SolarCity will be a public company on Thursday morning. (Thanks Dana Hull).

After lowering its stock price to a reported $10 per share from a range of $13 to $15, IPO aspirant SolarCity was unable to fill its book and postponed its IPO, according to Reuters, which quoted an underwriter of the deal. SolarCity has not returned requests for comment.

SolarCity then lowered the deal size and now looks to raise $92 million and sell 11.5 million shares at $8 under the symbol SCTY. (See S-1 Amendment No. 5)

SolarCity hoped to sell 10 million shares of its stock at $13 to $15 per share in its maiden offering. A total of 65,012 shares were to be sold by stockholders. SolarCity had originally planned to raise $201 million.

According to the S-1 amendment, Chirman Elon Musk still intends to purchase $15 million of shares at the IPO price:

Elon Musk, the chairman of our board, has indicated his intent to purchase $15.0 million of our common stock in this offering from the underwriters at the initial public offering price [...] Entities affiliated with Draper Fisher Jurvetson have indicated an intent to purchase an aggregate of 1,500,000 shares of our common stock in this offering at the initial public offering price. Entities affiliated with DBL Equity Fund have indicated an intent to purchase an aggregate of 300,000 shares of our common stock in this offering at the initial public offering price.

Like BrightSource Energy, another solar firm, albeit in vastly different sectors -- institutional investors were having none of the high valuations anticipated by these VC-funded startups. If you're selling electrons like SolarCity or BrightSource Energy, then you get valued like a conventional power generator, not like a consumer gadget.

***

We reported on some accounting headwinds at the firm earlier today, and looked at the stock performance of recent greentech IPOs.

Included in Amendment No. 3 to the S-1, published Friday, is this important passage regarding a judgment on the manner in which Solar City is accounting for Fair Market Value. Note that the Treasury sets different price-per-watt value guidelines by state and that Arizona takes a big hit here:

The Internal Revenue Service recently notified us that it is conducting an income tax audit of two of our investment funds

In October of 2012, we were notified that the Internal Revenue Service was commencing income tax audits of two of our investment funds which audit will include a review of the fair market value of the solar power systems submitted for grant under the 1603 Grant Program. If, at the conclusion of the audits currently being conducted, the Internal Revenue Service determines that the valuations were incorrect and that our investment funds received U.S. Treasury grants in excess of the amounts to which they were entitled, we could be subject to tax liabilities, including interest and penalties, and we could be required to make indemnity payments to the fund investors.

If the Internal Revenue Service or the U.S. Treasury Department makes additional determinations that the fair market value of our solar energy systems is materially lower than what we have claimed, we may have to pay significant amounts to our investment funds or to our fund investors and such determinations could have a material adverse effect on our business, financial condition and prospects.

We and our fund investors claim the Federal ITC or the U.S. Treasury grant in amounts based on the fair market value of our solar energy systems. We have obtained independent appraisals to support the fair market values we report for claiming Federal ITCs and U.S. Treasury grants. The Internal Revenue Service and the U.S. Treasury Department review these fair market values. With respect to U.S. Treasury grants, the U.S. Treasury Department reviews the reported fair market value in determining the amount initially awarded, and the Internal Revenue Service and the U.S. Treasury Department may also subsequently audit the fair market value and determine that amounts previously awarded must be repaid to the U.S. Treasury Department. Such audits of a small number of our investment funds are ongoing. With respect to Federal ITCs, the Internal Revenue Service may review the fair market value on audit and determine that the tax credits previously claimed must be reduced. If the fair market value is determined in either of these circumstances to be less than we reported, we may owe the fund or our fund investors an amount equal to this difference, plus any costs and expenses associated with a challenge to that valuation. The U.S. Treasury Department has determined in some instances to award us U.S. Treasury grants for our solar energy systems at a materially lower value than we had established in our appraisals and, as a result, we have been required to pay our fund investors a true-up payment or contribute additional assets to the associated investment funds. For example, in the fourth quarter of 2011, we had discussions with representatives of the U.S. Treasury Department relating to U.S. Treasury grant applications for certain commercial solar energy systems submitted in the third and fourth quarters of 2011 and the appropriate U.S. Treasury grant valuation guidelines for such systems. We were unsuccessful in our attempts to have the U.S. Treasury Department reconsider its valuation for these systems, and while we maintained the accuracy of the contracted value to the investment fund, we elected at that time to receive the lower amounts communicated by the U.S. Treasury Department. Thereafter, other U.S. Treasury grant applications were accepted and the U.S. Treasury grant paid in full on the basis of the valuations submitted. On December 5, 2012, the U.S. Treasury Department notified one of our investment funds that it has established new guidelines for residential solar energy systems placed in service in California and Arizona on or after October 1, 2012. The new guidelines communicated are $6.00 per watt in California and $5.00 per watt in Arizona. Prior to this change, we had been reimbursed at $6.87 per watt in California and $6.20 per watt in Arizona. As a result of this updated guidance, we will be obligated to contribute additional solar energy systems to this investment fund so that the fund investors will recover a shortfall of approximately $200,000. If the Internal Revenue Service or the U.S. Treasury Department further disagrees now or in the future, as a result of any pending or future audit, the outcome of the Department of Treasury Inspector General investigation, the change in guidelines or otherwise, with the fair market value of more of our solar energy systems that we have constructed or that we construct in the future, including any systems for which grants have already been paid, and determines we have claimed too high of a fair market value, it could have a material adverse effect on our business, financial condition and prospects. For example, a hypothetical five percent downward adjustment in the fair market value in the approximately $341 million of U.S. Department of Treasury grant applications that we have submitted as of September 30, 2012 would obligate us to repay approximately $17 million to our fund investors.

