This week, two solar cell "startups" that couldn't be further away from one another in terms of their efficiencies or materials won funding from VCs and strategic investors.

Sol Voltaics claims its gallium-arsenide (GaAs) nanowires can boost a 17 percent efficient solar module to 22 percent. The company just won $9.4 million led by Umoe, along with Industrifonden, Nano Future Invest, Foundation Asset Management, Provider Venture, Scatec, and Teknoinvest. Umoe's CEO Jens Ullveit-Moe is the former chairman of REC Solar. Kang Sun, former CEO of JA Solar and current CEO of Amprius, joined the board of directors.

“With this closing, we now have the resources to take the company to pilot production," said David Epstein, CEO of Sol Voltaics. Epstein, a former VC at Crosslink Capital, moved to Sweden to helm Sol Voltaics. Commercial production of enhanced modules will begin in 2015 and move into volume production in 2016, according to the company.

We reported on the Swedish solar startup and its gallium-arsenide (GaAs) nanowires in April of this year. In June, the firm collected a $6 million conditional loan from the Swedish Energy Agency, Sweden’s national authority for energy policy issues.

"We're making an active ink to put on top of solar panels," said the CEO in our earlier report. Sol Voltaics plans to use GaAs nanowires to create another absorber layer on top of existing solar cells to extract more light and raise efficiency by 25 percent -- an enormous stride, as far as solar efficiency numbers go. This suggests that a 17-percent-efficient crystalline silicon panel has the potential to reach 22 percent efficiency with the addition of the nanowires.

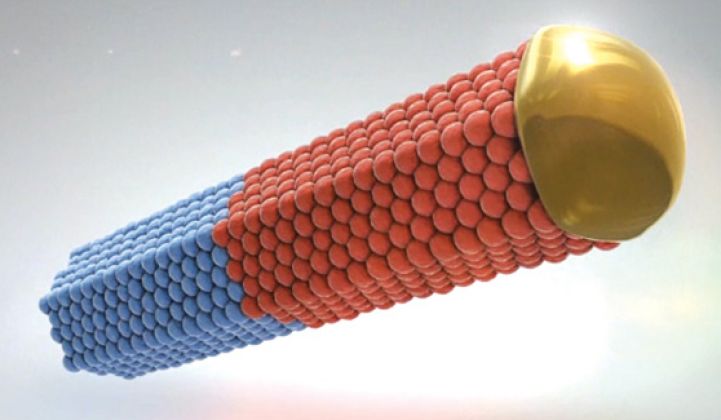

The GaAs nanowires are tiny solar cells about 1 or 2 microns long and approximately 100 nanometers in diameter, and they're sold as an ink-like solution. The layer of nanowires acts like a second solar panel, according to the CEO, and can "capture light very effectively on top of panels using a phenomenon called wave-concentrated photovoltaics (WCPV)." He claims that "the method we use to make these products is cost-effective with silicon."

Epstein added, "The solar market is booming even though companies are struggling. They are struggling because [the industry is] at the bottom of the cost curve. We've mined all of the cost out of solar panels. The only place to improve the economics is in efficiency -- to produce more power per panel." According to the CEO, higher efficiency means revenues go up, margins move from negative to positive, and levelized cost of energy (LCOE) goes down.

"Efficiency creates value," said the CEO, who went on to claim that PV module price per watt varies depending on efficiency -- higher efficiency panels sell at an average of $0.94 per watt, while projections of $0.42 per watt will happen only for low-end modules. Epstein added, "People already don't want these low-efficiency modules -- the projections going down to 42 cents will happen for lower-end modules."

The potentially higher-volume, lower-cost method used by Sol Voltaics to grow the nanowires was invented by company founder and CSO Lars Samuelson and described in Nature in December 2012. The journal characterized the process as the "continuous gas-phase synthesis of nanowires with tunable properties."

The company has already raised $11 million from investors and claims the ability to get to full production for less than $50 million. A modestly sized lab can crank out megawatts' worth of wires, according to the CEO. The firm is a sister company to LED nanowire firm Glo.

Once you have this magic nanowire sauce, you have to sell it -- and that leaves the daunting task of selling to Chinese panel manufacturers such as Yingli or Trina (or Suntech or LDK - both struggling to survive). Additionally, most solar manufacturers have had to cut back on R&D -- and the Sol Voltaics process requires integration into gigawatt-scale production sites, as well as capex investment in more equipment to apply and set the nanowires. The necessity of improved efficiency seems obvious, but this remains a challenging customer base.

Still, if the benefits of III-V material can be had on the cheap, there's some potential for disruption.

On the other end of the efficiency continuum lies Dyesol and its Dye Solar Cell (DSC) technology. Dyesol claims to be a supplier of DSC "materials, technology and know-how," but it's really a development-stage company with no products or path to commercial viability. Dyesol had $957,000 in revenue, according to its preliminary financial report for 2013. Losses for 2013 were $9.4 million, while revenue fell by half. This imbalance has been Dyesol's financial situation for years. Accumulated losses for the company are $74.6 million.

Yet this profit-challenged company has a market capitalization of $86 million on the ASX and just completed due diligence with Saudi Arabian conglomerate Tasnee (National Industrialization Company of Saudi Arabia) on an additional $16 million strategic investment on top of the $4 million Tasnee invested earlier this year. According to the Saudi Gazette, "Tasnee is the second largest industrial company in Saudi Arabia and the second largest producer of titanium oxide in the world. It also owns several titanium mines in Australia." Tasnee's stake will exceed 20 percent of the firm and will require shareholder approval.

Dyesol uses a layer of nanotitania on a glass, metal or polymer substrate, hence the strategic aspect of Tasnee's investment -- one which seems to have blinded the Saudi firm to the weaknesses of DSCs and OSCs.

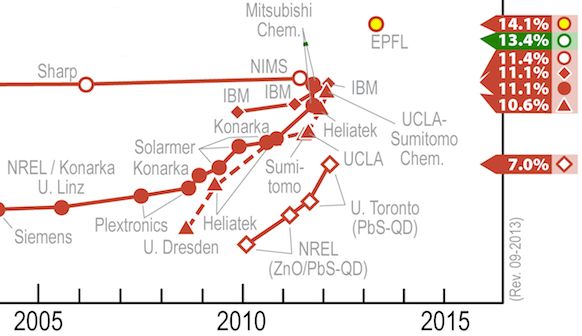

Dyesol has claimed that its "technology, when compared with conventional silicon-based PV technology, costs less to manufacture and produces electricity more efficiently, even in low-light conditions, and can be directly integrated into conventional glass-paneled buildings." This is aspirational language at best, and deceptive at worst. This technology has the lowest efficiency of any NREL-listed materials system and has never delivered on its commercial or cost promise.

Dyesol, like Konarka before it, has also suggested that building-integrated photovoltaics are a natural application for this laboratory-grade, low-efficiency, unproven and unreliable materials system.

Dyesol does claim a solid-state DSC laboratory efficiency mark through EPFL. The firm also says it is "confident of achieving industrial efficiencies greater than 10 percent because of the added simplicity of working with solid-state systems."

Organic and dye-sensitized solar cell developers include Heliatek, Solarmer, Plextronics, EPFL, Mitsubishi, Peccell, and G24i. Eight19 Limited raised $7 million from the Carbon Trust and Rhodia to develop plastic organic solar cells. Ireland's SolarPrint has eliminated the liquid part of DSC technology and replaced it with nanomaterials and printing. Intel has done some research into OSCs, as well.

Solar OSC and DSC Efficiency Records, as per NREL