SunPower announced yet another strong quarter in this morning's earnings call. One of the world's leading vertically integrated solar manufacturers and power plant developers showed strength across residential, commercial and utility segments. The company also beat its GAAP revenue guidance for the quarter.

The real excitement -- and the reason the stock is up 15 percent -- stems from yesterday's announcement that SunPower and First Solar are forming a solar project YieldCo. But SunPower couldn't discuss that transaction at this time. Tom Werner, SunPower's CEO, did say that the rationale behind the strategic decision to pursue the YieldCo is that "we are the two most respected companies in the solar space" with strong balance sheets, diversified assets and complementary technologies.

Werner said he expects the strategic decision will provide a lower cost of capital and improved visibility.

He sees continued strength in the U.S., Japan, China and South Africa, and suggested that utility-scale solar is transitioning away from RPS-driven projects to new drivers and economic structures.

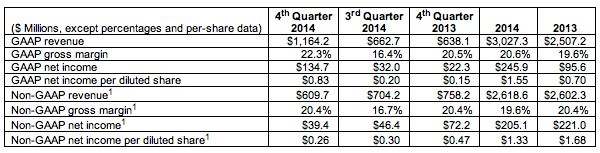

So until the two solar EPCs can discuss their joint YieldCo, SunPower stockholders will have to be content with a profitable quarter with stable ASPs and expansion on the horizon for 2015 and 2016. Here are the financials for the most recent quarter and the 2013 and 2014 totals.

Q4 highlights

-

"Construction of the 579-megawatt Solar Star Projects for Berkshire Hathaway Energy and Southern California Edison is on plan, with more than 412 megawatts (AC) now connected to the grid."

-

SunPower "continued to see significant demand in the commercial sector during the fourth quarter with strong repeat customer bookings as we added to our $1.4 billion pipeline."

-

SunPower made a number of acquisitions and investments in the "emerging smart energy ecosystem," including Sunverge Energy in the area of residential battery storage and Tendril in the area of energy information and management software. The company also acquired microinverter designer SolarBridge.

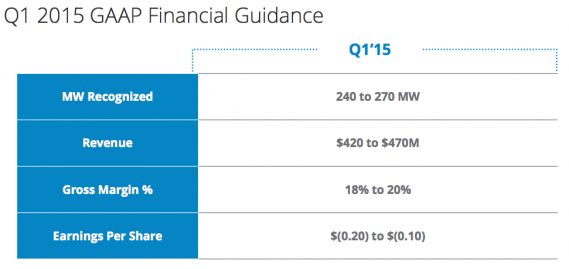

First-quarter 2015 financial outlook

The company's first quarter 2015 consolidated GAAP guidance:

- Includes revenue of $420 million to $470 million, gross margin of 18 percent to 20 percent, and net loss per diluted share of $0.20 to $0.10.

- The company notes that as a result of today's announcement of its intention to form a joint YieldCo vehicle with First Solar, it is withdrawing its previously disclosed fiscal year 2015 guidance "until such time [that] the company can finalize the impact of the proposed YieldCo vehicle on its expected financial performance."

Capacity expansion

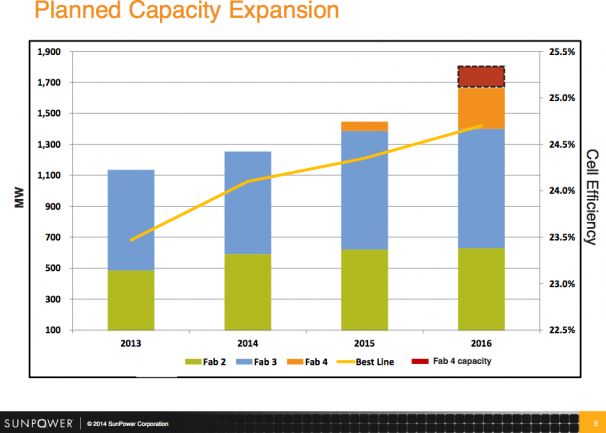

As discussed on last quarter's call, SunPower has been capacity-constrained since late 2013 and is essentially allocating its production. The company's construction of a new 350-megawatt fab in the Philippines, Fab 4, remains on track to produce up to 100 megawatts next year, according to CEO Werner, while Fab 5 is still in the works. Werner notes that the firm is still improving efficiency, with a 24.5 percent efficiency anticipated in 2016.

The equity analyst group at Baird has suggested that "SunPower’s Fab 4 should reduce costs by >35 percent, coincide with the introduction of higher-efficiency panels, and expand production capacity by ~350 megawatts. We believe cost reductions will drive margin expansion in 2015+."