SunPower's stock is up 10 percent since its second-quarter earnings call this week.

The vertically integrated solar provider achieved three "key milestones" this quarter, according to CEO Tom Werner.

Key milestones

-

SunPower and First Solar launched the joint YieldCo 8point3 Energy: SunPower asserts that "8point3 Energy Partners will provide us a significant long-term cost-of-capital advantage and enhance the scale and predictability of our future cash flows."

-

SunPower acquired the 1.5-gigawatt U.S. solar project development pipeline of Infigen Energy: The $38 million acquisition included approximately 35 solar projects ranging up to 100 megawatts with project build-out through 2020. Three projects totaling 55 megawatts have PPAs in place with SCE, with completion expected next year. These projects will likely join the "portfolio of potential drop-down assets" for the YieldCo. UBS suggests, "This deal should help SunPower's project pipeline and relieve some concern about the U.S. being a viable market when/if the ITC is reduced. Furthermore, these projects will likely be dropped into CAFD."

-

Signed residential solar partnerships with three U.S. utilities: SunPower inked channel partnerships with Dominion Retail and ConEdison Solutions (as well as an undisclosed partner) for the competitive New Jersey and New York electricity markets. ConEdison Solutions is a competitive electricity and natural gas provider and Con Ed's retail arm. SunPower's Werner told GTM that these partnerships are indicators that utilities really want to be involved in solar deployment.

Takeaways from the earnings call

-

The U.S. and Japanese markets continue to drive SunPower's distributed generation business.

-

SunPower is hitting record yield, with average solar-cell efficiency "close to 23 percent" across all lines.

-

The company expects manufacturing to grow to from ~1,500 megawatts this year to almost 2 gigawatts next year.

-

The 579-megawatt Solar Star project for Berkshire Hathaway Energy and SCE is fully grid-connected.

-

Signed the largest school-district solar contract in the U.S. with Kern High School District, with 22 megawatts to be deployed over 27 sites

-

The company's commercial project pipeline now exceeds $1 billion, and there is talk of the launch of new commercial products.

-

Power plants accounted for 43 percent of revenue, residential for 40 percent.

-

SunPower will be installing fewer of the C7 concentrators in China this year.

- The U.S. and Japanese markets continue to drive SunPower's distributed generation business.

- SunPower is hitting record yield, with average solar-cell efficiency "close to 23 percent" across all lines.

- The company expects manufacturing to grow to from ~1,500 megawatts this year to almost 2 gigawatts next year.

- The 579-megawatt Solar Star project for Berkshire Hathaway Energy and SCE is fully grid-connected.

- Signed the largest school-district solar contract in the U.S. with Kern High School District, with 22 megawatts to be deployed over 27 sites

- The company's commercial project pipeline now exceeds $1 billion, and there is talk of the launch of new commercial products.

- Power plants accounted for 43 percent of revenue, residential for 40 percent.

- SunPower will be installing fewer of the C7 concentrators in China this year.

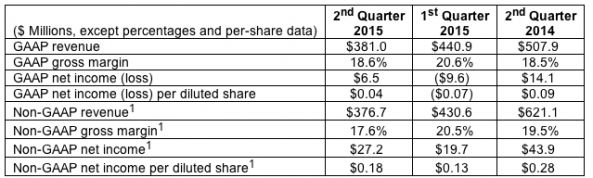

Chart: SunPower Q2 Financial Results

Source: SunPower

Bullish solar growth forecast

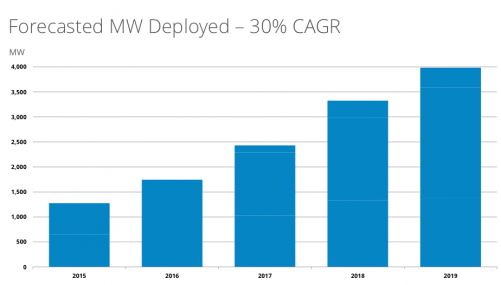

SunPower boosted its megawatts deployment forecast from a CAGR of 25 percent to 30 percent for 2013-2019 (compared to a guidance provided in 2014), with deployments growing from ~1,275 megawatts in 2015 to nearly 4 gigawatts in 2019.

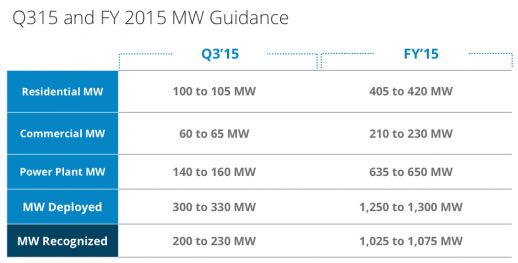

2015 guidance

SunPower anticipates 2015 non-GAAP revenue of $2.4 billion to $2.6 billion, gross margin of 21 percent to 23 percent, and deployments of 1,250 to 1,300 megawatts. For Q3 2015, SunPower expects GAAP revenue of $400 million to $450 million and gross margin of 10 percent to 12 percent. The company will be relying more on the EBITDA metric and expects an EBITDA of $0 to $15 million on 300 to 330 deployed megawatts for the quarter.

The 8point3 YieldCo (CAFD)

UBS suggests that "a frantic M&A methodology would be much more difficult to maintain over the long term. Given [SunPower's] more measured approach to CAFD and decision not to chase accelerated IDR levels, we believe investors will continue to discount the story vs. peers. That said, we see recent success at SunPower in expanding its own backlog and development acquisitions as improving the overall quality and duration of its drop-down backlog, putting CAFD on track to eventually have among the greatest long-term drop-down visibility."

UBS adds that SunPower is "continuing to position [itself] as fundamentally a tech company rather than following its peer SunEdison in redefining as a General Partnership around its YieldCo structure. Rather, SunPower appears to view its CAFD vehicle as the principal, but not necessarily the only, drop-down vehicle, in contrast to other industry peers. Not only are projects outside of the core OECD geographic focus not drop-down candidates, but SunPower anticipates providing modules and developing projects for other industry partners still."

SunPower’s shares traded up about 10 percent today.