Every quarter, GTM Research's solar analysts compile the most important data and findings from the past three months. The most important charts from the Q4 2014 Solar Executive Briefing covering pricing, installations, financing, policy and business models follow.

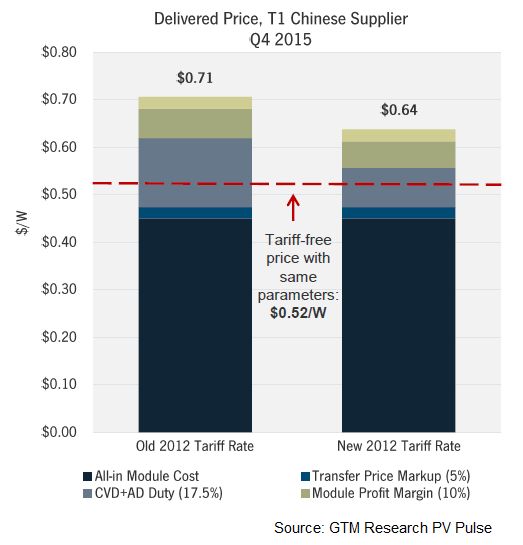

The new China solar tariff decision may drive panel prices below 65 cents per watt this year.

Earlier this month, the U.S. Department of Commerce filed its preliminary review of the import tariffs on Chinese cells into the U.S. The review called for tariffs on Chinese cells to be reduced, and assuming the final decision doesn't stray too far from the review, GTM Research expects U.S. module prices to fall to 64 cents per watt this year.

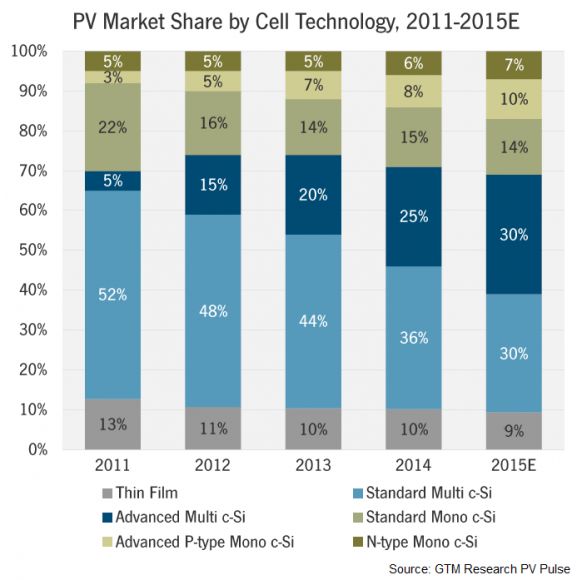

High-efficiency module technologies are gaining steam.

According to GTM Research's Shyam Mehta, the shift is "driven by the increased value proposition of high efficiency relative to module costs, an end-market mix shift toward rooftop applications, and reduced all-in costs for high-efficiency products."

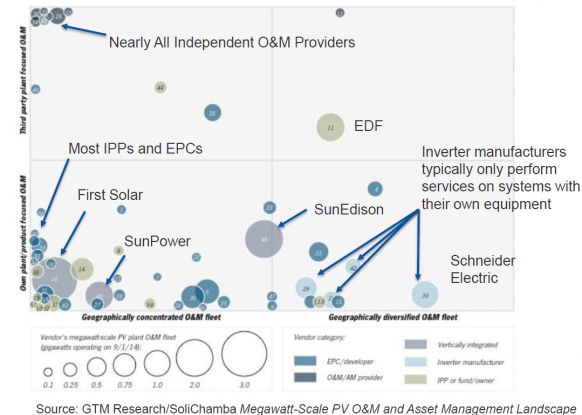

The megawatt-scale solar operations and maintenance (O&M) market still looks like the Wild West.

Dozens of companies are fighting for market share in the operations and maintenance market, from inverter and module manufacturers to developers and EPCs. Everyone wants a piece of the O&M pie.

