The SolarCity IPO is expected to price after market close on Dec. 11 and begin trading on Dec. 12, according to sources close to the deal and Bloomberg.

SolarCity hopes to sell 10 million shares of its stock at $13 to $15 per share in its maiden offering. A total of 65,012 shares are to be sold by stockholders. SolarCity's plans to raise $201M have been pulled back -- the firm now looks to raise approximately $151 million, according to this filing with the SEC.

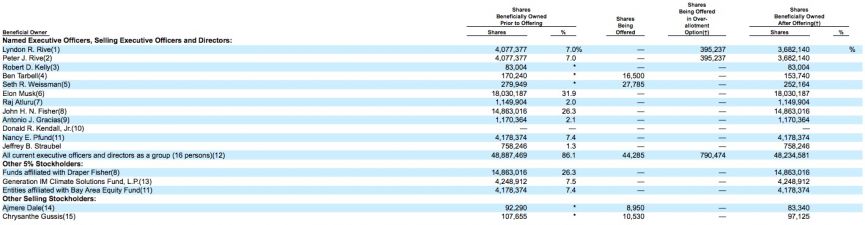

According to the S-1, Elon Musk, the chairman of the board, "has indicated his intent to purchase $15.0 million of our common stock in this offering from the underwriters at the initial public offering price."

Debra Fiakas, the Managing Director of Crystal Equity Research, writes that this is "a deal worth considering, but only after the shares get some seasoning. A $13.00 per share price puts a $932 million market value on SolarCity and implies a multiple of 8.4 times revenue. This seems a bit pricey given that the company has not been consistently profitable."

In the investor road show, Founder and CEO Lyndon Rive highlights the no-money-down aspect of the SolarCity residential leasing model and the rapid growth of the firm. Rive spoke of the SolarCity opportunity with growth of EVs and its SolarStrong and Walmart business.

Here is our recent coverage of the long-awaited liquidity event:

There is a long list of withdrawn cleantech IPOs: BrightSource Energy, Elevance Renewable Sciences, Genomatica, Coskata, Fallbrook Technologies, Solyndra, and Smith Electric Vehicles.

And while the list of actual cleantech IPOs -- Tesla (TSLA), Enphase (ENPH), Kior, Gevo, Amyris, Codexis -- is growing, the list of successful cleantech IPOs is not.

SolarCity, the VC-funded and tax-equity-bankrolled solar installer and financier, aims to reverse that trend.

SolarCity will launch its $200 million maiden public offering before the end of the year, according to a person close to the deal who was cited in Reuters. The institutional investor road show starts after the Thanksgiving holiday in the U.S.

SolarCity has benefited from the glut of solar manufacturing capacity, the collapse of solar panel pricing, and the questionable solar manufacturing policy of the Chinese government. Cheaper solar panels means lower costs for SolarCity and presumably for its customers. As per the firm's S-1, Trina, Yingli, and Kyocera are the primary module suppliers for SolarCity. Inverters are sourced from Power-One, SMA, Schneider, and Fronius.

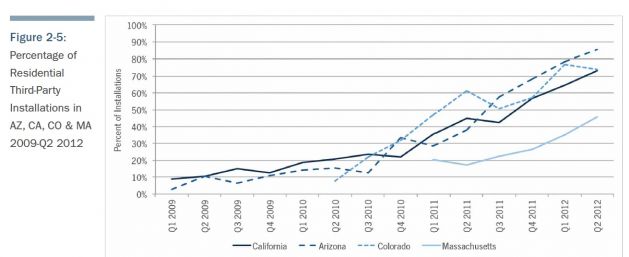

SolarCity's third-party financing model allows residential and commercial customers to install solar with no money down. Third-party ownership is one of the few solar success stories of recent years, having long surpassed 50 percent of residential solar customers in California, Arizona, and Colorado. Here's the statewide growth of third-party ownership in the U.S., according to GTM Research:

Source: GTM Research

SolarCity's S-1 registration emerged from its JOBS Act-imposed review in October and shows the 2,000-employee company looking to list on the Nasdaq under ticker symbol SCTY, with Goldman Sachs, Credit Suisse and BoA Merrill Lynch as co-lead underwriters.

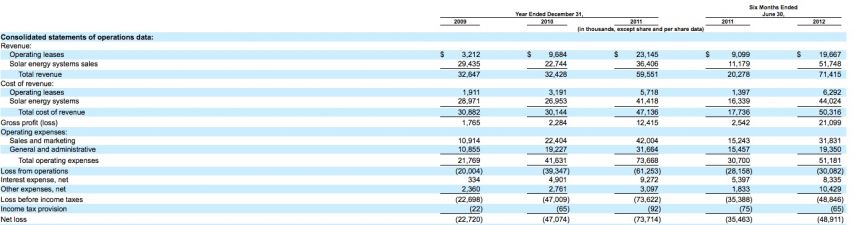

Losses are growing at the firm, but so is revenue. The firm had $59.5 million in revenue in 2011, $32.4 million in 2010, and $32.6 million in 2009. The firm had $49 million in net losses on $71 million in revenue for the first six months of 2012, compared to a $35 million net loss on $20 million in revenue for the first six months of 2011.

