Tesla Motors just had a billion-dollar sales quarter.

Ben Kallo of Baird Equity Research writes: "Tesla beat estimates across the board, had stronger-than-expected production, and remains on track for initial Model X deliveries in Q3," adding, "We remain buyers at current levels."

Tesla Q1 results and highlights

-

The company built 11,160 vehicles, 10 percent better than its guidance.

-

Tesla delivered 10,045 vehicles in the quarter. CEO Elon Musk noted that delivery for Tesla means getting a car to the customer, not into a dealer channel as with the traditional automakers.

-

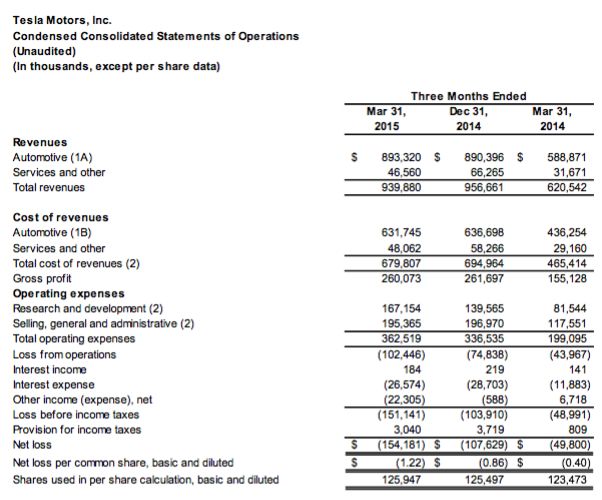

The company reported a GAAP net loss of $154 million for the first quarter of 2015. Judging by Musk's response at the Tesla battery unveiling, profit is not the prime directive for this CEO.

-

Tesla reported non-GAAP revenues of $1.1 billion, compared to $713 million a year ago. GAAP revenue was $940 million.

-

The company claims that the Model X SUV is "on track for start of deliveries in late Q3." Tesla is counting on Model X sales to meet 2015 guidance.

-

Tesla is "confident" in its ability to deliver "55,000 Model S and Model X vehicles combined in 2015."

-

"We continue to see growing Model S demand," reported the company in its shareholder letter.

-

"Q1 automotive revenue included $66 million of total regulatory credit revenue, of which $51 million came from the sale of ZEV credits."

-

Tesla will now segregate its new vehicle business from its other business activities such as powertrain sales, service revenue, Tesla Energy and pre-owned Tesla vehicle sales. "Services and other revenue was $46.6 million. This includes $22 million of powertrain sales to Daimler and $20 million of service revenue." The remaining $4.6 million of revenue presumably came from sales of stationary energy storage, pre-owned vehicles, and locks of Musk's hair. The pre-owned sedans come with a four-year, 50,000-mile limited warranty.

-

Tesla hit a Q1 total company GAAP gross margin of 27.7 percent.

Energy storage according to Musk

Musk said Tesla is focused on optimizing the operational efficiency of the company for the long term, not for quarterly results. As for the recent automotive Apple rumors, Musk said that he hopes Apple enters the vehicle business.

The energy business occupied much of the attention of the analysts in the Q&A portion of the earnings call.

Musk said that the response for the energy storage products "has been overwhelming." He added that there are 38,000 reservations for the residential Powerwall product and 2,500 reservations for the 100-kilowatt C&I battery.

The CEO said that the company had "sold out through the next year in the first week." Musk said that there had been so many requests for distributors, "We have to triage our response to people who want to be distributors." Tesla suggests that stationary energy demand could be double that of automobiles in terms of megawatts.

Musk said that the 7-kilowatt-hour daily cycling storage unit is more suited to the rate cases and utility policies of Germany and Australia. The CEO said that storage economics in the U.S., with rare exception, are more expensive than power provided via a utility. But, said Musk, that doesn't mean that people won't buy it for the security of backup power.

Q2 and 2015 guidance

-

Tesla expects to produce about 12,500 vehicles in Q2.

-

It looks to deliver 10,000 to 11,000 vehicles in Q2.

-

The company is "still on track to deliver approximately 55,000 Model S and X vehicles in 2015."

Tesla stock is trading up more than 1.3 percent in after-hours trading.