The announcement that PG&E has stopped taking applications for its portion of the CSI residential program has caused a bit of nostalgia and something of a feel-good moment among some in the solar industry.

In our opinion, however, the CSI residential program would still be languishing had it not benefited from battles won and lucky breaks that could barely be imagined when the CSI program was being created. The three biggest are:

- Changing the federal residential Investment Tax Credit from a maximum of a $2,000 tax credit to a 30 percent unlimited tax credit in October 2008.

- A glut of PV capacity that drove prices down from above $2 per watt to well below $1 per watt.

- The rise of third-party financing that gained serious traction in 2010.

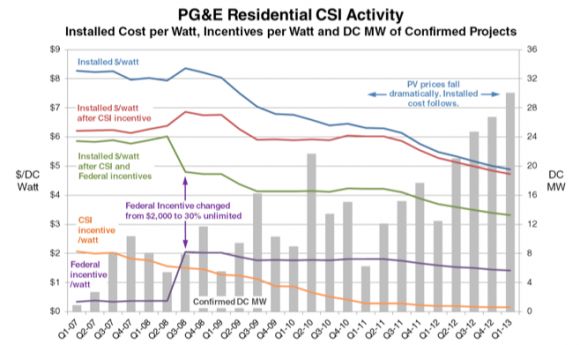

The first chart below shows PG&E’s CSI residential cost and demand activity. The purple and green lines illustrate the first point. A 30 percent unlimited residential tax credit was a pipe dream and had all sorts of opposition, including from the IRS, which was concerned it would encourage fraud. However, when miraculously implemented, it had the effect of dropping installed costs by more than $1 per watt. Solar businesses immediately started selling the new incentive.

The change was effective starting 2009 and it took a few quarters to take hold, but you can see megawatt-scale increases -- even during the recession. By our estimate, PG&E residential customers have, to date, received over $500 million of tax credits, directly if they buy the system, or indirectly if they contract with a third-party finance company.

The second point, the rapid decline in PV price, is shown by the blue line in the figure below. China’s mega-expansion and resulting aggressive market actions clearly drove growth. The price reductions of more than $1 per watt have largely been passed through by solar businesses to consumers. Combined with the 30 percent unlimited tax credit, installed cost was reduced by more than $2 per watt -- the vast majority of system savings.

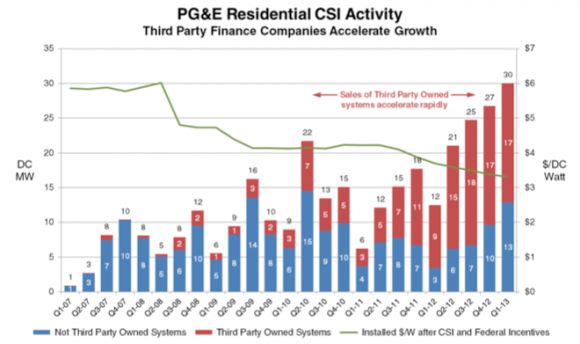

The next chart shows the dramatic rise of consumer and investor acceptance of residential third-party financing in PG&E territory. By late 2009, the results of the pioneers' efforts began to be clearly apparent. For the last six quarters, TPO systems have dominated the residential market. We have frequently wondered what demand would be in the CSI residential program without these financing mechanisms, but we are sure that it would not approach the megawatt numbers we see now.

Referring back to the first chart, and as shown by the red and orange lines, the CSI incentive has declined as planned and has been just a small part of system savings over the past few years. Depending on who you talk to, it’s either been icing on the cake or a nuisance that cost time and money.

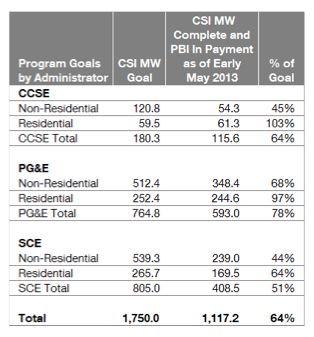

So how is the CSI program doing overall? Table one below shows the results through early May 2013. From the start of the program, we have been vocal in our view that the CSI is overly complicated, administratively expensive and causes long project delays. We have also been consistent in our view that the program would not have enough demand to reach the 1,750 megawatt requirement by the end of 2016. PG&E’s and CCSE’s residential programs are bright spots. As we near the six-and-a-half year mark of the ten-year program, we’re still not convinced that the CSI will meet its goals.

Now that PG&E’s residential program is functionally complete, and presuming the utility continues to support residential net metering, we’ll see another cost and demand experiment. Our guess is that consumers will get a faster install at a lower cost and that solar businesses will operate more efficiently and potentially more profitably. We think this will lead to an increase in demand for residential solar in PG&E territory.

***

Glenn Harris is CEO of SunCentric Incorporated.