PJM, the biggest competitive energy market in the world, could double the amount of planned wind and would still save ratepayers money, according to a new study of the PJM grid system.

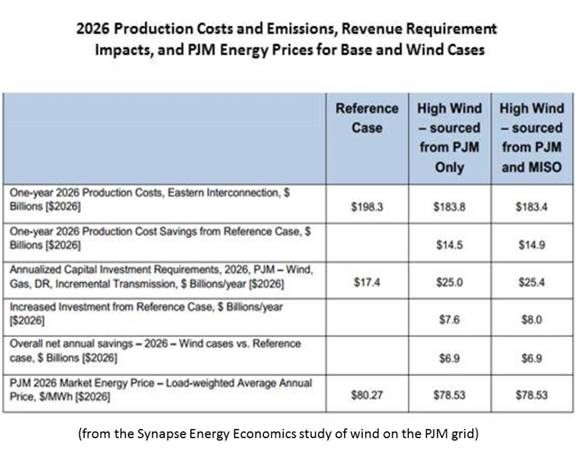

The PJM system, which covers thirteen states plus Washington, D.C., could go from the 32.1 gigawatts of wind projected to be built because of state mandates to 65.4 gigawatts of wind, and it would produce a net benefit of about $1 billion in 2021 and $6.9 billion in 2026, a Synapse Energy Economics study concluded.

In 2012, wind provided about 3.4 percent of PJM’s installed capacity -- about 6,300 megawatts of a total of approximately 185,000 megawatts.

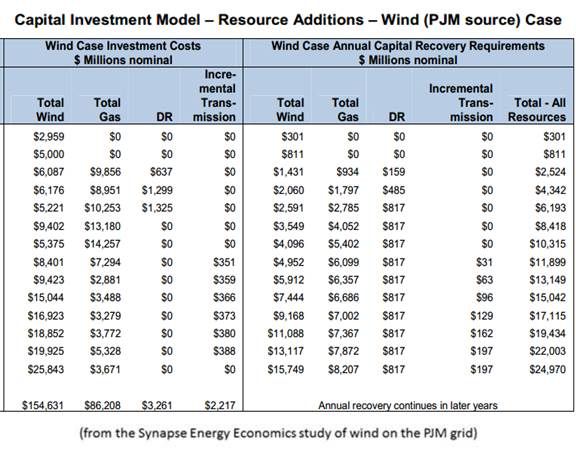

The incremental new investment for the wind and transmission build were estimated at $7.6 billion to $8.0 billion for 2026, and the estimated net production cost savings were $14.5 billion to $14.9 billion, a nearly 2:1 ratio of savings to investment.

The doubled wind use, which primarily replaced gas and coal in the study, would drive down PJM energy costs by $1.74 per megawatt-hour.

The study found little need for investment in new transmission beyond what is already planned to meet current renewable portfolio standard (RPS) mandates in the PJM states.

According to the study, “These findings validate an economic preference for an energy future with greater levels of wind power than current renewable portfolio standards suggest. It is a future where wind-powered resources displace a significant portion of energy that would otherwise be obtained from traditional fossil fuels, all the while retaining sufficient resource adequacy to ensure reliable grid operation.”

Synapse assumed a price on carbon in 2026 of $30 per ton. Without it, doubling wind would still drive $2.6 billion in 2026 savings because of “fossil fuel displacement and market price effects that low cost wind power brings to a competitive energy market.”

Synapse used a transparent methodology that included the ProSym hourly dispatch and unit commitment production cost modeling tool across PJM’s ten-zone configuration, as well as a wide range of other variables. It also used a multiple-variable capital investment spreadsheet tool and did multiple production-cost simulations.

The study first modeled a business as usual (BAU) scenario, using PJM states (Delaware, Illinois, Indiana, Kentucky, Maryland, Michigan, New Jersey, North Carolina, Ohio, Pennsylvania, Tennessee, Virginia and West Virginia and Washington, D.C.) mandate-required renewables. The renewables were assumed to be almost entirely wind. It then compared a scenario of doubled wind only from PJM sources and a scenario that included wind imported from the wind-rich Midwest system (MISO) states.

The gains from importing MISO wind offset the cost of building new HVDC transmission to deliver it, according to the study.

The increases in renewables would, Synapse estimated, cut PJM carbon dioxide 14 percent, nitrogen oxide 10 percent and sulfur dioxide 6 percent.

Among the recommended next steps, Synapse suggested running the effects of multiple combinations of increasing wind, offshore wind, solar and energy efficiency on the PJM system.

Synapse’s 2012 assessment of the MISO grid found less certain ratepayer savings, probably because the wind build and the new transmission needs are likely to be much bigger.

An average MISO region residential customer using 1,000 kilowatt-hours per month would have between a $1.10 per month bill increase to a $17.50 per month savings from adding 20 gigawatts of wind by 2020; the same customer would experience a $22.30 per month increase to a $12.20 per month savings from adding 40 gigawatts of wind; adding 50 gigawatts of wind would result in a $22.50 per month increase to a $26.20 per month savings.

“Ongoing wind installations across the MISO grid will continually and inexorably exert downward price pressure on market energy prices,” Synapse found. “Energy market price reductions will be material and pervasive, ranging initially (2012-2018) from $3 to $5 per megawatt-hour, and continuing to reduce energy market prices by $5 to $22 per megawatt-hour by 2031, when on the order of 100 gigawatts of wind energy could be on-line in the Midwest region.”

“Transmission is a key piece,” former Federal Energy Regulatory Commission Chair Jim Hoecker said of the new Synapse PJM study. “Without even considering the multiple other benefits of strengthening the grid, the report makes a persuasive case that major increases in wind energy and the transmission needed to bring it to market is a highly economic proposition that regional planners should not ignore.”