When SolarCity launched its MyPower solar loan product in October 2014, CEO Lyndon Rive declared, “It is by far the best product out there.”

Turns out, it was not.

A little over a year after MyPower was introduced to the market, it has been pulled as SolarCity, the leading residential solar installer, develops a new loan product.

The idea behind MyPower was that it looked like the power-purchase agreements that have made SolarCity a leader in the industry. “All that matters is your effective cost per kilowatt-hour," Rive noted at the time of launch.

“[SolarCity] was taking the idea of just paying for your electricity usage but also adding what people want: to own their system,” said Nicole Litvak, senior solar analyst with GTM Research. “It seemed like it would be a simple transition. It turned out to be totally the opposite.”

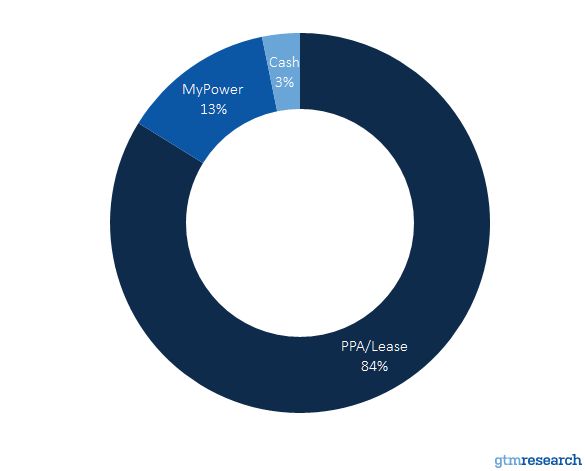

When the product was launched in late 2014, Rive said nearly half the company’s business could be loans by the end of 2015. Instead, the official guidance of 25 percent could not be met, even from the outset. In first quarter of 2015, MyPower accounted for 15 percent of total installations, a figure that ended up at 13 percent for the whole of the year.

FIGURE: SolarCity Deployments by Product, 2015

Source: GTM Research

The product was a complicated sell. Many prospective SolarCity customers are drawn to a lease because they are interested in the first-year savings compared to their traditional electric bill that a solar PV system can provide, noted Litvak. With MyPower, as with other solar loans, customers had to hand over their federal Investment Tax Credit funds or pay some form of penalty.

It wasn’t the forking over of the tax credit that was the chief problem, however, Rive told GTM. Instead, it was the fact that many of SolarCity’s customers did not qualify for the 30 percent Investment Tax Credit. “In hindsight, I definitely underestimated that,” he said, adding that SolarCity’s customer base was far from being made up solely by the wealthy homeowners who are often portrayed as typical solar customers. “I underestimated the success we’ve seen, which is fantastic.”

Even for the customers who were able to take advantage of the ITC, there were still numerous other sticking points that made it a tough sell. There was the issue of a 2.9 percent escalator, which made the transaction more like a PPA than a fixed loan.

Customers made payments based on their system production in kilowatt-hours, but the contract said that could increase 2.9 percent every year. Rive acknowledged that tying the loan repayment to the production of the solar PV system was a mistake, and a feature that would not reappear in future loan products.

Another problematic feature was the 30-year payback period, far longer than the average 20 years for PPAs. “Thirty years is just a long time for consumers,” says Litvak. “Even with being able to transfer to a new homeowner.”

The loan term will also be shorter, and likely more flexible in future products. There will be a 20-year loan offering, but there could also be terms as short as seven or 10 years. In Massachusetts, for instance, 10-year loans are becoming the standard.

“It added up to more confusion than benefit for customers, and that is hard to sell,” said Aaron James, VP of network partnerships at EnergySage, an online marketplace that allows solar customers to comparison shop. SolarCity is not on EnergySage’s platform. “We couldn’t model this as a typical solar loan.”

Lastly, another solar marketplace, Pick My Solar, found that the cost of MyPower for the average California customer was simply far more expensive than other options in the market.

SolarCity says it won’t make the mistake of trying to give a loan the illusion of being like a PPA again. “[The new product] is just addressing the basic things of the loan that we should have done rather than making a loan a PPA,” said Rive. He would not comment on when the new loan would launch but added that MyPower has been a distraction, so it makes sense to discontinue that program before another offering is unveiled.

However, Rive maintains that it was a good product and that any new product would not be better for the customer in terms of financials. “It is just going to be [simpler],” he said. “We want something that’s as [simple] to sell as a PPA instead of the sales team going to PPA as the default option.”

Jonathan Bass, VP of communications for SolarCity, was more effusive. “This is the most successful loan product of any solar provider,” he said, noting that even 10 percent to 15 percent of SolarCity’s volume is far more than the loan products sold by competitors. “It’s all relative.”

It's reasonable for SolarCity to ditch the flawed MyPower product. But it is unclear whether a new loan product will satisfy investors, even if it appeals to customers.

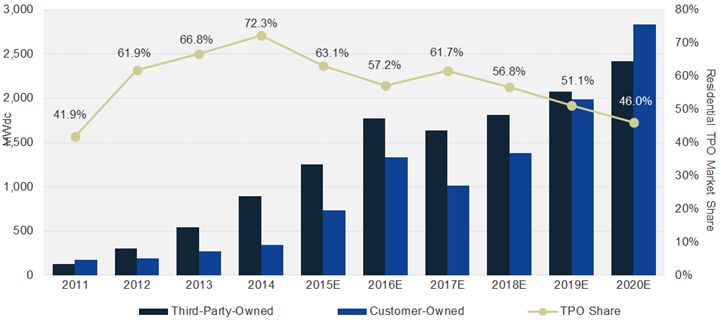

Third-party financing, SolarCity’s sweet spot, is still the dominant form of financing for residential solar, but by 2020, GTM Research forecasts that direct ownership will eclipse third-party ownership, as the following chart illustrates.

For investors, however, a simpler loan product could add to the complexity of valuing SolarCity, at least in the short term. “It was already complicated enough for investors to know how SolarCity was valuing itself based on just PPAs,” said Litvak. “And now it’s more complicated.”

SolarCity wants to create products that make the company's valuation independent of whether the company is selling systems via loans, PPAs or for cash. “That’s the ideal goal,” said Rive.