The California Solar Initiative (CSI) is approaching its goals. Look what it has done.

CSI was made law by 2006’s Senate Bill 1, the combined design of California Public Utilities Commission (CPUC) work and Governor Arnold Schwarzenegger’s “million solar roofs” vision.

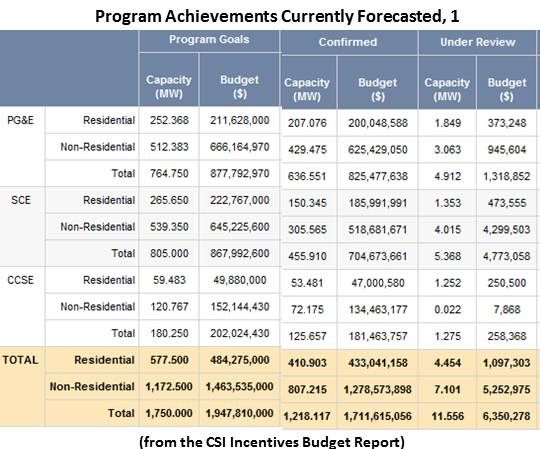

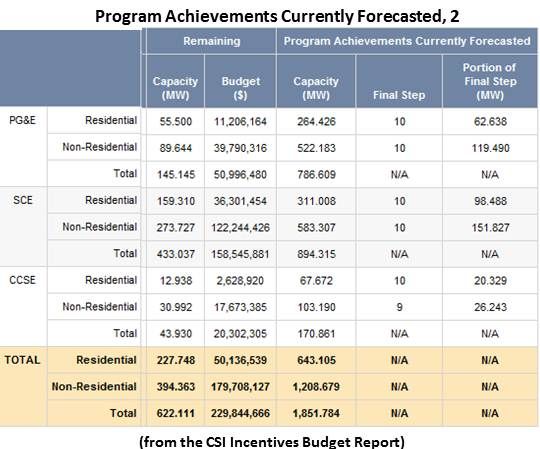

It had two initial goals, according to CSI Senior Regulatory Analyst James Loewen. One was to build 1,940 megawatts of solar in California in supported system allotments of one kilowatt to one megawatt. A General Market Program of 1,750 megawatts was aimed at residential and non-residential settings and another 190 megawatts targeted low-income settings. The other goal, Loewen said, was to transform the solar market and make solar “sustainable, vibrant and even mainstream.”

The California Energy Commission (CEC) was budgeted at approximately $400 million to oversee the New Solar Homes Partnership (NSHP), intended to increase installations of new-home solar systems in the territories of the three major California investor-owned utilities (IOUs), Pacific Gas and Electric (PG&E), Southern California Edison (SCE) and San Diego Gas and Electric (SDG&E),.

A voluntary program for publicly owned utilities (POUs) was budgeted at almost $800 million.

The CPUC was allotted the balance of the funding, approximately $2.2 billion, to oversee new and retrofit non-residential solar and residential retrofits in the IOU territories.

The program has six segments, one residential (up to ten kilowatts) and one non-residential (ten kilowatts to one megawatt) for each of the IOUs, with the SDG&E segments administered by the California Center for Sustainable Energy (CCSE).

Unlike programs before it “that lowered rebate rates when the money started to get depleted,” Loewen said, “the CSI program built in step-downs in accordance not with a time schedule but with a megawatts-achieved schedule.” That, he said, “gives you budget control and stability.”

Rebates are paid in two ways. There is a payment on installation of a system and a second payment made monthly that is based on the customer’s meter reading.

Paradoxically, it is difficult to simply say how close CSI is to its endpoint, but thanks to a web tool Loewen helped create, it is easy to quantify how far along it is.

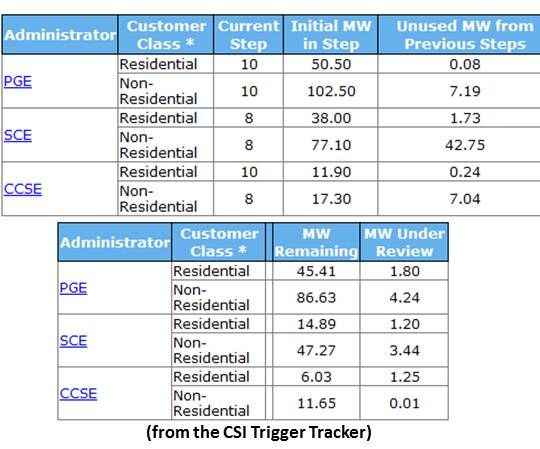

“The six sub-programs in the General Market Program,” he explained, “are at different points, because they all step down independently. You can get the blow-by-blow, day-to-day, at a website we call Trigger Tracker.”

