According to the Austin Business Journal, HelioVolt, a once well-funded and well-regarded CIGS PV aspirant, has delayed its job creation commitments by two years in an attempt to preserve some local funding and save face. HelioVolt altered an agreement with state officials 18 months after it received $1 million from the Texas Enterprise Fund calling for the creation of 158 jobs. Now, an amended agreement extends the target date for creating those jobs from December 2010 to December 2012, according to Gov. Rick Perry’s office, which oversees the Texas Enterprise Fund.

The company's emergence from stealth and sudden transparency was coincident with an impending review by Texans for Public Justice, detailing the status of 45 Texas Enterprise Fund projects receiving a combined $363 million. Heliovolt currently employs fewer than one hundred people.

*

Hoku Scientific, everyone's favorite solar company that went public as a fuel-cell firm, then transitioned into a cash-oxidizing power house of broken polysilicon promises, continues to flail about. They are currently bringing their mojo to Tianwei New Energy Holdings and exploring an investment fund to finance PV systems to be installed and operated in Hawaii by Hoku's PV integration subsidiary. Tianwei New Energy Holdings is a provider of silicon wafers, PV cells, modules and systems.

Hoku, traded on the Nasdaq, had Q4 2009 revenues of $259,000 and net losses of $1.3 million.

*

Brilliant observation from the Anonymous Solar Consultant on CPV: Amonix is the only company that has more than a few years of on-the-ground performance data. Their product reflects the learned reality that CPV as a utility-scale product shouldn’t try to look, smell or feel like PV (Solfocus) or attempt to minimize installation resources or cost (GreenVolts). They don’t try to hide the cranes and large equipment needed to construct their systems. They also spin/track ten times the kilowatts per unit compared to any of the other CPV competitors.

*

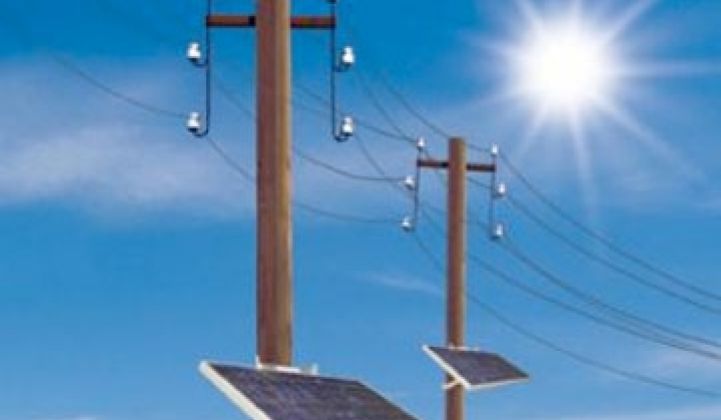

Petra Solar raised $40 million for its “smart” PV systems from investors Craton Equity Partners ($15M), Espírito Santo Ventures, Element Partners, Blue Run Ventures, OnPoint Technologies (U.S. Army's Venture Fund) and Kuwait's National Technology Enterprises Company (NTEC). Mounted on utility and streetlight poles, the Petra PV system consists of a PV module and integrated line voltage inverter with communications capability. The firm claims the inverter electronics can improve power quality and grid reliability through the injection of VARs and non-linear power.

Petra is currently fulfilling a $200 million contract from PSE&G, New Jersey's largest publicly owned utility. By the end of 2010, the company expects to employ 165 people.

*

Energy Conversion Devices (ECD), a manufacturer of thin-film flexible solar laminates for the BIPV and commercial rooftop markets, announced financial results for the the second quarter of its fiscal year 2010. Total consolidated revenues for the second quarter of fiscal 2010 were $52.9 million compared to $103.1 million in the second quarter of fiscal 2009 and $42.9 million in the first quarter of fiscal 2010. For the second quarter, the company reported a net loss of $39.1 million.

ECD CEO Mark Morelli said, "We are confident in our ability to achieve 12 percent laminate conversion efficiency and less than $0.95 cost per watt."

Cue comment from ECD Fan.

*

Deutsche Bank (DB) Equity Research, in a recent investment note, prognosticated about the PV industry in 2010 and 2011. Here are some tidbits:

- The PV industry will resume meaningful growth in 2010 -- forecasting 44% MWp installed y/y growth in 2010 to ~8.4GWp, and 2011 growth of ~29% to ~10.8GWp

- Expect a strong first half of 2010, a weaker second half and a return to an oversupply situation

- DB anticipates module ASP declines of more than 20 percent in 2010.

- The US and Chinese markets could disappoint in 2010

- Look for small growing markets in Italy, the Czech Republic and France

- The march toward grid parity will again accelerate

- DB anticipates an incremental reduction in the German FIT of ~15% to be implemented by July 2010 for most ground-mount systems, and a FIT cut of similar magnitude by April 2010 for roof-mount systems.

- DB asserts that FIT reductions of this magnitude would not devastate the German market, and that the German market would grow modestly in 2010

- The U.S. market will grow to ~810 megawatts in 2010, eclipsing 1.4 gigawatts in 2011 and 2.2 gigawatts in 2012, and should become the largest market in the world within several years

- Chinese installations in 2010: DB is forecasting 400 megawatts in 2010, climbing to 760 megawatts in 2011

*

Some great solar links

SolarInstallData.com provides data describing large-scale solar PV installations.

SolarHub is a free reference database of PV module and inverter product specs with detailed product information and vendor comparisons. Great for consumers and great for marketing professionals as well.