It's been a difficult day for the stocks of residential solar installers and financiers.

SolarCity posts larger-than-expected loss

SolarCity had strong revenue but shares fell after the leading solar installer/financier posted a larger-than-expected loss for the first quarter of 2016, while forecasting a disappointing guidance.

- Revenue of $122.6 million beat estimates of $109 million and was up 82 percent over the same quarter last year

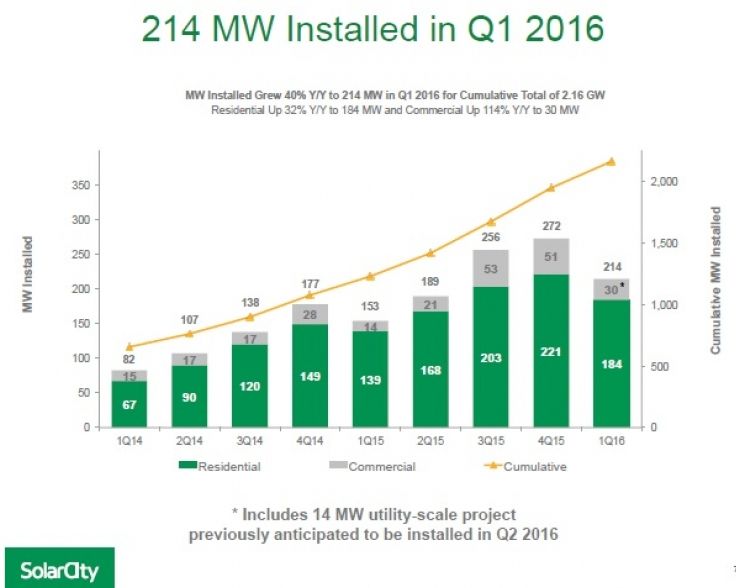

- SolarCity installed 214 megawatts of solar in Q1, exceeding guidance of 180 megawatts and up 40 percent year-over-year

- But bookings were down a lot, a trend attributed to regulatory uncertainty

- The leading residential solar installer cut 2016 installation guidance (1 to 1.1 gigawatts instead of 1.25 gigawatts) and reported a 150-megawatt fall in expected Q1 bookings. For Q2, SolarCity expects 185 megawatt in installations -- down 2 percent compared to Q2 2015.

- Sales costs (customer acquisition costs) jumped 80 percent to 97 cents per watt

- SolarCity mentioned "the launch of our new loan product this week"

- The firm raised $728 million in asset financing in the quarter

- SolarCity lost money for the 13th quarter in a row

- As of Monday’s close, shares are down more than 50 percent this year

SolarCity's letter to investors states, "[W]e exceeded our installation targets for the quarter, and despite an uptick in costs, we are already on the path to bring them back down later this year. We have raised $1.1 billion in new project financing through the end of April, including a groundbreaking $227 million cash equity transaction with John Hancock that offers both a sizable new financing channel and a reputable valuation of our underlying contracted assets. In turn, we head into the remainder of the year well-positioned not only to achieve our goal of generating positive cash by year-end but reaching the state of our operations in which our MW portfolio will continue to grow along with our cash balance. Though our industry has endured a rocky road over the last several months, we are solely focused on executing on our plan and achieving our targets for this year and beyond."

Baird notes, "SCTY beat on revenue and installations, but lowered FY:16 guidance due to weak Q1 bookings, and also had a significant increase in customer acquisition costs (although this is expected to be temporary). We want to get more constructive on the stock but think management has ruined its credibility for now, although the Musk/Reeve relationship should attract long-term growth investors. We believe the stock will be under pressure as investors recalibrate expectations, which could provide an attractive entry point."

Oppenheimer is "lowering expectations and price target." The equity analyst noted, "While SCTY deployments surprised to the upside, 1Q:16 booking and 2Q16/FY16 guidance disappointed due in part to adjustments in net metering rules and the removal of ITC expiration as a lever of sales. With the reduction of guidance pointing to mid-teens MW growth Y/Y in context of the company reaching monetization levels which should generate cash by 2H:16, we believe SCTY shares are at a crossroad. We continue to see significant potential for spread capture in the residential solar business, but acknowledge lengthy capital recycling timelines and a challenged ability to forecast.

