Sungevity was almost broke.

Sungevity's just-announced reverse merger with Easterly Acquisition Corp. valued the solar sales and customer-acquisition platform firm at $357 million. As we've reported, Sungevity raised $650 million in project finance and equity funding from private equity giant Apollo Global Management last year, with total investment of more than $850 million in VC and project financing from investors including home improvement store Lowe's and European utility E.ON.

The company claims it can quickly deliver a firm price quote for residential solar rooftop systems without having to pay a visit to the roof site. It aims to own the customer experience from sale though installation and operations and maintenance. The company contrasts Sungevity as "an asset-light, sustainable business model that is scalable, thrives on relatively modest levels of capital and enables a path to profitability and cash flow generation. This stands in sharp contrast to the capital-intensive, asset-driven and vertically integrated model now ubiquitously deployed in today’s downstream solar market."

We covered the deal here. There are certainly positive aspects to the merger, as pointed out by the experienced solar investors we interviewed about the transaction.

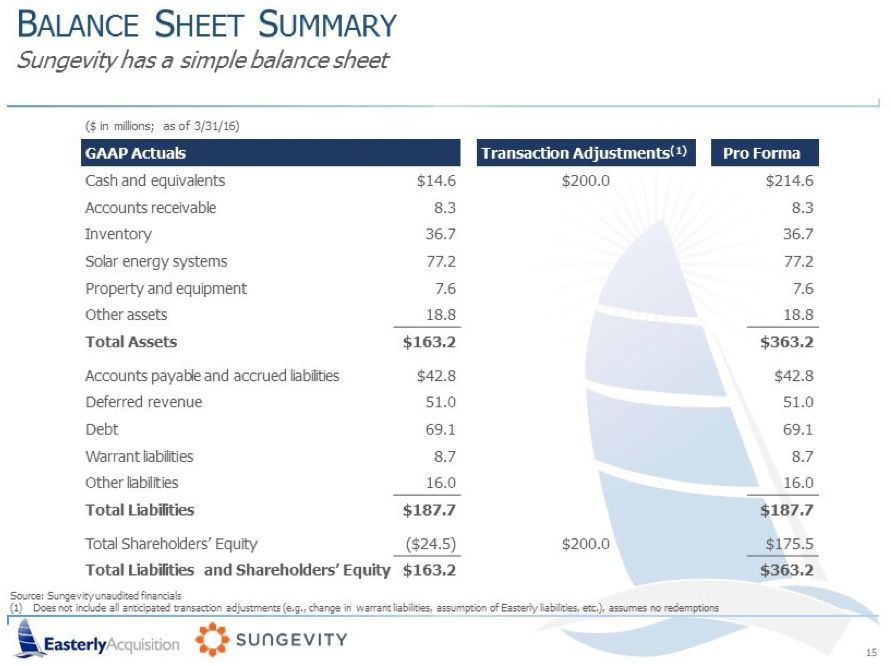

- Sungevity gets access to $200 million in capital as part of the deal. A source suggests that Sungevity came up short with the Apollo round (only $50 million in equity of the $650 million, at a tough valuation). "So they probably couldn’t have raised much more in the private markets unless their performance was superb."

- "The valuation was probably relatively good for them." Sungevity has seen down rounds and recaps. "So it was probably a bump on the last valuation."

- "This solves the real structural issue of having a large preferred shareholder base -- they all get converted to common [shares]."

However:

- "Being public as a microcap by itself is a terrible place to be. In general, this is a terrible way to go public. You don’t get to sell your story to a long-term shareholder base and don’t pick up any analyst coverage in the IPO process. If you knock it out of the park operationally, this can self-resolve, but the typical fact pattern is companies waste the money they raised in such a reverse merger and then can’t raise any additional capital since they don’t have any real shareholder base and no banks will touch them/underwrite a follow-on offering."

- "[Sungevity has] shown repeatedly that it can’t run the business at a profit, has consumed a massive amount of capital [despite] being 'capital-light,' and as a result has continuously been recapped."

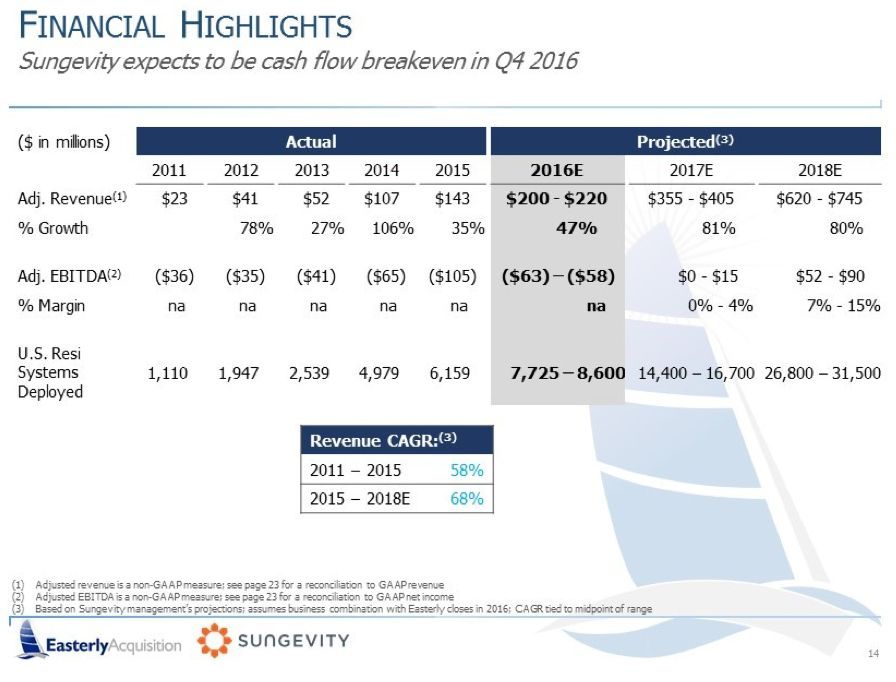

And here's the kicker: despite talk of being EBITDA positive in 2017, an SEC document filed by the merger hopefuls shows that, absent this deal, Sungevity was about to run out of money. The company is burning about $15 million per quarter, and had about $15 million in the bank three months ago. The company laid off 250 employees in March of this year.

"I would say this merger is a hell of a deal for Sungevity considering they were about to dry-hole again," said one of our sources.