Darren Van't Hof of US Bank would not comment on the IRS judgment, saying it was inappropriate with the IPO imminent.

We'll understand the impact of this ruling when the deal prices tonight.

According to the updated S-1, Elon Musk, the chairman of the board, "has indicated his intent to purchase $15.0 million of our common stock in this offering from the underwriters at the initial public offering price." Musk's intent to purchase stock could indicate troubles in selling this IPO to institutional investors.

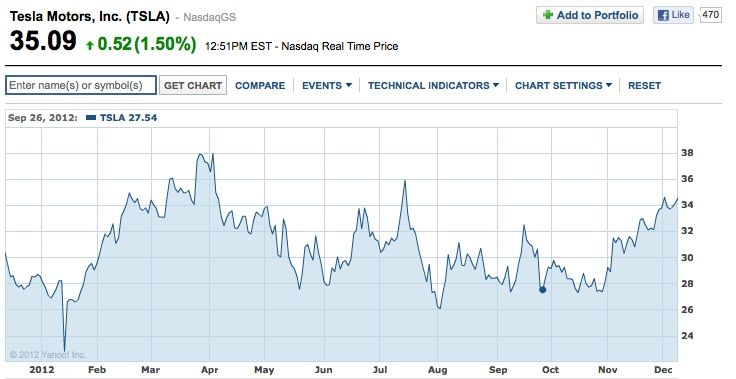

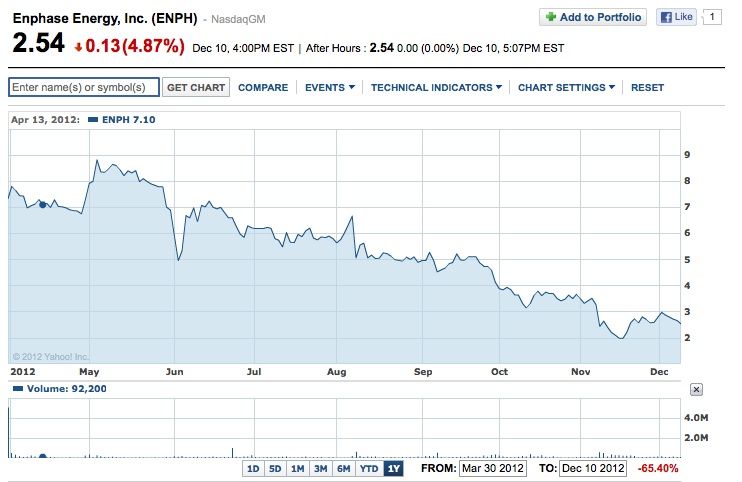

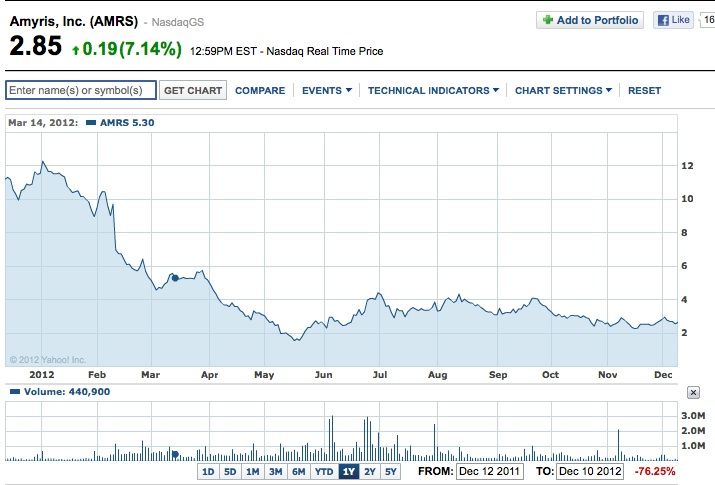

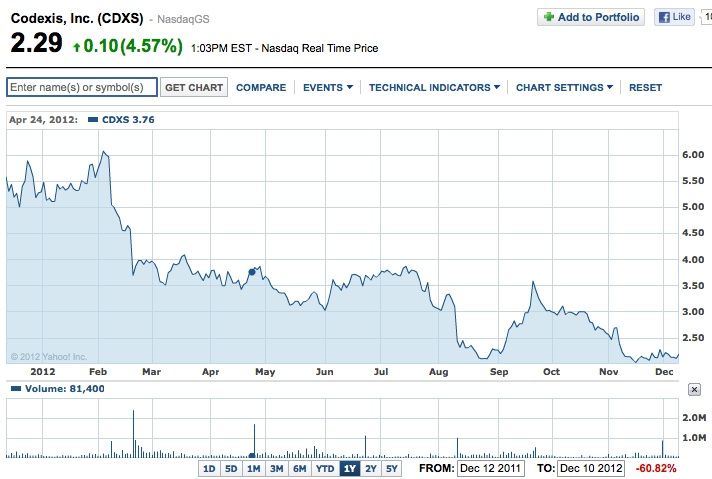

But Musk's Tesla is one of the few recent cleantech IPOs which has had some legs. Other recent cleantech IPOs show a clear downward trend whether they be solar or biofuels. (Stock charts from Yahoo.)

Tesla (TSLA) is a maker of battery-powered electric vehicles:

Enphase (ENPH) is a manufacturer of solar photovoltaic microinverter hardware for residential and commercial rooftops:

KIOR (KIOR) is a biomass-to-fuel aspirant.

Gevo (GEVO) is planning to produce isobutanol using synthetic biology and chemistry.

Amyris (AMRS) looks to use synthetic biology to make green chemicals and fuels.

Codexis (CDXS) also aspires to make bio-based chemicals.

Ceres (CERE) is a developer of green bio-crops.