(Click to enlarge)

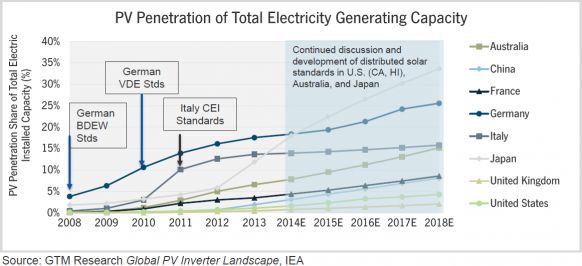

Grid integration is becoming an increasing focus for inverter manufacturers.

Inverter manufacturers are beginning to design solutions to help alleviate some of the integration challenges facing utilities. The chart below highlights a few markets with high PV penetration relative to electricity generating capacity.

(Click to enlarge)

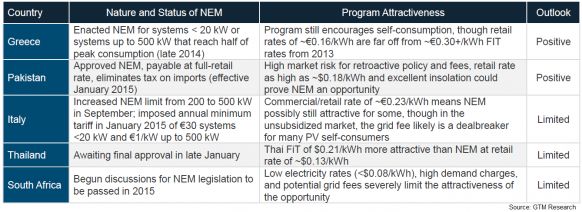

Net energy metering is becoming popular outside of the U.S.

Net energy metering has helped grow distributed generation PV markets in the United States, and other countries have started to take notice. GTM Research's Adam James highlights a few NEM proposals across three continents that aren't North America.

(Click to enlarge)

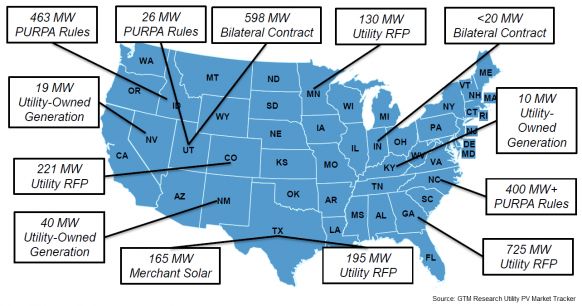

More than 4 gigawatts of utility-scale solar have been procured outside of RPS requirements in the past twelve months.

GTM Research's Cory Honeyman attributes the success of projects outside RPS guidelines to utility-scale PV's competitiveness with natural-gas alternatives.

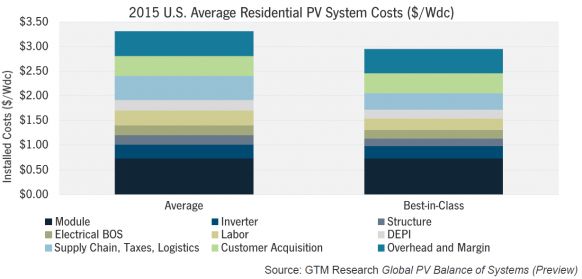

Best-in-class residential solar will be installed for less than $3 per watt this year.

The largest cost difference between best-in-class installers and the rest of the market comes from labor and supply chain savings.

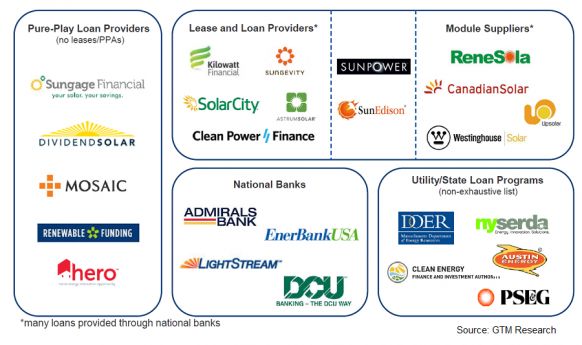

Loans are the hottest thing in U.S. residential solar.

As we reported last year, the market share for residential solar leases peaked in 2014 as loans have emerged and shifted the market back toward direct ownership. Solar Analyst Nicole Litvak developed a taxonomy of companies offering residential solar loans in the U.S.

***

GTM Research clients receive quarterly slide-based market briefings from the solar analyst team. For more information on the solar research subscription, download the brochure here or contact Matt Casey at [email protected].