UBS noted, "SolarCity cut install guidance even more than we expected (200 MW vs. our 75 to 150 MW expectations) and delivered a cost-per-watt well above previous quarters, underscoring the regulatory uncertainty to the story and continued risk to longer term MW growth and cost trends. We are increasingly skeptical of 2017 cost targets of ~$2.25/W exiting the year and have adjusted our valuation accordingly (now expecting average $2.52/w in 2017), particularly in light of risks to longer term MW growth rate necessary to achieve economies of scale baked into cost targets (lowering MW too)."

SolarEdge posts another strong quarter

The leading module-level electronics supplier has continued its winning streak.

- The company posted record revenue of $125.2 million for the quarter, up 44.9 percent year-over-year, but flat compared to the last quarter. These figures beat Street estimates.

- GAAP gross margin was 32.5 percent, up from 30.9 percent in the previous quarter while up 27.4 percent from the same quarter last year. The company expects gross margin to "normalize" next quarter

- GAAP net income was $20.8 million -- another profitable quarter.

- The company shipped 416 megawatts (AC) worth of inverters

- SolarEdge guided next quarter revenues to be within the range of $125 million to $134 million and gross margins to be within the range of 29 percent to 31.0 percent.

Oppenheimer Equity Research notes, "SEDG posted strong 1Q:16 results but guided revenue below the Street at midrange on slower-than-expected demand in the U.S. and mix shift. With HD Wave beginning to ship, we should see some support for margin in the back half of CY16 pending customer interest. We expect shares will be under pressure [in the] near term on margin concerns and commentary on select price declines. We note SEDG is consistently generating cash, with $15M of FCF in the quarter, which we view as positive, but may become a focus of customers in price negotiations. While we remain cautious on margin trajectory, we would view margin stabilization as an opportunity to get more constructive."

Oppenheimer added, "SEDG expects commercial sales (currently slightly below 1/3 of the mix) to move close to 50% in FY17, partially driven by slower residential demand. Further, the company notes that its customer base is becoming more diverse and it's seeing more demand from smaller solar distributors. Of note, SEDG's largest customer dropped to just below 10% of sales this quarter."

Vivint Solar now free of SunEdison

U.S. residential installer Vivint Solar is now free of bankrupt acquirer SunEdison, but the firm is still struggling.

- Vivint Solar installed 55 megawatts in Q1. That's up 19 percent year-on-year but down from the last three quarters. The company expects 60 megawatts of installations next quarter.

- Revenue for the quarter was $17.2 million compared to the consensus estimate of $17.6 million

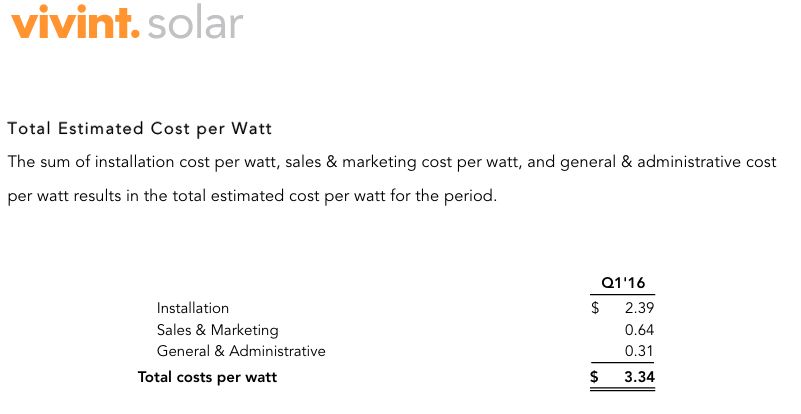

- The firm’s installed cost per watt grew to $3.34

- The net loss for the quarter was $69 million, worse than expected

- Total installs for 2016 are expected to be 260 megawatts, compared to 230 megawatts last year

Vivint Solar's CEO, Greg Butterfield, has stepped down, and David Bywater, formerly COO at Vivint Smart Home, will serve as interim CEO. The executive move comes two months after Vivint's $2.2 billion acquisition by SunEdison was terminated.

