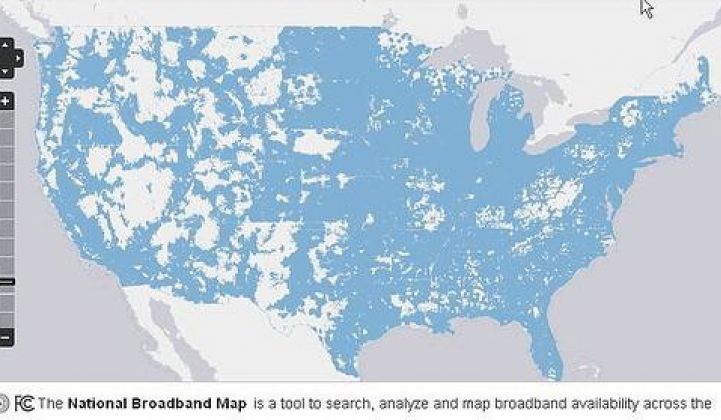

How do you get the smart grid deployed to the most remote, rural parts of the country? One answer could be rural broadband, which has billions of dollars in federal funding support meant to push connectivity to 15 million U.S. residents who live in areas that are too distant and expensive for commercial telecommunications providers to reach.

But to date, the Federal Communications Commission’s big broadband push, known as the Connect America Fund, hasn’t included electric cooperatives, municipal utilities and other rural power players as eligible providers. Instead, the FCC has limited funding to a certain class of telecommunications companies, known as “price cap carriers,” incumbent to these remote markets -- and so far, those incumbents haven’t been able to spend the money they’ve already been given.

That’s the view of the Utilities Telecom Council (UTC) industry trade group on the passage this week of the latest installment of $485 million in FCC funding for the Connect America Fund. That includes $300 million in fiscal year 2013 funding, as well as $185 million or so left unspent from the same amount targeted to the program last year, Brett Kilbourne, UTC vice president of government and regulator affairs, said in a Wednesday interview.

Opening that money to the rural co-ops that already power the country’s farthest reaches could help get the funds spent faster, Kilbourne and the UTC contend. It could also help utilities add smart grid connectivity and services to their distant power lines and end-users, which can save energy and reduce member costs on top of giving everyone instant internet access.

According to the UTC, “Through leveraging existing utility infrastructure, rights‐of-way, and expertise, these utility partners can provide rapid, and more cost-effective, deployment.” The key term here is cost-effective, because these customers are expensive to serve -- the most recent price caps for the CAF program’s first phase of funding, at $775 per customer, were declined by several eligible companies on the grounds that it wouldn’t cover the costs.

While this year’s funding doesn’t include utilities, the UTC has set up its own group, the Rural Broadband Council (RBC), to lobby for a change to those rules. Indeed, we’ve seen a lot of tussling between the incumbent price cap carriers and competitors like cable companies over the pricing models for the CAF program, indicating that utilities aren’t alone in wanting a share of the pie.

The U.S. Department of Agriculture is a big rural broadband funder, but FCC is the granddaddy of the nationwide push, with $4.5 billion budgeted for expansion and support of the CAF program. The next, “Phase II” stage of the fund will open an ongoing annual support stream of $1.8 billion for both voice and broadband service, indicating the ongoing costs of supporting a program that fills the gaps between cost and revenue from a strictly economic perspective.

Last week’s announcement also noted that “any funding not accepted in Phase 1 will be used to connect unserved communities in Phase II,” indicating a focus on connecting places not yet hooked up in previous deployments. Just how “unserved” is defined is a trickier matter, however, Kilbourne noted -- complaints about the program include reports that some local incumbents have hooked up a relatively small number of residents in order to close off the region or ZIP code to competing bids, for example.

As for what utilities could do with their own broadband network, we’ve got several examples of how municipal utilities like Chattanooga EPB, Tacoma PUD and Habersham EMC are using fiber networks to connect utilities to their customers, support distribution grid sensors and controls, and enable fast-acting balancing of grid-side and demand-side resources, to name a few examples. But we’ve also seen examples of ill-conceived utility broadband projects faltering due to the high costs involved, as happened to Xcel Energy’s SmartGridCity project in Boulder, Colo.

Today’s smart grid industry is largely focused around big, investor-owned utilities and their big infrastructure and IT plans. But there’s a world of smaller IOUs, municipal utilities and electric cooperatives in the United States that want to spread smart grid technology to their residents and member-owners, respectively. While the UTC hasn’t yet put together business cases on the comparative costs and benefits of laying rural broadband for reaching those goals -- and adding universal connectivity to boot -- those are on their way, Kilbourne said.