Off-grid solar financier SunFunder just closed a "beyond-the-grid" solar fund worth $15 million. The company has plans to grow the fund to $50 million.

The round was capitalized with $15 million from the U.S. government's Overseas Private Investment Corporation (OPIC).

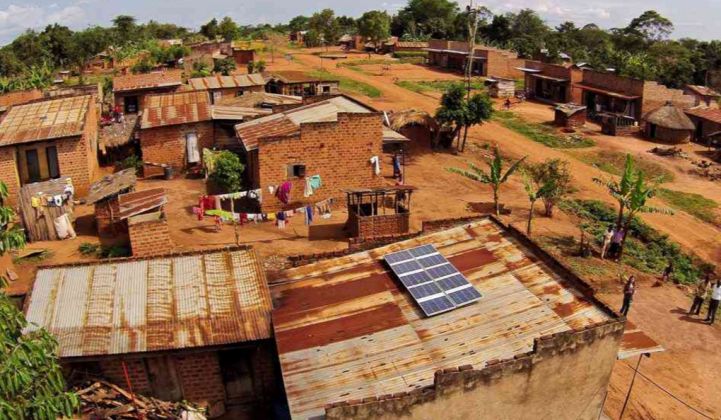

SunFunder is a company based in Tanzania and San Francisco that provides project finance loans and short-term inventory loans to solar companies deploying off-grid projects in Africa, India, Pakistan, and the Philippines. The money will be used to finance a combination of solar PV, lithium-ion batteries and LED bulbs -- technologies that could add up to a $3 billion market by 2020, according to BNEF.

"The project is expected to have a highly developmental impact by expanding the availability of debt financing to growing off-grid solar companies, the majority of which will be located in sub-Saharan Africa. An estimated 95% of those living without electricity are in sub-Saharan Africa, and off-grid solar solutions are often the cheapest and fastest way to extend energy access," wrote OPIC in its summary of the deal.

Although it's one of the biggest deals in the off-grid space, it's still just a small step toward the "clean trillion" needed to address energy poverty and climate change.

Distributed generation suffers in developing countries due to a lack of credit scoring, insufficient data and disaggregation. That’s why institutional money (i.e., pension funds) won’t look at investment vehicles until they reach minimum levels -- say, $100 million -- and collect years of data to de-risk investment decisions. The transaction costs are just too high for anything smaller.

At the same time, commercial banks rarely bother with the market because of a lack of staff expertise in developing countries. That leaves a lot of economic distributed solar in emerging markets stranded. Without capital, the sector can’t aggregate projects at the levels necessary to reach the threshold of large banks -- a classic conundrum.

This problem is exactly what specialized intermediaries like Generate Capital were built to solve in developed markets. By aggregating small deals for proven clean energy technologies, they can step in and provide financial "plumbing" that unlocks investment in underserved segments.

Similarly, SunFunder is stepping in to create the necessary plumbing from the bottom up. Rather than starting with resorts, hospitals and other commercial users, the company is starting with basic household lighting. That may seem small, but it's potentially worth $27 billion.

"As a result of its lending operations, SunFunder estimates that the fund will enable several million individuals to benefit from switching from kerosene to solar energy over the next five years," wrote OPIC.

The companies supported by SunFunder will be small and local, according to OPIC.

"The vast majority of the downstream loans will support small and medium-sized enterprises, and an estimated 25% of financing will support women-owned or women-led businesses. An estimated 73% of the fund’s customer base will be located in rural areas," wrote the organization.

The lighting market offers shorter time horizons for repayment (from 0-3 years). It’s this short time window -- coupled with sophisticated data collection on repayment -- that limits investor risk and enables securitization of projects.

By building energy services and credit off basic solar lighting, SunFunder hopes to raise money from commercial banks and other institutional investors for commercial/industrial "mini-grids" that could replace diesel generators. At 400 gigawatts of capacity around the world, diesel generators offer up a market 30 percent larger than America's coal fleet.

Once big banks see this opportunity, the pathway to the clean trillion will become a lot more clear.