SolarCity's quarterly earnings calls are adventures in advanced lease accounting, velocity of money, and non-GAAP financial methods. Old-fashioned terms such as "revenue" and "gross margin" give way to "nominal contracted payments added" and "retained value" in order to more accurately describe SolarCity's business.

Here are the highlights, followed by the more informative graphs.

- The company now has 190,000 customers and still looks to hit 1 million customers in 2018

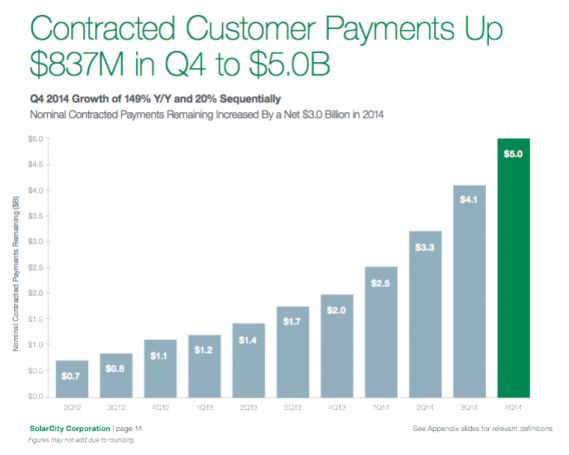

- SolarCity had $3.0 billion in nominal contracted payments added

- Retained value increased by ~$1.4 billion

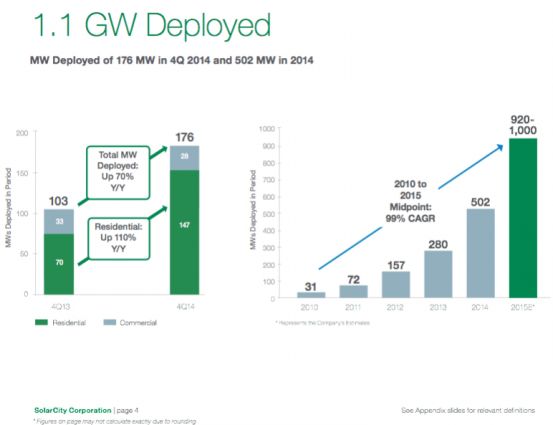

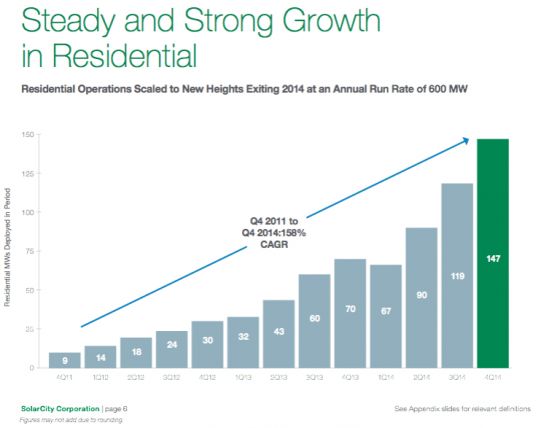

- Residential megawatts deployed grew by 106 percent

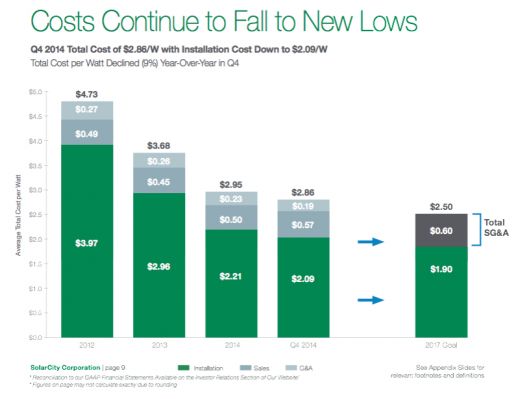

- Unit cost was lowered ~20 percent to $2.09 cents per watt

- The company has already met most of its contracted project financing requirements for 2015

- Market share has increased to 39 percent

CEO Lyndon Rive noted that Q1 2015 has started out with extremely strong bookings. In the question-and-answer period, he suggested that SolarCity's loan business could make up 25 percent to 30 percent of its mix in 2015.

Brad Buss, the CFO, said, "If you look at nominal contracted payments remaining, it's a very good proxy for our projection of future revenue and cash inflows from energy contracts under management -- and it also is the main input for retained value."

At the end of 2014, nominal contracted payments remaining amounted to $5 billion, a 149 percent growth rate year-over-year.

Buss added, "Our retained value expressed in dollars is a strong indicator of the value that's being created, and it's really not apparent from reading our GAAP financial statements -- hence we're providing this key metric." Retained value increased by ~$1.4 billion.

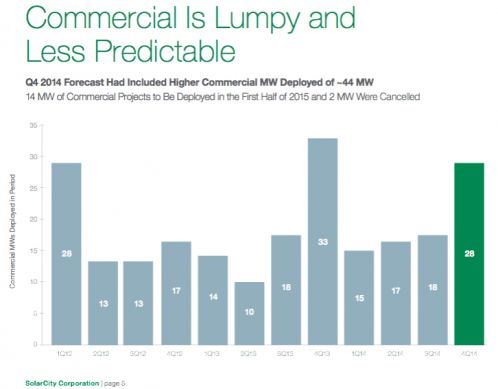

Tanguy Serra, SolarCity's COO, said that the company is on track to continue doubling its residential business once again this year. He noted that the 9,600-employee company built 28 megawatts of commercial solar in the 4th quarter.

Silevo's giga factory

The construction of the Silevo Buffalo module manufacturing plant is on schedule. The company is targeting construction completion and initial equipment installation by Q1 2016, initial production in 2016, with the site slated to be at full capacity in the first quarter of 2017. Peter Rive, SolarCity CTO, noted that its Chinese cell factory has moved from 5-inch to 6-inch cells.

2015 guidance

2015 installation guidance was held at 920 megawatts to 1,000 megawatts and Q1 was guided to 145 megawatts. The company expects to enter new markets and new states this year.

Commercial solar markets

In reference to the commercial solar market, Lyndon Rive said, "We like this business and are designing technology to enable the lowest cost structure," adding, "We are doubling down on the growth of commercial." CTO Peter Rive claimed that new technology and processes have trimmed commercial installation times from two to three weeks down to two to three days. COO Serra said he is excited to differentiate in commercial solar by scrubbing cost out of the sector.

Lyndon Rive said that the bookings in Q1 indicate a strong year ahead.

Unit cost was lowered ~20 percent to $2.09 cents per watt, despite what Rive called "roughly flat" solar module pricing.

Ben Kallo at RW Baird reports that SolarCity "slightly missed its installation guidance, largely driven by commercial project push-outs, but continued to reduce costs, maintained full-year installation guidance, has secured the majority of its 2015 financing requirements, and is seeing strong Q1 bookings. U.S. market demand and fundamentals remain strong, although shares could face pressure from concerns over the steep ramp needed to meet installation targets, additional metrics which complicate the story, and potential pressure on retained value."

SolarCity's share price is $53.81, down almost 6 percent.