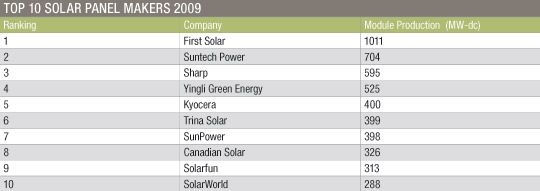

Reporting from Intersolar North America in San Francisco -- If you looked at a list of the top ten solar suppliers in the world, say, five years ago, that list would not resemble today's top five. And in this volatile and dynamic solar market, there is no reason to believe that the same five leaders are going to maintain their mantle five years from now.

Solar Frontier (formerly known as Showa Shell) and their CIGS solar panels could be one of those break-out companies. (Another break-out firm that comes to mind is Samsung.) Solar Frontier began research into CIGS thin-film solar in 1993, shipped 46 megawatts in 2009 and will ship more than that in 2010. The firm currently operates a 60-megawatt and a 20-megawatt factory.

The relatively quiet (until now, that is) firm has had product in the field since 2003 and with the backing of Shell, Showa and other big money sources has a sizable balance sheet.

The loosely used term of "bankability" in solar usually means a firm has to have more than ten megawatts built and shipped, a few years of field data, and a strong balance sheet. Solar Frontier can check off all those boxes.

And they are ready to invest billions of dollars. They're already on their way with a 900-megawatt panel factory in Miyazaki Japan.

Ashley, the newly hired COO, said "We think we're in a horse race with our cadmium telluride competitors," adding, "It will take two to three years in this race to catch them. There are competitors in the market who are intimidated. We're not intimidated." In case anyone hasn't figured it out, we're talking about solar cost leader First Solar here.

This is a new style of rhetoric for a Japanese company.

A press release from earlier this year had Showa Shell CEO Shigeaki Kameda making these ambitious efficiency claims: "While the aperture area efficiency of panels coming off of the assembly line today are at a competitive efficiency of around 13.0%, we expect to reach 14.2% when our third plant starts operating in 2011, and approach 15.0% by 2014."

The firm builds a CIGS product although the website using the term "CIS." Ichiro Sugiyama, The Deputy General Manager, assured me that it is indeed a CIGS material system. The material is processed using a "two-stage selenization" system. Most CIGS companies use a cadmium sulfide (CdS) buffer layer, but Solar Frontier uses a zinc compoun,d which eliminates the need to deal with the less than environmentally friendly element cadmium.

The firm is involved with a one-megawatt installation in Spain that is soon growing to three megawatts and a ten-megawatt installation in Saudi Arabia. Factory capex is $1 per watt according to Ashley, the COO. The firm is not releasing dollar-per-watt module information until the larger plant is "up and running." Ucilia Wang, in her new blog, gives some background on Gregory Ashley, the VP at the firm.

If Solar Frontier can meet the efficiency claims and time frame they target, they will be a company to watch. That type of performance would validate the potential of CIGS and explain why even First Solar has a fifty-person CIGS initiative in Silicon Valley.