Duke, EON, Exelon and HelioPower executives talked with GTM CEO Scott Clavenna about solar-utility relations, the impact of low natural gas prices and other contentious issues at GTM Research’s recent U.S. Solar Market Insight conference.

“I am a solar advocate in a utility company. I have a lonely job,” Duke Energy (NYSE:DUK)’s Emily Felt said with a laugh. The first of three points she makes to Duke executives, she said, is that solar is a fuel hedge. “They get that. You substitute what you would expect to spend on fuel with upfront capital investment.”

The second point “is about solar integration.” Half of Duke’s Carolinas generation is nuclear, she explained. “If you have one or two gigawatts of solar, that is a problem. Luckily, we have 2,000 megawatts of pumped storage.”

Third, Felt said, is regulatory innovation. “We need to take a deep dive into how solar costs and benefits interact with our rate structures.”

“Duke is a fully integrated monopoly utility,” Exelon (NYSE:EXC) renewables lead Bryan Miller said. “Our utilities are in deregulated markets and are pure wires companies. Exelon owns the power.” Retail power is a tough, pure commodity business, he said. Solar “lets us relate to our customers in a way that is not a commodity relationship.”

“Energy is a complicated beast,” observed HelioPower President Ty Jagerson. “In the commercial and residential spaces, the margins are really gruesome.”

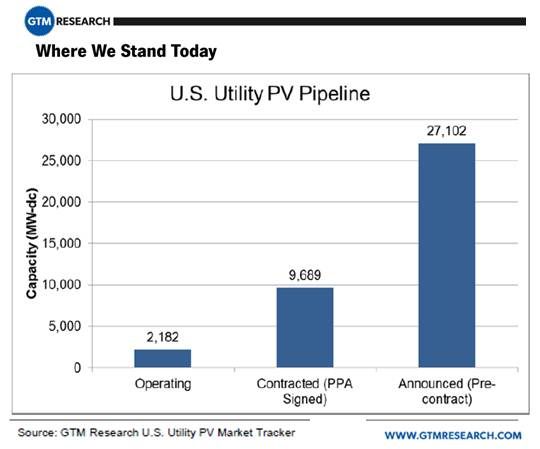

At utility scale, he said, “if you start developing a large-scale solar project right now, you are not going to finish until around 2016. That could be four, five, six development cycles for a lot of the products in that system.” Pricing for such projects doesn’t reflect that.

“It makes for a more complicated blend for solar in all its different implementations,” Jagerson said. “We think solar is a component, not the component.” Therefore, he added, solar and natural gas, solar and wind, even solar and battery power, are "frenemies" and they have different applications.”

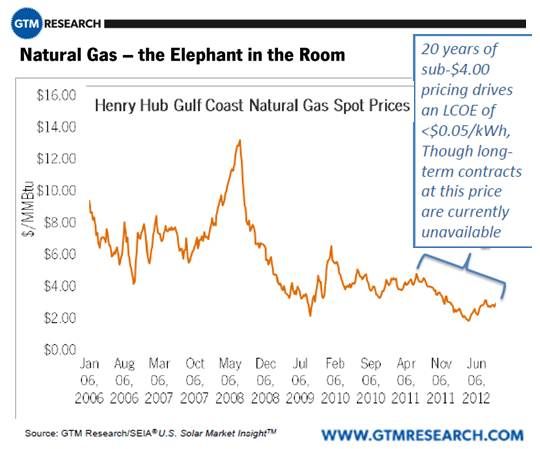

"Frenemies is appropriate,” E.ON (PINK:EONGY) Climate and Renewables VP Peter Moritzburke agreed. “Low price natural gas in the U.S. is a wholesale market dynamic we are keeping a very close eye on. It means low wholesale power prices in general which makes non-gas resources look relatively expensive.”

But, Moritzburke added, “if you have a low wholesale power price environment, ratepayers and regulators should be more willing to accept some of the higher costs of integrating renewables. It is a great time to put in place very aggressive renewable portfolio standards with solar carve-outs.”

Natural gas is no longer a bridge fuel to a renewable energy future, Clavenna suggested, but rather “a default fuel for all-new generation.” Renewables are at the edges and evolving toward a merchant solution. “How do you think things will evolve over the next five years?” he asked.

“Low-price natural gas has changed our renewables strategy,” Miller replied. “Solar and gas are more contentious than frenemies. It is very hard to imagine doing a merchant solar play.” But demand is already starting to drive the price up, he added. “The best cure for low prices is low prices.”

As Duke modernizes its fleet, Felt said, “gas will replace coal.” But until it is clear how volatile prices will be, she said, “I don’t think solar will replace gas.”

“What about wind, especially with the difficulties about the PTC?” Clavenna asked.

“Wind is often a shoulder, off-peak resource, and solar is more peak coincident,” Moritzburke said. They are competing, he added, but the price of solar is on a downward trajectory, while the price of wind may go back up with commodity prices. “For a capacity factor for solar in the 30 percent range and a capacity factor for wind in the 45 percent or higher range,” he said, “the capex for solar will compete head-to-head with wind.”

Solar is already competing in California, Miller said. “In the clearing prices in last year’s large-scale renewables solicitations from the California IOUs, solar beat some wind for the first time.” And, he agreed, they are on totally different technology and cost curves. “Wind versus solar is happening before our eyes.”

“How do utilities, developers, and IPPs get along?” Clavenna asked.

E.ON works with solar companies on grid integration issues, Moritzburke said, but “there are tensions between sellers and buyers. There always will be.”

“It is my job to sit in the middle of all those tensions and conflicts between developer and IPP and utility,” Miller said. “I mediate those disputes and then send my therapy bills to my employer.”

“Utilities have people who are behind solar,” Jagerson said. But “the culture and the business incentives are not there.” Developers, he said, feel like “a very strong, gusty, sandy wind is constantly blowing in their face. It is frustrating. But most utilities are getting better.”

We need to “start speaking each other’s language,” Felt said. “Duke’s tenets are 'clean, reliable, and affordable.' Solar is without question clean. It will be affordable. But reliable will be the last piece. Let’s substitute 'controllable' for reliable. When you talk about clean, affordable and controllable, that’s when our guys perk up.”

“As we get to higher penetration levels, it is a natural sign of maturity,” Miller said, to understand “the broader fabric of everything that goes into keeping the lights on.”