Investment bank Morgan Stanley has suggested that the falling costs of both solar modules and battery storage present a potential tipping point that could encourage huge numbers of homeowners and businesses in the U.S. to go off-grid.

The initial report, published earlier this month, has been followed up by a note from Morgan Stanley highlighting the extent to which investors had been unaware of these mega-trends, which threaten massive disruption in the trillion-dollar utility business.

It's well known that solar is becoming more popular, but many had no idea of the size of the market that Morgan Stanley identified. And while most had been skeptical of the potential impact of battery storage, they were intrigued by the potential cost reductions that could be achieved by Tesla, the electric car company, and its ability to monitor power levels in batteries and schedule a battery swap in the case of depletion.

More importantly, the investors were particularly focused on how utilities might respond. Solar, they suggested, should be seen as an opportunity, and utilities should look at ways of becoming enablers of these technologies, rather than barriers.

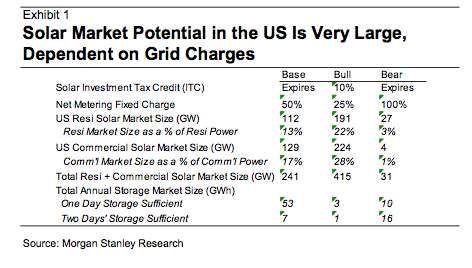

Addressable distributed solar market in US could be 415 gigawatts

There were a couple of major takeaways in Morgan Stanley's original report. First, the addressable solar market in the U.S. is much larger than anyone had previously imagined. Second, the Tesla Giga battery manufacturing facility could bring down the cost of storage more quickly than anyone had imagined.

Even without the continuation of the 30 percent investment tax credit -- and taking into account the fact that many homes are unsuitable for solar -- Morgan Stanley says its “base case” addressable market for distributed solar in the U.S. is 240 gigawatts within five years.

In its bull case (a 10 percent tax credit remains and there are lower grid charges), the report estimates the addressable solar market at 415 gigawatts. That compares to just 6.2 gigawatts of residential and commercial solar installed to date.

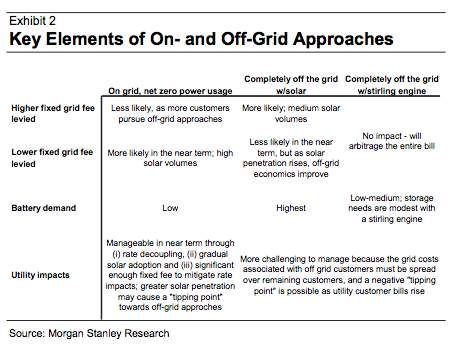

Another key takeaway is Morgan Stanley’s assessment that the higher the fixed grid charges imposed on distributed generation customers, the more likely they are to buy batteries and go off the grid.

And this is where Tesla -- and its new Giga factory for battery storage manufacturing -- will play a critical role.

“There may be a 'tipping point' that causes customers to seek an off-grid approach,” Morgan Stanley writes. “The more customers move to solar, the [more the] remaining utility customers' bills will rise, creating even further 'headroom' for Tesla’s off-grid approach.”

The report suggests that for every $25 per kilowatt-hour reduction in the cost of Tesla’s batteries, the all-in cost of power to customers will fall by $.01-$.02 per kilowatt-hour, or 15 percent to 30 percent of the residential customer price for grid charges in some U.S. states.

“Tesla’s off-grid, battery-based option will, post-construction of its Giga factory, be in our view at approximate parity with the cost of the utility grid in higher-cost states, and over time we believe this will move in Tesla’s favor.”

Morgan Stanley expects customers to take one of three potential approaches. The first is solar customers staying on the grid, but with net zero grid power use. In this scenario, a customer produces more power than needed during the day, but draws from the grid at night.

Under this approach, homeowners might not use batteries to a large extent, because the grid is effectively acting as a battery and power management system, ensuring customers have power when they need it. However, Morgan Stanley says this will likely push up bills for remaining utility customers, creating more “rate headroom” for off-grid approaches.

The second scenario is using no grid power, even at night, but having the ability to seek emergency grid service in the event of a home power system failure. In this approach, the homeowner would purchase significant battery storage capacity to draw down power at night stored in their batteries that was produced during the day from their solar panels. Customers would, however, remain connected to the grid, and could seek “emergency power service” from the utility in the event that the home power system fails.

The interesting question about this approach is the cost of that service. It would be likely, Morgan Stanley says, that the utilities would set a high emergency access fee, providing a further incentive for customers to go fully off-grid.

That leads to the third approach -- fully off the grid. Customers may choose this approach because to have any grid access would require a large, non-bypass-able, fixed-grid charge.

The key variable in this approach is the cost of power storage. Assuming that it could reduce the cost of batteries to levels significantly below other storage options, Tesla’s Giga factory would have a significant impact on the extent to which customers pursue this off-grid approach.

Tesla could provide emergency power service by monitoring the power levels in home batteries and delivering replacement batteries in the event that home batteries run out of power.

But it is not just solar that is providing off-grid options. Morgan Stanley notes that the Stirling engine product being developed by NRG (which provide power from natural gas) could be cost-competitive with solar, particularly in those states with less favorable solar conditions.

These Stirling engines, coupled with batteries, would have a low capital cost, would allow households to use waste heat from the generator for heating the air and water in the home, and would run around the clock.

Morgan Stanley’s short- and medium-term distributed generation scenarios

So here’s how Morgan Stanley sees the market playing out over the next decade.

Over the next three to four years, solar penetration will continue at a rapid rate in Hawaii, the West and the Southwest, and solar service providers such as SolarCity will continue to expand their scale and geographic scope. Solar installed costs will come down.

Utilities will react by imposing fixed grid fees on distributed generation customers, but these fees will not significantly slow down the adoption of solar in the “sun-rich, rate-high” areas of the U.S.

Tesla will build its Giga factory and reduce the cost of storage further, and Tesla and SolarCity will integrate storage into a complete home/office energy management system to allow customers to go off-grid, building off the two firms' existing joint venture.

Hawaii, currently at 10 percent solar penetration, may experience levels of solar penetration that begin to substantially impact remaining utility customer bills, as well as impacting grid functionality. As a result, the “rate headroom” for remaining customers to go off-grid will rise, and customers might choose a “solar plus batteries” off-grid approach.

Utility bills will continue to rise, as utilities continue to maintain significant capex levels, driven by changes to the grid from the increase in renewables and gas-fired generation, as well as coal plant retirements and other factors.

Morgan Stanley’s scenario for five to eight years from now holds that California and other Southwestern states will reach solar penetration levels above the 10 percent level currently being experienced by Hawaii. Solar and storage costs will continue to fall, but at a lower rate.

“Given the incentive for customers to move to solar, more customers in the West/Southwest will, in our view, seek to do so,” it says. “If it becomes challenging for solar customers to secure utility approval to interconnect to the grid, we believe customers would likely pursue an off-grid approach offered by companies such as Tesla and SolarCity.”

However, under a “changing utilities scenario,” utilities take steps to enhance the ability to integrate large amounts of renewables onto the grid. The idea would be to ensure solar customers stay on the grid and contribute to the cost of maintaining the grid, rather than losing solar customers to off-grid business models.

***

Editor's note: This article is reposted from RenewEconomy. Author credit goes to Giles Parkinson.