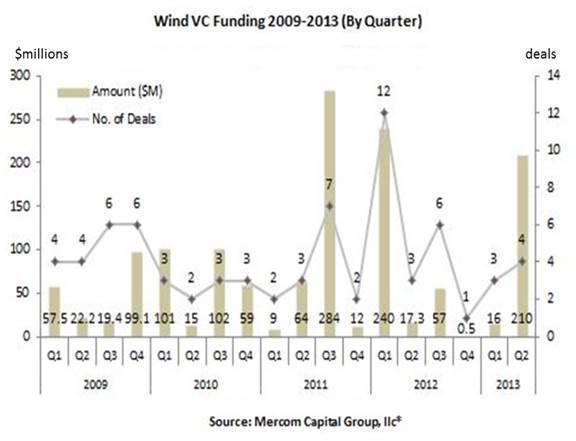

Money is flowing back into wind after a first-quarter hiatus stemming from policy uncertainty.

The Q2 2013 venture capital investment of $210 million dwarfed the Q2 2012 $16 million VC funding, according to Mercom Capital. Though total Q2 2013 wind sector investment of $3.5 billion, covering VC funding, debt financing and announced project deals, did not match Q2 2012’s nearly $5.5 billion, it was a strong showing for an off year.

The VC money included a $135 million Goldman Sachs (GS) addition to its now $385 million backing for India project developer ReNew Power.

There were 36 wind project acquisitions in Q2. That brought the 2013 total to 53, as compared to 72 during all of 2012. Fifteen investment funds, eight project developers, six independent producers and four utilities were among the buyers.

Another indicator was the just-reported Broadwind Energy (BWEN) $200 million order backlog for turbine towers. CEO Peter Duprey said his company is now booking 2014 orders and expects to fill its 500-tower annual manufacturing capability.

Although no new wind capacity went on-line in Q2, 25 power purchase agreements representing 3,950 megawatts of capacity have been completed thus far in 2013. Utilities have announced they will build a further 1,300 megawatts and 1,280 megawatts of wind are in construction, according to the American Wind Energy Association Q2 Market Report.

Utilities also issued eleven wind-specific RFPs representing 1,300 more megawatts. Many are seeking to complete deals in time to take advantage of the current production tax credit that will apply if construction gets underway this year.

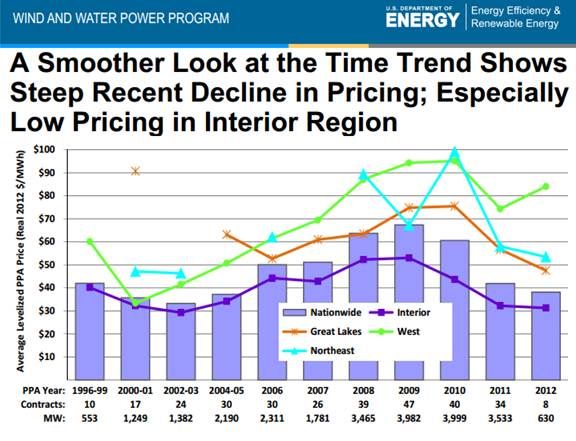

The reasons behind the PPA activity were reflected in data from the Lawrence Berkeley National Lab (LBNL) 2012 Wind Technologies Market report. It showed that PPA prices for wind in the resource-rich Midwest fell as low as $40 per megawatt-hour last year.

Competitiveness remained tenuous, however, because low natural gas prices and slowed electricity demand kept wholesale power prices as low as $20 per megawatt-hour to $40 per megawatt-hour. PPA activity in the West and other regions continues to be driven largely by state mandates.

Bigger, smarter turbines have increased wind’s average capacity factor to 32.1 percent, the LBNL report noted, despite more wind being built in low-wind locations.

GE dominated the 2012 U.S. wind turbine manufacturing marketplace with a 38 percent share and 5 gigawatts of new capacity. Vestas was second with 20 percent. Siemens (14 percent) and Gamesa (10 percent) followed. New inroads were made in 2012 by Chinese and South Korean manufacturers, including Goldwind, China Creative Wind Energy, Guodian United Power, Sinovel, Hyundai, HZ Windpower, and Sany Electric.

Recent turbine prices, which the LBNL report said are exerting downward pressure in the marketplace, range from $950 per kilowatt to $1,300 per kilowatt. Average project costs fell almost $200 per kilowatt in 2012 to $1,940 per kilowatt.

Obstacles to further price competitiveness and growth for wind, according to the LBNL report, include federal policy uncertainty, low natural gas and wholesale electricity prices, competition from solar in sunny regions, slowed electricity demand, the filling out of state mandates, and transmission bottlenecks.

The single most noticeable 2Q 2013 wind industry trend was a dramatic opening up of utility-scale offshore wind opportunities.

The Department of Interior (DOI) Bureau of Ocean Energy Management (BOEM) July competitive lease auction for wind development off the Massachusetts-Rhode Island coast was won by Deepwater Wind.

Backed by the D.E. Shaw hedge fund, the developer plans to begin construction in 2017 on a $5 billion, 1,000-megawatt project. Deepwater Wind expects to sell the electricity to Long Island, Rhode Island, Massachusetts and Connecticut utilities looking to hedge high and unpredictable electricity prices.

BOEM announced another lease auction for Virginia coastal waters in September, with another for ocean acreage off Maryland expected to follow.

And Cape Wind, the first U.S. large-scale offshore wind project, continued to move toward initiating construction by late 2013 or early 2014. In June, PensionDanmark committed $200 million to the project, and in July the developers signed a $15 million deal with the Lawrence-Lynch Corp. to build onshore interconnections.

Also noteworthy:

Sinovel, once China’s wind turbine manufacturing flagship, announced it would close offices in the U.S., Canada, Belgium, and Italy. It has lost steam internationally since being implicated in the theft of intellectual property from U.S.-based AMSC. Though it has a 2013 order pipeline of more than 9 gigawatts, only 82.5 megawatts are outside China.

At the request of the Anti-Mafia Directorate, Sicilian police arrested five, including a town mayor, on charges that permits were delayed at two Iberdrola-owned wind farms in order to force the developer to use preferred suppliers. This follows an ongoing investigation into Mafia involvement in a wind farm in the southern Italian region of Calabria.

Finally, Google, Inc. (GOOG) bought kite-wind pioneer Makani Power in May. Makani’s flying wing would carry rotors up to high altitude winds and deliver electricity to ground substations via the power cable tethering the craft. Makani believes it can eliminate 90 percent of a traditional turbine’s bulk and cut wind energy’s LCOE in half. It plans to have an Airborne Wind Turbine operational by 2015.