Despite a lower-than-anticipated second-quarter loss and better-than-expected revenues, today's earnings call from SunPower was rougher than most, with restructuring news from CEO Tom Werner, along with some input from irate equity analysts.

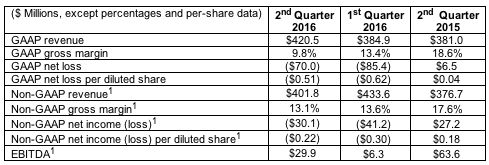

The integrated solar equipment and power supplier posted $420.5 million in Q2 revenue at 9.8 percent gross margin, along with $70 million in losses. No surprise there.

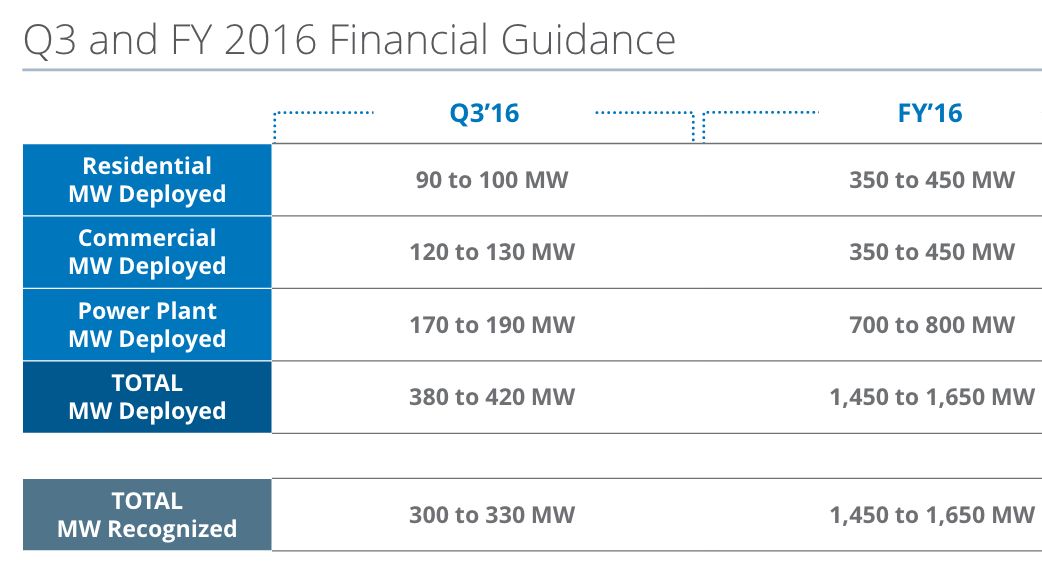

What came as a bit of a surprise was that SunPower trimmed its 2016 revenue guidance and announced that it is shedding 1,200 jobs at its module assembly factory in the Philippines. SunPower lowered 2016 revenue guidance to $3 billion to $3.2 billion with deployments of 1.45 gigawatts to 1.65 gigawatts in 2016, down from $3.2 billion to $3.4 billion and deployments of 1.6 gigawatts to 1.9 gigawatts, along with a net loss of $175 million to $125 million. For 2017, the company expects a net loss of $200 million to $100 million.

CEO Tom Werner, in his remarks and in a conversation with GTM after the call, characterized the corporate moves as proactive.

"The extension of the Investment Tax Credit, as well as the bonus depreciation credit, while beneficial to the long-term health of the industry, has reduced the urgency to complete new solar projects by the end of 2016, with many customers adopting a longer-term timeline for project completion," Werner said, in a release.

Werner also suggested that the favorable regulatory climate has drawn in new market entrants, along with irrational PPA pricing that had hit SunPower in its margins. Werner suggested that there is a bit of "a PPA oversupply" and that "the market had gotten ahead of itself on pricing." The CEO cited one vendor quoting prices 15 percent below every other bidder in a recent Mexican power tender. Werner recently went into more detail on his view of the state of the market in his blog.

Shayle Kann, GTM Research VP, said at GTM's most recent Solar Summit that utility-scale solar in the U.S. is "extraordinarily competitive now" with average PPA prices for utility-scale projects falling below 6 cents per kilowatt-hour in 2015 (including the ITC benefit). This year, the average PPA price could be below 5 cents per kilowatt-hour.

Here's a summary of SunPower's second-quarter performance.

Werner said, in a release, "We intend to focus our development resources on a limited number of core markets, primarily in the Americas, where we believe we have a sustainable competitive advantage and a project pipeline of over 9 gigawatts," adding, "We are realigning our manufacturing operations to increase the relative mix of X-Series capacity due to expected strong customer demand in our DG business as well as adjusting our panel assembly capacity to be closer to our core markets." The CEO also said the company would produce more than 500 megawatts of its lower-efficiency module entry.

Werner noted that the company had deployed approximately 500,000 microinverters to date, and is seeing, along with every other residential solar provider, "a shift toward cash and loans."

Chuck Boynton, SunPower's CFO, said the company "exited the quarter with more than $590 million in cash."

As for the now-aggressive PPA pricing environment, Werner noted that "equilibrium is a point you pass through."

Here's a summary of SunPower's updated guidance.

Listen to the bonus podcast from Stephen Lacey featuring an interview with solar pioneer and SunPower founder Dick Swanson: