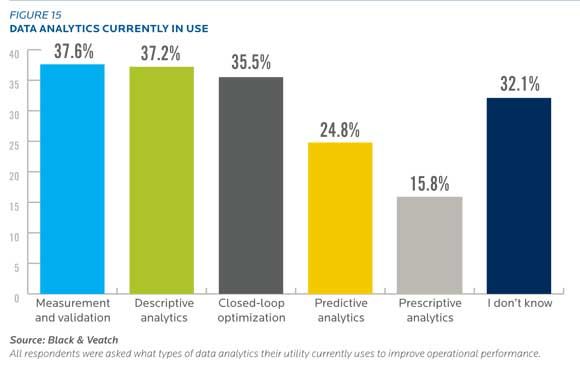

When 235 utility respondents were asked by Black & Veatch what sort of data analytics their utility was using to improve operational performance, many said they simply didn’t know.

The results of an inaugural report by Black & Veatch, 2014 Strategic Directions: Utility Automation & Integration, show that utilities are interested in remote monitoring, asset maintenance and data analytics, but deploying those technologies effectively is a bit of a head-scratcher for many utilities.

Some of the confusion may be in the language. Although the question was clear, perhaps the operational teams, which made up about half of the respondents, aren’t trained on the different flavors of data analytics, such as predictive versus prescriptive analytics. Additionally, respondents were allowed to pick more than one answer, which could have muddied the results.

But “I don’t know” was a concerning, yet popular, answer for various questions, including queries about what data is used for, remote monitoring, cloud services and emerging technologies. “Some of that is the need to bridge IT and OT,” said Marty Travers, president of Black & Veatch’s telecommunications business.

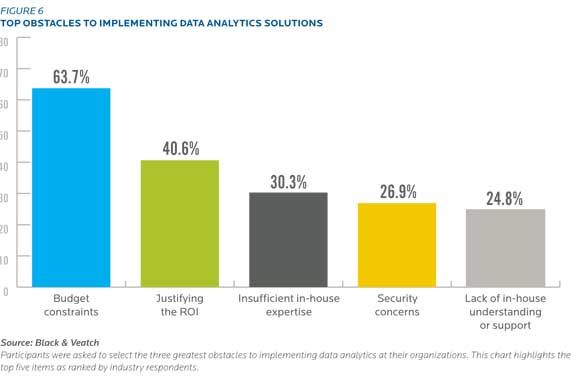

Travers is likely correct, but the potential barriers between IT and operational staff is precisely one of the problems utilities have when building robust business cases for data analytics. Even among utilities that are pulling in a lot of data, many aren't doing anything with the results, according to the findings of another recent survey from Oracle. The difficulty of building a business case was one of the significant barriers to deploying automation technology, according to Black & Veatch’s report.

“It’s a call to action for the whole industry,” Travers said of the difficulty utilities are having in justifying the ROI of automation and analytics. Despite significant obstacles to rolling out sophisticated data analytics across the entire utility, many utilities are cherry-picking projects, mostly for operational benefits such as asset management. GTM Research values the market for advanced metering analytics alone at nearly $10 billion by 2020.

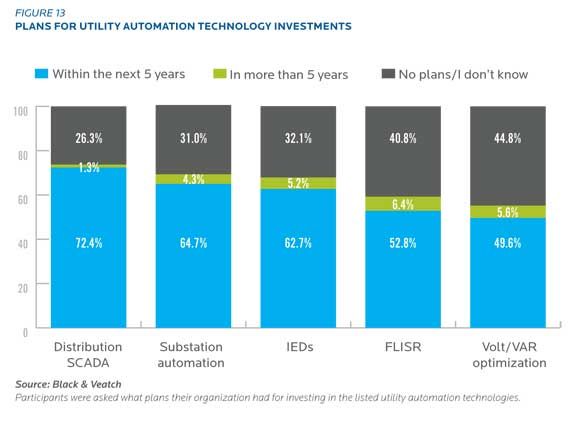

Nearly three-quarters of utilities surveyed said they were planning distribution automation projects within the next five years, with substation automation not far behind. More than 70 percent of utilities said they plan to expand the use of sensors for field data analytics in the next three years.

“Change is happening at the CIO level,” said Travers. “But the industry still needs to be shown the high value of analytics.”