SolarCity's $210 million in VC funding and $1.9 billion valuation comes from Elon Musk (with a 31.9 percent pre-IPO stake), Draper Fisher Jurvetson (26.3 percent), Generation Investment Management (7.5 percent), DBL Investors (7.4 percent), with the remainder coming from Silver Lake Kraftwerk, Valor Equity Partners, Nicholas Pritzker, the Mayfield Fund, et al. SolarCity landed more than $1.5 billion through tax-equity investment funds and other financing vehicles.

Rob Day notes that the structure of the most recent round from Silver Lake "adds pressure for this to be the last round of financing into the company before an IPO (barring possibly just re-opening the Series G if needed), and it puts the company into an 'IPO or bust' situation, as far as some very important investors are concerned."

The Woodlawn Associates analysis of the SolarCity S-1 (cited by Rob Day here) provides an analysis of SolarCity's IRRs. Day notes that "SolarCity appears to be getting pretty industry-standard IRRs...but it also suggests there's no magic returns advantage to the company, other than benefits of scale to attract the lower-cost capital." Day notes that customer acquisition costs have started to drop after several flat years, although this may be due to customer mix rather than process improvement.

There are a few lawsuit red flags in the S-1 related to the U.S. Treasury Grant program and SolarCity's accounting.

The Office of the Inspector General of the U.S. Department of Treasury has issued subpoenas to a number of significant participants in the rooftop solar energy installation industry, including us. The subpoena we received requires us to deliver certain documents in our possession relating to our participation in the U.S. Treasury grant program.

In particular, our subpoena requested, among other things, documents dated, created, revised or referred to since January 1, 2007 that relate to our applications for U.S. Treasury grants or communications with certain other solar development companies or certain firms that appraise solar energy property for U.S. Treasury grant application purposes. The Inspector General is working with the Civil Division of the U.S. Department of Justice to investigate the administration and implementation of the U.S. Treasury grant program, including possible misrepresentations concerning the fair market value of the solar power systems submitted for grant under that program made in grant applications by companies in the solar industry, including us.

We are not aware of, and have not been made aware of, any specific allegations of misconduct or misrepresentation by us or our officers, directors or employees, and no such assertions have been made by the Inspector General or the Department of Justice. However, if at the conclusion of the investigation the Inspector General concludes that misrepresentations were made, the Department of Justice could decide to bring a civil action to recover amounts it believes were improperly paid to us. If it were successful in asserting this action, we could then be required to pay damages and penalties for any funds received based on such misrepresentations (which, in turn, could require us to make indemnity payments to certain of our fund investors).

And this, also from the S-1:

In October of 2012, we were notified that the Internal Revenue Service was commencing income tax audits of two of our investment funds which audit will include a review of the fair market value of the solar power systems submitted for grant under the 1603 Grant Program. If, at the conclusion of the audits currently being conducted, the Internal Revenue Service determines that the valuations were incorrect and that our investment funds received U.S. Treasury grants in excess of the amounts to which they were entitled, we could be subject to tax liabilities, including interest and penalties, and we could be required to make indemnity payments to the fund investors.

If the Internal Revenue Service or the U.S. Treasury Department disagrees now or in the future, as a result of any pending or future audit, the outcome of the Department of Treasury Inspector General investigation or otherwise, with the fair market value of more of our solar energy systems that we have constructed or that we construct in the future, including any systems for which grants have already been paid, and determines we have claimed too high of a fair market value, it could have a material adverse effect on our business, financial condition and prospects. For example, a hypothetical five percent downward adjustment in the fair market value in the approximately $325 million of U.S. Department of Treasury grant applications that we have submitted as of August 31, 2012 would obligate us to repay approximately $16 million to our fund investors.

So, is SolarCity's IPO the liquidity event that frees cleantech from its fiscal winter?

On one hand, solar installation and finance is a different world from PV panel manufacturing, one with actual profit margins. SolarCity profits from the remarkable drop in solar pricing and the growth in third-party ownership financing. Greater scale means more access to lower-cost capital. SolarCity has shown strong growth, while its management has executed on its business plan and adapted to changing markets. There's also Chairman Elon Musk, who seems to have his own reality distortion field and a hot hand of late.

On the other hand, if you view SolarCity as a solar company (rather than a specialty leasing/finance firm) there are potential headwinds from investors. Recent solar IPO aspirant BrightSource could not sell its IPO because of "market conditions" -- and because it was overpriced. Enphase, the pioneering solar microinverter firm, made it through the public window, but its stock is being painted with the same savage brush as the rest of the solar industry. If the market treats SolarCity the way it treats Enphase or Suntech, the company has a problem.

What competitive advantage does SolarCity really have? How high is the barrier to entry in this business? Are there more efficient sales channels to the solar customer? Are Vivint, OneRoof, SunPower or SunEdison better positioned for customer acquisition and scale? When will SolarCity stop losing money and turn a profit? And how are the returns from the firm's many projects split between its funding partners?

In any case, December now has the potential to be a very exciting month for cleantech.