(Ahmad Chatila is still CEO of bankrupt SunEdison, although a report from Queen’s University and Dartmouth notes that two-thirds of CEOs are gone by the time bankruptcy protection is sought -- ousted by the board or creditors, or having left by choice. The study notes that debtor-in-possession funding, as SunEdison has sought in the form of a recent $300 million loan, increases the likelihood of the CEO departing.)

Last week we reported on earnings at SunPower and Enphase. Here's a recap.

SunPower has strong outlook but larger-than-expected losses

SunPower reported first-quarter 2016 results last week with larger-than-expected losses on GAAP revenues of $384.9 million. On a GAAP basis, the company now expects 2016 revenue of $2.8 billion to $3 billion, gross margin of 13 percent to 15 percent, and net income of $0 million to $50 million. On a GAAP basis, the company expects Q2 revenue of $290 million to $340 million, gross margin of 10 percent to 12 percent, and net loss of $90 million to $65 million.

According to SunPower CEO Tom Werner, "In our power plant business, consistent with our strong historical delivery execution, we continued construction on a number of key U.S. projects slated for completion during the second half of 2016, including our 100-megawatt project for NV Energy, the 102-megawatt Henrietta power plant and our 68-megawatt project for Stanford University. Additionally, we achieved commercial operation on our 50-megawatt Hooper project for Xcel Energy, a project currently owned by 8point3 Energy Partners. SunPower also achieved notable international success during the first quarter when we were awarded approximately 500-megawatt of power-purchase agreements in Mexico's first electricity auction. This award comprised approximately 25 percent of the awarded solar capacity, or around 20 percent of the entire awarded energy across all resources, and demonstrates the increasing cost-competitiveness of wholesale solar power versus competing technologies. We also expect to begin construction of our second solar power plant project in Chile later this year, with a capacity of approximately 100 megawatts."

Baird Equity Research notes, "SPWR continues to see strong demand for its commercial and residential projects in the U.S., and should be able to significantly expand margins with its Equinox and Helix technologies. That said, SPWR issued weak Q2 guidance (as expected), as 2016 will be 2H-weighted due to project timing. This could act as a near-term overhang, although we want to own the stock heading into a strong 2H:16.

Q1 beat our estimates on the top and bottom lines." The analyst added, "International demand remains robust, with significant opportunities in Mexico and Chile. SPWR will begin a new 100 MW JV project with Total in Chile during 2016, and indicated its total Latin America pipeline is >2.5 GW. Given SPWR’s recent success in the Mexican auction (~500 MW awarded), we believe SPWR is well positioned for grown in Central/South America, and should continue to benefit from its relationship with Total."

Enphase has shipped 11 million microinverters since its founding

Enphase Energy had total revenue of $64.1 million for the first quarter of 2016, selling 143 megawatts (AC), or 611,000 microinverters. GAAP gross margin was 18.3 percent, resulting in a GAAP net loss for the first quarter of 2016 of $18.8 million. The company has shipped approximately 11 million microinverters since its founding.

Paul Nahi, president and CEO of Enphase Energy, said, "We continue to execute on our cost-reduction roadmap."

"We expect revenue for the second quarter of 2016 to be within a range of $76 million to $82 million," said Kris Sennesael, CFO of Enphase, adding that he expects "gross margin to be within a range of 17 percent to 20 percent."

Oppenheimer Equity Research noted that results were in line with guidance, "although modestly below Street expectations," adding, "We believe cash management looks challenged without additional capital or tighter management of working capital. We highlight that 2Q guidance on sales growth looks solid (up 32% Q/Q) and will need to continue for ENPH to reach profitability."