According to survey data from The Solar Foundation, there are 173,807 solar workers in the U.S., up from 142,689 in the previous year, making the solar industry one of the bright spots in the U.S. job market.

Between November 2013 and November 2014, solar employment increased by nearly 22 percent, almost twenty times faster than employment in the overall economy, according to the jobs census. Over the last five years, solar industry employment has grown by 86 percent, amounting to about 80,000 new jobs.

This doesn't come as much of a surprise. According to data from GTM Research and the Solar Energy Industries Association, it’s estimated that more than 7,200 megawatts of solar energy were installed in 2014 in the U.S. Put another way, a new solar system is now installed every two and a half minutes in this country.

Solar still represents only about 1 percent of total U.S. electricity generation, but it outpaced job growth in more established fossil-fuel industries. The report notes that in 2014, the oil and gas pipeline construction industry and the crude petroleum and natural gas extraction industry added 10,529 and 8,688 jobs, respectively.

Here are four other trends highlighted in The Solar Foundation report.

The solar market is becoming more streamlined

Installation jobs made up the vast majority of total year-over-year growth, accounting for 56 percent of all solar jobs in 2014 (97,031 positions). Manufacturing jobs also increased significantly, accounting for 19 percent of jobs in the sector (32,490 positions).

Figure: Solar Sector Employment 2010-2015 (Projected)

While overall job numbers are up, it now takes fewer people to do the work. In 2014, there were 15.5 jobs per megawatt installed; in 2013, there were 19.5.

Solar jobs are counted based on the number of people who spend at least 50 percent of their time dedicated to solar activities. Last year, 90 percent of all solar workers worked on solar 100 percent of the time.

“This industry is increasingly specialized, increasingly a pure-play” space, according to Andrea Luecke, executive director of The Solar Foundation. As the industry continues to mature and consolidate, it will allow companies to save money on labor while providing better quality services, she added.

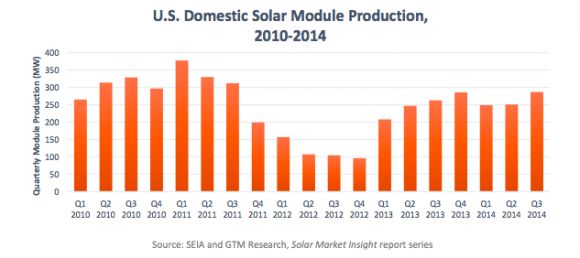

Domestic solar manufacturing is back

Despite the fact that R&D investments are down, the U.S. is still at the forefront of technological development in solar. Global demand for solar is growing, and the U.S has enormous market potential. These factors have helped nudge domestic solar product manufacturing upward.

Solar manufacturing grew 8.8 percent over the past year. The third quarter of 2014 saw domestic solar module production spike, up 275 percent since the slumping 2012. Domestic production of polysilicon, cells, wafers and inverters is also up year over year.

U.S. module manufacturing capacity is now on track to surpass 3.5 gigawatts by 2018, up from 1.6 gigawatts today. Cell manufacturing capacity could increase to 2 gigawatts, up from 0.7 gigawatts, over the same period.

There were several major announcements in solar manufacturing last year: Suniva announced plans to open a second U.S. manufacturing facility in Michigan, First Solar announced plans to add two new production lines, and Solar City announced acquisition of Silevo and its plans to build 1 gigawatt of module production capacity.

“In 2012, solar manufacturing lost 8,500 jobs. Everyone was worried solar manufacturing was on the brink of collapse,” said Luecke. “Despite the trade case and uncertainty, it’s now getting stronger.”

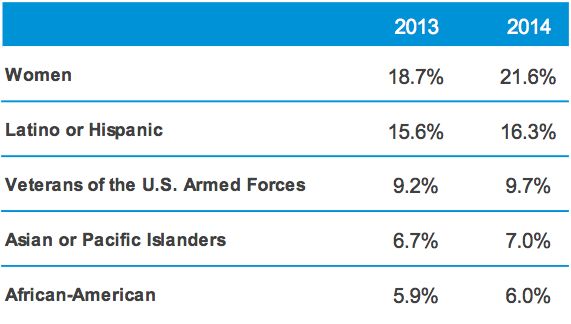

The solar market is becoming more diverse

Across the board, the number of women, veterans and ethnic minorities employed by solar firms increased in 2014 compared to the previous year. Training programs from the Department of Labor, the Department of Defense, the Department of Energy and companies such as SunEdison have helped to bring more underrepresented demographics into the sector.

Figure: Solar Worker Demographic Breakdown

But there’s still more work to do, said Luecke. African-Americans now make up 6 percent of solar workers, up slightly from 5.9 percent. This represents less than half of the 2013 national average for African-American participation in the labor force.

Last year, Reginald Parker of 510nano, which currently maintains the largest African-American-owned solar plant in the United States, told Greentech Media that minority groups often miss out on recruitment opportunities.

“Women and minorities get locked out even before they know there’s a chance to get in,” he said.

Research shows that companies with more diverse teams perform better than companies that lack diversity.

“It makes good business sense to be diverse; you avoid groupthink when you have people from different backgrounds,” said Luecke. “And it’s not just a gender and racial thing; it’s also about age, culture and income. Diversity is a good thing; it generally leads to more innovative thought.”

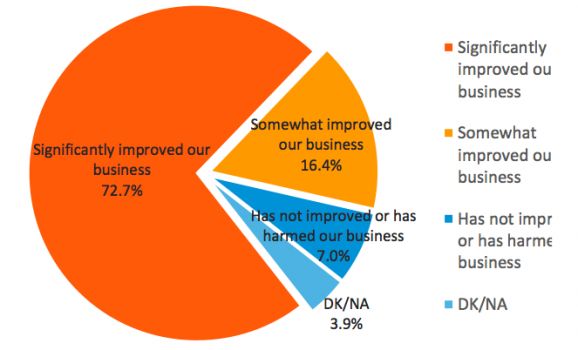

The Investment Tax Credit fostered growth

Nearly three quarters of businesses that responded to the survey said the 30 percent federal Investment Tax Credit significantly improved their business. Another 16 percent said it has somewhat improved their business.

In 2016, the ITC will be lowered to 10 percent for large-scale projects and will be eliminated for residential projects. Nearly 40 percent of respondents said the change would not affect their workforce. That could be because many of these companies aren’t eligible for the tax credit, such as manufacturers that sell their product globally.

Almost all installers (94 percent) feel the ITC is vital to their sector, however. More than 60 percent of installers surveyed said eliminating the residential credit and reducing the commercial one would likely cause them to lay off staff.

The short term, at least, looks promising. The solar industry expects to add another 36,000 jobs over the next twelve months, up 21 percent over 2014. Solar sales firms are expected to see the most growth (up 26 percent).

Those numbers may seem overly optimistic, said Luecke. But in previous years, solar employers actually sold themselves short, exceeding their predictions in 2012 and 2013 by 2.7 percent and 6.2 percent, respectively.

“I think next year we’re going to continue to see strong growth,” said Luecke. “Then, in 2017, all bets are off.”