SolarCity is offering another $70.2 million in asset-backed notes.

Late last year, SolarCity executed on a solar financing milestone and offered a private placement of $54.4 million of an "aggregate principal amount of Solar Asset Backed Notes, Series 2013-1."

That was one of the first times securitization was employed for distributed solar generation.

"Securitization is the practice of pooling disparate sources of debt and selling it as a package to investors on the secondary market," as stated by GTM's Stephen Lacey. Securitization improves liquidity and can spur demand (and could be applied to energy efficiency as well). It has the potential to lower the cost of solar financing while enlarging the finance pool. (Learn a lot more about this financial tool by reading our article, "The Encyclopedia of Solar Securitization.")

The yield on SolarCity's BBB+ rated 2013-1 notes was 4.80 percent. As a banker colleague of mine noted at the time, "It's not a bad rate. A little under where a swapped bank deal would end up. Tenor is nothing extraordinary. Rumor is that the required coverage ratio is relatively high, so the amount of leverage is relatively low -- to be expected for a first deal."

Last year's offer contained these gems:

- S&P assumes a solar module degradation rate of approximately 1.3 percent per year

- Residential customers need a FICO of 680+ with no bankruptcy in the last five years in order to qualify for a lease or PPA.

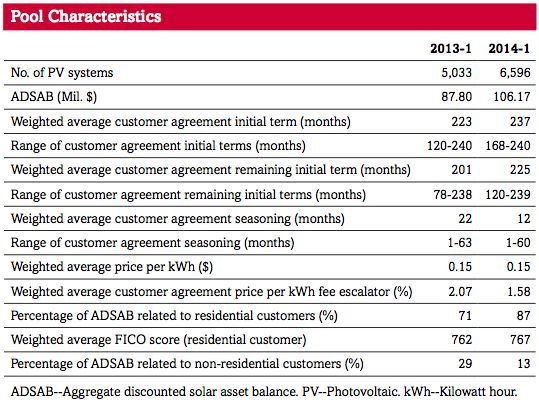

- Weighted average PPA price is $0.15 per kilowatt-hour with a 2.07 percent escalator.

- California, Arizona, and Colorado (the top solar states) accounted for approximately 90 percent of SolarCity's total portfolio.

The new offer, 2014-1, comes with a new set of insights into SolarCity's securitization strategy:

- 2013 vs. 2014: The number of PV systems in the pool jumps from 5,033 to 6,596, and the price-per-kilowatt-hour escalator drops a bit. FICO score expectations and assumed solar module degradation rate are essentially unchanged. The 2014 pool leans toward longer customer agreements with a greater focus on residential rooftops, because the money for this type of company is in long residential leases.

- Net energy metering: S&P's take on the regulatory climate for solar expects "some balancing of utilities' and solar developers' needs, including potential transition periods to modified rates for existing solar customers." S&P sees this trend as mitigating the regulatory headwinds.

-

Inverter modeling: S&P anticipates inverter replacement ten years after each solar system is put into service. "The transaction has a reserve built up leading up to this expected expense."

It's fair to say that distributed solar has reached the scale where it can access larger pools of once-unavailable, lower-cost capital. It's another piece of the equation in which solar is cutting cost and going mainstream. Watch for other solar finance firms like Sunrun or Vivint to explore this source of capital.

We'll be watching for the yield on these notes when the transaction closes next week -- and how that compares with SolarCity's 2013 securities.

***

Securitization will be explored in detail by NREL's Senior Financial Analyst Michael Mendelsohn at the "Securitizing Distributed Solar" session during the preconference seminar at GTM's Solar Summit. Learn more about the conference here and register here.