Back in February, Greentech Media took a look at 2012 investment trends across a broad range of technologies and businesses that could be considered part of the smart grid. Amidst a general decline in post-stimulus utility spending and shrinking venture capital investment, we observed two key emerging trends:

1) VC funding for companies reliant on big utility capital spending (smart metering, distribution automation, etc.) has gone away, and unless there’s some huge government stimulus or regulatory push to reboot that market, it’s not likely to return anytime soon. That, in turn, will put pressure on the remaining VC-backed hardware and equipment vendors to find exits, whether through public offerings or acquisitions.

2) Future smart grid investment will be focused on managing the emerging challenges on the grid. That includes software and data analytics to integrate smart grid systems at the utility level, as well as energy storage, efficiency, energy management, building automation and other technologies that offer benefits not only to utilities, but also to their customers.

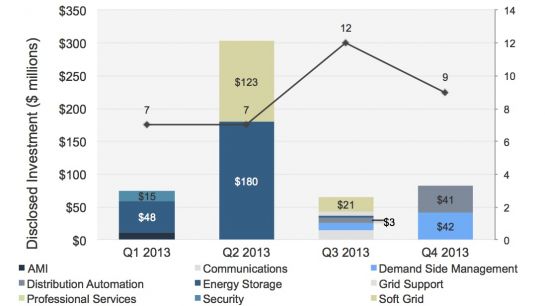

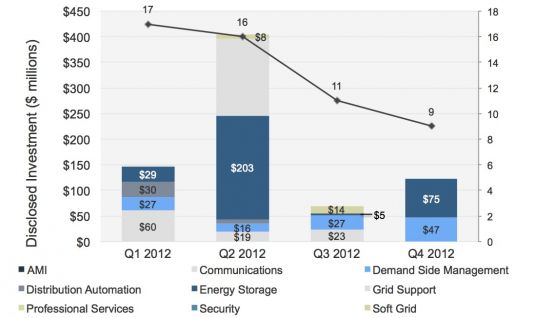

It looks like the past twelve months have proven out these premises. According to a GTM Research tally of smart grid VC and corporate M&A activity for the year, 2013 saw a big drop in investment across both categories, as well as a shift from traditional definitions of what’s part of the smart grid and a new focus on investments into what more properly belongs in a new category that we’ve described as the “grid edge.” Here’s a tally of 2013’s venture capital investment into a set of grid-related technology sectors, which reveals the shift in emphasis from utility-centric technologies.

Smart Grid VC Funding, 2013

Also notable is the drop in both funding amounts and number of investments compared to 2012:

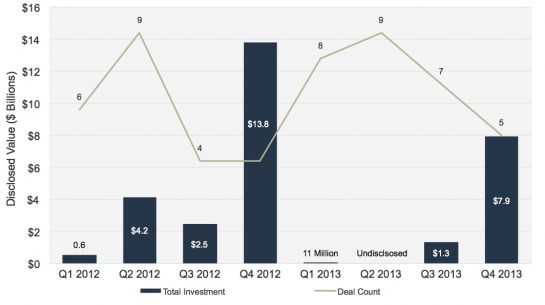

Meanwhile, merger and acquisition activity in the smart grid space saw a decline in deal count and valuations from 2012 to 2013, as this chart indicates:

Smart Grid M&A Activity, 2012-2013

Over the past several years, we’ve seen global companies such as Siemens, ABB, General Electric, Alstom, Toshiba, Schneider Electric, Honeywell, Johnson Controls, and others busily snapping up startups to fill out their portfolios. But the biggest deal of 2013, Schneider Electric’s purchase of Invensys, doesn’t match the scale of 2012 deals like Eaton’s $11.8 billion purchase of Cooper Industries.

A Narrowing Field for Smart Grid Tech, With Breakouts on the Horizon

On the VC investing front, it’s noteworthy that smart grid communications and smart metering, a sector that saw immense investment in years past, saw only $15 million raised in 2013, compared to $102 million raised in 2012. The only communications company with a significant VC investment in the sector was On-Ramp Wireless, a San Diego, Calif.-based startup with technology that promises significant advances on the wireless mesh and cellular systems that now dominate the utility landscape.

In the meantime, 2013’s sole smart grid IPO marked the emergence of a preeminent smart grid networking startup, Silver Spring Networks, into a class of its own. The Redwood City, Calif.-based company’s $81 million March public offering remains a standout exit in a field that has otherwise yielded less-lucrative exits by way of acquisition for other grid communications and networking contenders.

