The new numbers for solar PV’s Q2, just reported by GTM Research and the Solar Energy Industry Association (SEIA), make solar, according to SEIA President Rhone Resch, “the fastest growing industry in the United States.”

Resch kicked off the opening session of Solar Power International (SPI) 2012 by briefly recounting those numbers: 742 megawatts installed in 2Q 2012, a 45 percent jump over the first quarter and twice the Q2 2011 total.

Solar’s total installed U.S. capacity is now 5,700 megawatts, he said, and there are 3,400 megawatts under construction. The 2012 total PV installed capacity for the U.S. is projected to be 3,200 megawatts, 71 percent higher than the 2011 total.

More important for the long term, Resch noted, is the fact that the weighted national average system cost fell 10 percent from Q1.

Resch then turned to more sobering news. “Our industry is under direct attack on multiple fronts,” he told the audience of solar professionals. Funded, Resch said, by the fossil industries generally and the Koch brothers specifically, 81 percent of negative conservative Super PAC attack ads have assaulted renewables.

Renewable energy tax credits have become a political issue, he added. Bills to roll back solar’s federal investment tax credit (ITC) and wind’s production tax credit (PTC) have been introduced in Congress. One sponsor is Republican Vice Presidential candidate Paul Ryan.

Ryan’s controversial budget proposal would also end all incentives to renewables, and Ryan’s running mate, Republican Presidential nominee Mitt Romney has stated his intention, if elected, to do the same.

Perhaps even more threatening, Resch said, the October 2012 issue of Consumer Reports will put residential solar at the top of its updated list of consumer scams.

“A new twist on the home-improvement scam targets folks who want to cut their energy bills,” the article reports. “Solar energy, of course, can reduce your electric bill. But making the big upfront investment is the equivalent of paying for 30 to 40 years of electricity in advance. And lots of variables can confound payback.”

Unaware consumers, the piece explains, “give double-dealers an opportunity to … lure you into paying a big deposit to a contractor who skips town or otherwise never delivers.”

Consumer Reports acknowledges this really is not about solar, but about crooks.

“Home-improvement companies are the third most complained about businesses … [so] work only with licensed contractors specializing in solar installation. Conduct an energy audit and get bids from at least three companies. Check their Better Business Bureau rating and references. Never pay the full price upfront or [make] a deposit of more than $1,000 or 10 percent of the project price.”

Another budding scandal will also, Resch said, cast a shadow on the solar industry.

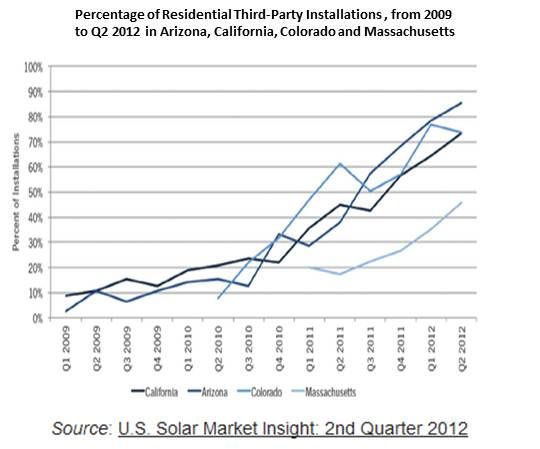

The remarkable growth recounted in the new numbers has been driven by two prominent factors: falling solar system costs and innovative third-party ownership (TPO) financing models.

TPO models have created a boom in residential and commercial solar installation but they are largely dependent on the ITC and other tax incentives. The long-term success of the industry rests on its ability to keep driving down costs after the manufacturing sector rights itself in the wake of the glut of imported, low-cost Chinese modules.

But, Resch explained, those who benefit from the ITC benefit more when the system price is high. Some stand accused of inflating numbers to that end.

Called lease escalation, installers write into end users’ twenty-year contracts a slowly rising lease payment. Because they use third-party money from institutional investors to cover the high upfront costs of the solar system, end users perceive a great opportunity. “But a 10 percent lease escalation today that requires a $100 per month payment today,” Rhesch cautioned, “will require a $700 per month payment at the end of the contract.”

This practice is the result of a few companies’ greed, Resch said, but it impacts all legitimate installation and financing businesses. “SEIA will expel violators,” he promised.

In 2016, when the current 30 percent ITC diminishes to 10 percent, Resch predicted, the industry could employ 250,000 people and be building ten gigawatts every year. But to reach those heights, he said, it must police itself. “Only together can we achieve this future.”

Solar Electric Power Association (SEPA) President Julia Hamm appeared alongside Resch and also closed her opening remarks with an observation about the future, this one from former President Bill Clinton, who will give SPI’s keynote address Wednesday night. “The future is not an inheritance,” Clinton has said, “it is an opportunity and an obligation.”