Trigger Tracker is one of many interactive graphs and charts at Go Solar California Solar Statistics website’s Solar Initiative Rebates page. It shows PG&E to be in the tenth and final residential step (45.41 megawatts to go) and non-residential (86.63 megawatts to go) steps. CCSE is in the tenth step of residential (6.14 megawatts to go), but only the eighth step of non-residential (11.65 megawatts to go) programs. SCE is in the eighth step of both (14.89 megawatts to go in residential, 47.27 megawatts in non-residential).

PG&E customers and SDG&E residential customers don’t have much opportunity left to capture CSI rebates, but SDG&E non-residential customers and SCE customers still have some leeway.

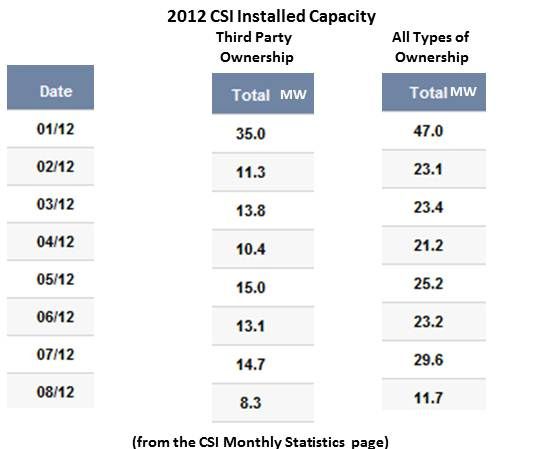

Another example of the information the interactive data holds is shown on the Monthly Statistics page. It allows the tracking of the recent dramatic rise of third-party-owned (TPO) systems. Switching from 2012 bar graphs to 2012 charts that compare TPO versus All Types of Ownership quickly shows the bulk of systems this year being financed by third parties.

_540_449_80.jpg)

_540_449_80.jpg)

Table One on the CSI Incentives Budget Report, Loewen pointed out, shows that the state is on track to meet the program’s goals. And, Loewen pointed out, “even though the megawatts are going up, the dollars going out the door are going down because the rebates are so much lower.”

CSI is on track, Loewen said, to meet its 1,750 megawatts of installed solar goal. And, for three general reasons, he is optimistic about achieving the market transformation goal. “First, costs are coming down,” he said. “Second, the third-party ownership model is growing, which is removing the upfront costs hurdle, and, third, the investment tax credit (ITC) will stay at 30 percent through 2016.”

Net energy metering, Loewen said of the incentive that preceded the CSI program and appears to be intact despite recent controversy, “is also a real sustaining feature for the market, because participants are paid for the energy their systems send to the grid at the retail rate, and that is a good rate to be getting.”

Loewen expressed one long-term concern. “There is a very close relationship between the third-party-owner model and the ITC. When the ITC goes down from 30 percent to 10 percent after 2016, it will be very interesting to see what impact it has.”

Loewen did not see the change in the ITC, the current consolidation in solar manufacturing, the new import tariffs on Chinese modules or any other factors driving the price up. “There is enough competition out there,” he said. "I see prices continuing to move down.”

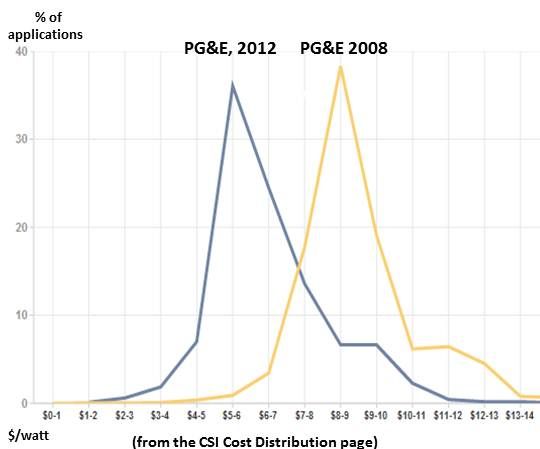

There may be no better measure of CSI’s success, and how right Loewen was, than a compelling graph generated on the Cost Distribution page. Setting the Series One options bar for PG&E in 2012 and the Series Two bar for PG&E in 2008 produced a graph with two peaks. One peak indicated the bulk of systems in 2008 cost $8 to $9 per watt. The other showed that the bulk of systems in 2012 cost $5 to $6 per watt.