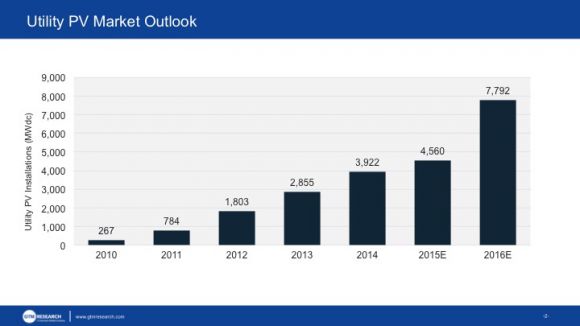

The cost of installing utility-scale solar has fallen considerably in recent years, from more than $6 per watt in 2009 to about $3 per watt in 2014. That has resulted in a boom in the sector, which is 31 times bigger than it was a decade ago.

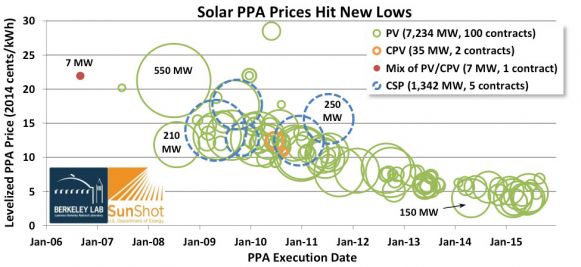

Power-purchase agreement (PPA) prices are also continuing their downward trend, according to the third annual report on utility-scale solar from Lawrence Berkeley National Laboratory.

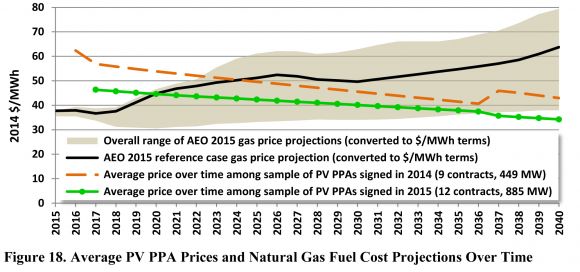

With the rush to get projects done before the cut to the federal Investment Tax Credit, levelized PPA prices have come down as low as $40 per megawatt-hour in the Southwest. At that price, PV compares to just the fuel costs for natural-gas plants. These numbers match what GTM Research has found as well.

Although the Southwest has the lowest prices, $50 to $75 per megawatt-hour is the new norm across the country, according to GTM Research. Boulder’s PPA with SunPower, for example, came in at $46 per megawatt-hour and Austin Energy’s most recent solar project came in at under $50 per megawatt-hour.

Falling prices have also opened up some markets to avoided-cost contracts, where solar is cheaper than a utility’s avoided costs to generate electricity elsewhere. In states like Utah and North Carolina, avoided-cost contracts are bringing in various solar contracts.

“This recent onslaught of applications for avoided-cost contracts has prompted the utilities involved and their state utility regulators to re-evaluate these contracts and the utilities’ PURPA requirements," reads the Berkeley lab study.

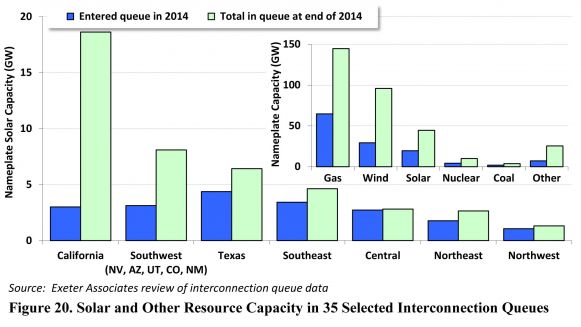

The rush to build utility-scale solar projects (defined as larger than 5 megawatts by Berkeley Lab) ahead of the ITC cliff is intense. Going into 2015, there were more than 44 gigawatts of capacity in the production queue.

“Even if only a modest fraction of the solar capacity in these queues meets that deadline, it will still mean an unprecedented amount of new construction in 2015 and 2016,” the study authors wrote. By the end of last year, there were about 8 gigawatts of utility-scale capacity in total.

For concentrated solar power, however, the era of new project construction may be over. Although the data set is small for CSP (six projects), “CSP prices do not seem to have declined over time to any notable extent, in stark contrast to the median PV prices included in the figure,” the Berkeley Lab report states. Also, while operations and maintenance costs for solar PV plants have generally declined, the one CSP plant in the study’s sample had rising O&M costs.

In the booming market of utility-scale solar PV, California and the Southwest still reign. They will account for about 60 percent of the scheduled capacity additions at the end of 2014, down from 80 percent at the end of 2013. Not all of this will be built, however, and GTM Research has projected about 27 gigawatts through 2016.

Even with a nearly 80 percent decrease in installations from 2016 to 2017, “the post-2016 outlook is not as bleak as we once thought,” said Colin Smith, solar market analyst with GTM Research.

“With the loss of the ITC, we expect to see a rise in PPA prices. But as the installation cost of utility PV continues to fall, we expect to see PPA prices start to return to 2015-2016 levels in 2019," he said.