Distribution automation saw a bit more VC attention, with $49 million invested through 2013, compared to $39 million in 2012. This year’s funding was focused on startups that are promising significant advances on existing technologies for monitoring and controlling the distribution grid. Two startups receiving significant funding -- Varentec and Gridco Systems -- are developing power electronics systems that are as yet untested in the distribution grid space today, while the third, Utilidata, is applying integrated sensor and software control systems for volt/VAR control in ways that also challenge existing methods on the low- and medium-voltage grid.

In the meantime, consolidation remains the name of the game on the DA side of the grid, with several smaller-scale acquisitions, such as Qualitrol’s purchase of BPL Global and Ormazabal’s acquisition of Current, narrowing the competitive field in the sector.

Beyond these few fundings, the bulk of 2013’s smart grid VC investments were aimed at three key sectors: energy storage; demand-side energy management; and grid software, analytics and security services that fall under the umbrella of “soft grid.” Let’s break down both categories to see where the action was.

Energy Storage on the Verge of New Markets, Increased Competition

Looking at the size and scope of deals, it’s noteworthy that energy storage -- a technology group that includes fuel cells as well as batteries, compressed air and thermal energy storage -- has consistently landed the largest investments over the past two years. Energy storage garnered $231 million in VC investment in 2013, compared to $302 million in 2012, and also includes the single largest funding of the year, the $130 million put into fuel cell maker Bloom Energy.

Other energy storage startups landing significant investments include fuel-cell maker ClearEdge Power, compressed air energy storage startup LightSail Energy, and four battery storage vendors. The first, Xtreme Power, has installed nearly 100 megawatts of its battery technology in grid-scale deployments. But it has also shifted away from making its own batteries to supplying the software systems to integrate other batteries into the grid, indicating the challenges involved in scaling up untested technologies in competition with established lithium-ion vendors.

The other three battery startups that landed VC investment in 2013 -- Eos Energy, Aquion Energy and Gridtential -- are promising innovative battery chemistries but still have years ahead before reaching scale.

Demand-Side Energy Management Growing, From Homes to Portfolios

Monitoring and managing energy within buildings is an integral part of the smart grid equation, and 2013’s VC investment record shows how this linkage is growing. Demand-side management startups raked in $52 million in venture capital investment in 2013, compared to $117 million in 2012. Companies winning investment in 2013 included GreenWave Reality, EcoFactor, Bidgely and Tado on the home energy management side, and FirstFuel, Optimum Energy, EnTouch, Aircuity and Building Robotics on the building management side.

Demand-side management also saw some significant acquisitions, including Toshiba’s purchase of Consert for home energy management, and NRG Energy’s acquisition of Energy Curtailment Specialists for demand response aggregation.

At the same time, many of the biggest investments into the building energy management space -- and one of the notable IPOs of the year -- stand out as being only tangentially linked to grid integration. Blackstone Group’s $2 billion acquisition of Vivint, a company that has bridged from home security into rooftop solar, energy management and internet service, stands out as centered on homeowners, rather than utility needs. And Control4, the home energy management company that raised $64 million in its August IPO, did so after specifically backing away from its utility-connected business efforts.

The Soft Grid: Connecting the New World of Grid Data

With the first wave of smart grid deployments now in the field, the utility industry is turning to software providers large and small to help make use of all this new technology. Startups in this space raised a collective $159 million in VC funding in 2013, marking a significant increase from $44 million in 2012.

But while some of the companies on this list are specifically focused on the utility and energy sector, many are applying their big-data analytical chops to a much broader set of industries. Two significant investments -- General Electric’s $105 million investment in Pivotal, a provider of cloud-based analytics, and the $66 million raised by TOA Technologies, a provider of mobile workforce management software -- fall into this category. Another significant grid analytics integration player, Space-Time Insight, raised $20 million both to deepen its utility-facing operations and expand into other industries.

Other grid data analytics investments included the $15 million raised by C3 Energy, $3 million raised by WegoWise, $1 million raised by Trove Predictive Data Science (formerly named GridGlo), and an undisclosed investment in Bit Stew. Meanwhile, cybersecurity is emerging as an important focus for smart grid-enabled utilities, driving investment in startups including Cylance and GridCOM Technologies.