Silver Spring Networks (SSNI) on Monday reported fourth-quarter and full-year 2013 financial results that, if disappointing compared to previous goals, still showed a strong growth path for the smart grid networking company. That includes a new customer in Hawaiian Electric Co., and two more undisclosed contract wins that bring the company’s backlog to close to $1 billion -- as well as a promise that its newly launched SilverLink Sensor Network is being tested out by multiple utility partners.

The Redwood City, Calif.-based company saw 2013 revenues grow 13 percent compared to the previous year -- lower than the 18 percent year-over-year revenue growth it had projected as recently as October. But that’s what the market was expecting after a Jan. 17 warning from the company that several delayed contracts would cause it to fall short of those projections.

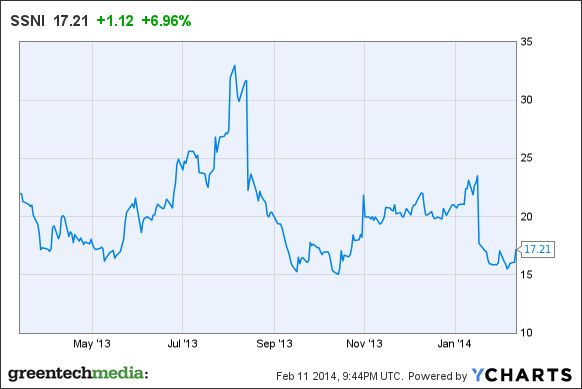

Shares of Silver Spring, traded on the New York Stock Exchange, were up 10 cents, or less than 1 percent, to $16.09 as of market close Monday afternoon. The company’s stock price took a significant hit after its January warning, losing roughly a quarter of its value. But with that news out of the way, it appears that Monday’s report did little to surprise investors.

In the meantime, Silver Spring laid out some new business that could boost its fortunes. First, the company reported that Hawaiian Electric Co. (HECO) has chosen Silver Spring for the initial phase of “one of the country’s most extensive smart grid programs.” While the company didn’t provide details on how many meters or other endpoints were represented in the deal, or about dollar figures associated with the upcoming deployment, it did reveal that it would include advanced metering infrastructure (AMI), as well as customer energy management portals, direct load control, volt/VAR optimization, prepayment, and distributed generation integration.

Those are some of the many services, including outage detection and fault location, demand response and customer engagement, and distribution automation networking, that Silver Spring provides for different U.S. utility customers over its core smart meter network. In Hawaii, it has been working on a smart grid demonstration project with HECO utility Maui Electric since 2011, and in October announced it was integrating solar inverters with its network -- an important feature that’s being pursued by a number of smart metering competitors as well.

Silver Spring has also won two more unnamed utility customers, representing 9 million homes and businesses, on top of its 18.2 million smart meters and other endpoints it has networked to date, said CEO Scott Lang during a Monday conference call. That brings the company’s backlog to just under $1 billion -- up from about $875 million at year end, which was itself up 17 percent from the previous year, he said. That equates to Silver Spring winning half of the smart meter business awarded in the United States this year, and bring it one-third of the country’s total AMI market share, he said.

The company's new SilverLink Sensor Network offering enables the smart meters, sensors, data collection nodes and other end devices it networks to serve as distributed computing and data analysis platforms. Lang said that SilverLink now has 26 different applications available in its “apps store,” including demonstration apps like voltage monitoring, home energy disaggregation, and smartphone apps for remote thermostat programming.

It’s also expanding its work beyond the six initial partners it named in its January launch, to include both third-party applications developers and APIs to connect to meter data management system (MDMS) vendors like Oracle and Itron -- an important move for an AMI vendor that works with a variety of MDMS platforms. Finally, Lang said that several utility partners plan to implement SilverLink Sensor Network applications “at scale” in the first half of 2014, though he didn't provide more details.

“The model will be...like an iTune-ish model, but instead of purchasing the software, we’ll have a recurring revenues model,” Lang said. “We’ll be able to monetize on a per-endpoint basis.” Expanding the reach of this new platform should help improve Silver Spring’s share of revenues that come from recurring software-as-a-service (SaaS) and managed services, as opposed to one-time revenues from deployments and software licenses, he said. The company reported 2013 services revenue of $102.5 million, up from $34.1 million in the previous year, while product revenue rose to $224.3 million in 2013, up from $162.6 million in 2012.

In terms of broader financial goals, Chief Financial Officer Jim Burns said on Monday’s conference call that the first half of 2014 was expected to be slower going, with revenue growth in the 5 percent to 8 percent range. But that’s expected to increase to 15 percent to 18 percent growth in the second half of the year, and Silver Spring is maintaining its 2015 goals to reach 20 percent revenue growth and 20 percent operating margins in that year, he said.

The company generated breakeven operating cash flow for 2013 and ended the year with $145.9 million in cash and investments and no debt. Here’s a breakdown of key metrics for fiscal year 2013, separated into GAAP figures, as well as the non-GAAP financials, known as “acceptance accounting,” which Silver Spring uses to represent product and service revenues from utility customers that aren’t yet accountable under GAAP rules.

- Non-GAAP revenue: $344.1 million, up 13 percent from the prior year

- GAAP revenue: $326.9 million, up 66 percent from 2012

- Non-GAAP gross margin: 33.1 percent, as compared with 33.9 percent in 2012

- GAAP gross margin: 35.3 percent as compared to 16.1 percent a year ago

- Non-GAAP net loss: $3.1 million as compared with $5.7 million a year ago

- GAAP net loss: $66.8 million as compared with $89.7 million a year ago (GAAP net loss includes non-cash charges of $42.1 million in connection with Silver Spring’s initial public offering)

- Non-GAAP net loss per share: $0.08, compared to $1.56 in 2012

- GAAP net loss per share: $4.53, compared to $24.45 in the previous year

Silver Spring has completed multi-million-smart-meter networking deployments with Florida Power & Light, Pacific Gas & Electric, Pepco, Oklahoma Gas & Electric, and Baltimore Gas & Electric, and it has upcoming deployments with Commonwealth Edison, Progress Energy, AEP Ohio and San Antonio, Texas municipal utility CPS, among others. Internationally, it has large-scale deployments in Australia, is expanding its work in New Zealand, and has a potentially large deployment being planned by Brazilian utility CPFL Energia, as well as smaller-scale pilots underway in Portugal and Singapore.

Lang noted that a recent decision by a pan-European regulatory body, CEPT, to free up unlicensed spectrum for wireless machine-to-machine networks could help Silver Spring win more contracts on the continent. That’s because Silver Spring’s core 900-megahertz mesh networks in use in the United States, Australia, New Zealand, Brazil and Singapore can’t be used in other markets where those frequencies are restricted.