Enphase Energy, the leading solar microinverter manufacturer, posted yet another strong quarter, with Q1 revenue in line with guidance.

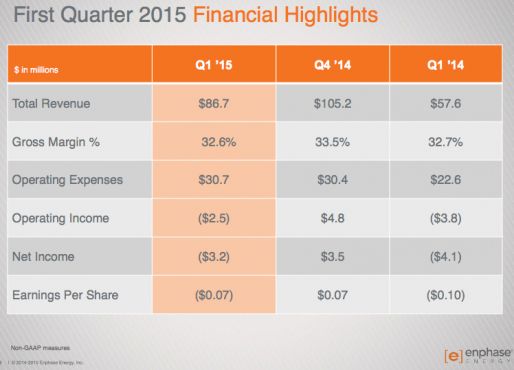

- Revenue was up 50 percent year-over-year to $86.65 million in the first quarter

- Enphase shipped 162 megawatts (AC) or 719,000 microinverters, a 74 percent increase from Q1 2014

- GAAP gross margin for the first quarter of 2015 was 32.3 percent

- GAAP net loss for the first quarter of 2015 was $6.3 million

- International revenue was up 52 percent year-over-year

- The company has shipped more than 8 million microinverters since its founding

The U.S. residential market continues to show strength, and Enphase is seeing strong growth in Australia as well. The company sees its main competition as string inverters and is adapting to a multiple-source situation at its largest customer, Vivint, once a single-source situation. A year ago, in the first quarter of 2014, Vivint accounted for 22 percent of Enphase's total revenue. In the first quarter of 2015, this was reduced to 17 percent of total revenue.

As we've reported, Enphase has introduced an energy storage system and a home energy management system and has moved fully into the operations and maintenance business with its $2.5 million acquisition of O&M firm Next Phase Solar.

Although the Tesla name was not uttered aloud, Enphase did remind the analysts that it too has a storage entry. "So because of all that, we feel that the installation -- the ease of installation [and] the cost of installation -- is going to be much less than with some potentially competing solutions. In addition to that, as we look at the total system cost, we are very, very comfortable that we'll be extremely cost-competitive with what's out there," said Paul Nahi, Enphase CEO, of his firm's storage offering, which is now in the testing phase.

On competition, Nahi said, "So the competitive environment today...doesn't look very much different than it did last year or the year before. Our competition is primarily [string] inverters with or without DC optimizers, and we continue to increase our market share against the [string] inverters...because of the value proposition of a microinverter. In fact, if you look at the market that we are currently in, let's say Australia specifically, the demand for storage there is robust, and it's driven by a very clear economic model. Our current presence in Australia is going to give us a tremendous launching platform for the AC Battery solution, as well as other countries."

Canaccord Genuity analyst Jed Dorsheimer lowered his price target to $16.00 from $18.00 and said, “While we have some concerns over potential challenges in a post-2017 tax equity environment, demand in the near term remains strong and allays some of our concerns. Competitive pressures from other MLPE solutions are not having an effect on microinverter sales yet. We believe the competitive risks are reflected in the shares.”

GTM Research inverter analyst Scott Moskowitz chimes in: "This was another great quarter for Enphase as it continues to grow its shipments and revenue. Gross margins were on the high end of the guidance, but are the lowest since Q3 '13. Enphase expresses that this is as a result of a strengthening U.S. dollar, so the market could forgive the percentage point."

Moskowitz continues: "It is notable that revenue per watt dropped 8.4 percent compared to Q4 and 13.5 percent in comparison to Q1 of last year. Sales of accessories were lower in Q1, and this was a main contributor to that change. Enphase states that it expects declines of 10 percent in ASP on an annual basis. However, there are other factors at play that will exacerbate this moving forward. The first is pricing pressure from competitors ABB and SolarEdge, which only increases now that SolarEdge is public and continuing to grow. The second is the commencement of commercial shipments of the C250, which will naturally come in at a lower price. The devaluation of the euro and the low pricing environment in Europe also contribute here, as Enphase has increased its presence in those markets."

Q2 2015 guidance

"We expect revenue for the second quarter of 2015 to be within a range of $100 million to $105 million," said CFO Kris Sennesael. "We expect gross margin to be within a range of 30 percent to 32 percent. As foreign exchange rates continue to deteriorate, we included in this outlook a negative impact on revenue of approximately $2.5 million to $3 million, and a negative impact on gross margin of approximately 2 percentage points. We also expect non-GAAP operating expenses for the second quarter of 2015 to be flat to up 2 percent, compared to the first quarter of 2015."

Note that guidance and financial highlight slides are non-GAAP.

***

Thanks to Seeking Alpha for the earnings call transcript