In January of this year, Sungevity, the solar sales, financing, and software startup, won $125 million in new venture capital and project financing.

Today the company landed another $15 million in funding, including investment from GE Ventures. Colleen Calhoun, Senior Executive Director for GE Energy Ventures, noted in a statement, “GE Ventures is pleased to invest in Sungevity for its sophisticated technology platform, capital-light business model and strong potential for growth as rooftop solar hits meaningful scale."

Previous investment has come from Brightpath Capital Partners, home improvement store Lowe's, Vision Ridge Partners, Firelake Capital. Craton Equity Partners and Eastern Sun Capital Partners.

Home and business owners can contract with a third party like Sungevity for a solar system installed, owned and maintained by the third party. The investor gets the 30 percent federal Investment Tax Credit (ITC) and the installer gets regular payments over the contract’s term. The resident gets solar-generated electricity at a rate below the retail utility rate without bearing the burdens of upfront costs and ownership risks.

It's another sign that investors still see value in the downstream solar market. SolarCity (SCTY) is trading at $37.49 per share. The optimism embedded in SolarCity's stock performance likely helps companies like Sungevity or Clean Power Finance.

The startup has a presence in Arizona, California, Colorado, Connecticut, Delaware, Maryland, Massachusetts, New Jersey and New York. The firm also has a foothold in Europe through Dutch company Zonline, and in Australia through a joint venture called Sungevity Australia.

Sungevity's goal is to lower the cost of solar customer acquisition, reduce installation costs (which it cut by 30 percent in 2012), and deliver a firm project quote within twenty-four hours of inquiry without a visit to the home.

According to GTM Research, in the first half of 2012, Sungevity had a 3.1 percent U.S. residential installer market share, compared to SolarCity at 13.3 percent. Sungevity financed the installation of panels from Suntech (42 percent), Schuco (29 percent), BP Solar, and Sharp in the first half of last year.

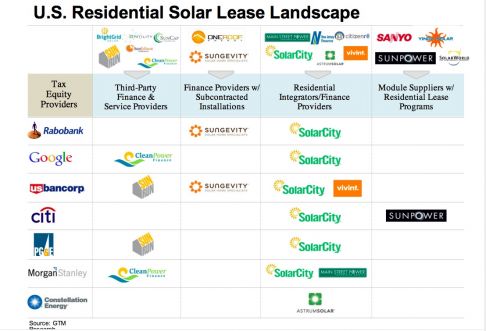

Sungevity, along with SolarCity, as well as SunEdison, Sunrun, Vivint, CPF, OneRoof, BrightGrid Solar, and a few others, have spearheaded the third-party ownership model that has driven the growth of residential and rooftop solar.

Sungevity notes that the firm has doubled the number of annual installations every year since its founding.