GTM Research and the Solar Energy Industries Association® (SEIA®) today release U.S. Solar Market Insight: 1st Quarter 2013, the definitive analysis of solar power markets in the U.S., with strategic state-specific data for 28 U.S. states and the District of Columbia.

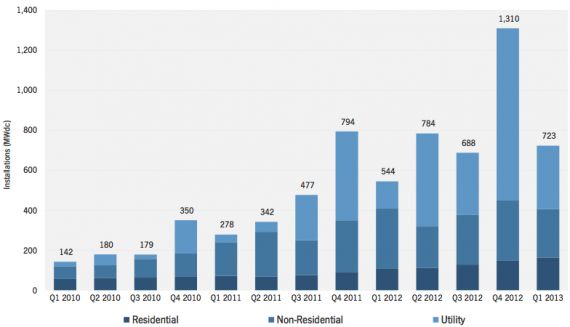

This quarter’s report finds that the U.S. installed 723 megawatts in Q1 2013, which accounted for over 48 percent of all new electric capacity installed in the U.S. last quarter. Overall, these installations represent the best first quarter of any given year for the industry. In addition, the residential and utility market segments registered first-quarter highs with 164 megawatts and 318 megawatts, respectively.

U.S. PV Installations by Market Segment, Q1 2010–Q1 2013

Source: U.S. Solar Market Insight

As explored in greater detail in the report, the residential market remains a highlight for U.S. solar with 53 percent year-over-year growth. Unlike the non-residential and utility markets, residential solar has not exhibited seasonality and market volatility on a national basis; quarterly growth in the U.S. residential market has ranged from 4 percent to 21 percent in twelve of the past thirteen quarters.

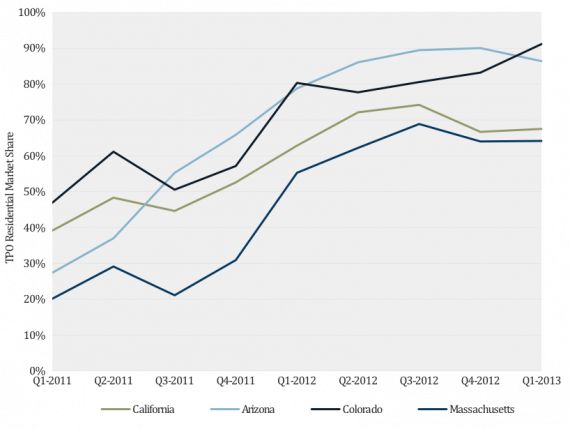

Furthermore, third-party-owned (TPO) residential systems continue to be a major storyline in the market. In the key states of California and Arizona, for example, TPO systems accounted for 67 percent and 86 percent, respectively, of all residential PV installed in Q1 2013.

In fact, the California residential market had a record quarter, installing more new PV capacity than ever before, resulting in a total that for the first time was greater than the non-residential market. This is largely driven by increased “retail rate” parity in major utility territories, where a residential PV system can provide a discount at retail electricity rates with few or no incentives other than the 30 percent federal investment tax credit (ITC).

Percentage of New Residential Installations Owned by Third Party in CA, AZ, CO and MA, Q1 2011–Q1 2013

Source: U.S. Solar Market Insight

“We are on the cusp of a new solar revolution in the U.S., driven by the rapid expansion of distributed generation,” said Shayle Kann, vice president of research at GTM. “Installations will speed up over the next four years as projects become economically preferable to retail power in more locations. However, changes to net metering and electricity rate structures could serve as the market's primary barrier to adoption.”

Looking at the market on the whole, the U.S. Solar Market Insight: 1st Quarter 2013 report forecasts 4.4 gigawatts of PV to be installed by the end of 2013, growing to nearly 9.2 gigawatts annually in 2016. GTM Research and SEIA® have increased each year’s forecast marginally from past editions of the report, due largely to increasingly bullish expectations for the residential market and the near-term opportunity it offers.

Despite the fact that little concentrating solar power (CSP) capacity came on-line during Q1 2013, CSP is also expected to make major gains by the end of the year, adding more than 900 megawatts of capacity. Combined, the U.S. is expected to add 5.3 gigawatts of solar electric capacity in 2013, enough to power more than 960,000 average American homes.

“The U.S. now has more than 8,500 megawatts of cumulative installed solar electric capacity, enough to power more than 1.3 million American households,” said Rhone Resch, president and CEO of SEIA. “This sustained growth is enabling the solar industry to create thousands of good American jobs and to provide clean, affordable energy for more families, businesses, utilities, and the military than ever before. This growth simply would not have occurred without consistent, long-term policies that have helped to ensure a stable business environment for our nation’s 5,600 solar companies -- many of them small businesses.”

Key Report Findings

- PV installations totaled 723 megawatts in Q1 2013, up 33 percent over Q1 2012

- Cumulative operating PV capacity in the U.S. now stands at 7.9 gigawatts

- The residential market grew 53 percent over Q1 2012 and 11 percent over Q4 2012, continuing its streak of consistent incremental quarterly growth

- The non-residential market shrank 20 percent on both a quarterly and annual basis, which reflects slow demand across a number of major markets

- The utility market more than doubled year-over-year, with 24 utility PV projects completed in Q1 2013

- The average residential PV system price fell below $5.00 per watt, while the average non-residential system price fell below $4.00 per watt

- Click here for more