was formerly a General Partner at Kleiner Perkins and founder of Sun Microsystems. Khosla Ventures is based in Menlo Park, California.