SMA, the German solar inverter giant, took a 27 percent stake in Tigo Energy for $20 million, along with exclusive rights for worldwide sales of the "smart module technology TS4 Retrofit" and a seat on Tigo's board of directors. Tigo has won more than $90 million in equity funding since 2008, according to CrunchBase.

Tigo's module-level power electronics (MLPE) product platform allows solar module companies to equip their panels with a choice of:

- Bypass diodes only

- Monitoring of V, I and temperature

- Rapid shutdown plus monitoring capabilities (about an additional 2 cents per watt)

- Optimization, rapid shutdown, and monitoring capabilities (another 2 cents per watt)

In a previous interview, Zvi Alon, the CEO of Tigo, said that the company's platform was "like a USB socket," allowing different covers to be installed and customized by the installer, adding, "Not every module needs to be equipped with an additional function." Alon noted that the platform is "module- and inverter-agnostic."

"Around the world, over a billion solar modules have been installed that cannot be individually monitored. With this stake in Tigo Energy, we can, for the first time, give all solar modules intelligence -- in both existing and new plants,” said Pierre-Pascal Urbon, CEO of SMA, in a release. SMA had sales of approximately $1.1 billion in 2015.

GTM Research notes that SMA gave up its position atop the inverter-shipment rankings in 2015 to Huawei, "despite increasing its global shipments by 44 percent." SMA did bolster its leadership position in the U.S. and held onto its position at the top of the global rankings when measured by revenue. Huawei and SMA were the leading global vendors of solar photovoltaic inverters in 2015, according to preliminary findings from GTM Research’s upcoming report, The Global PV Inverter and MLPE Landscape.

FIGURE: Top 10 Global PV Inverter Vendors by Shipments and Revenue, 2015

Source: GTM Research's Global PV Inverter and MLPE Landscape

Tigo's announced customers for its modular system include Hanwha, SolarOne, JA Solar, Sunpreme, JinkoSolar and Trina Solar. Alon called the Tigo system "a market advantage instead of a SolarCity advantage."

A spokesperson for Tigo competitor SolarEdge said, "In our view, the SMA-Tigo deal is just further validation of the DC-optimized inverter architecture and its value for all segments of the PV industry."

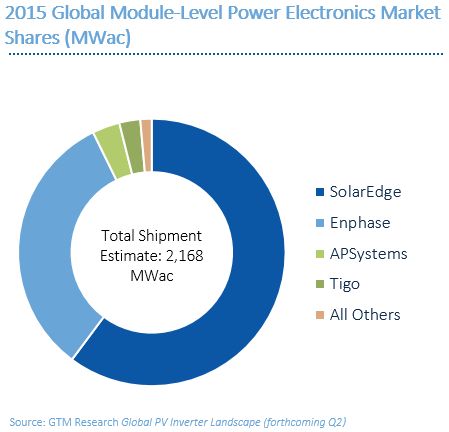

GTM Research's Scott Moskowitz, an analyst for solar markets, said, "SMA's investment in Tigo Energy is another catalyst for the module-level power electronics market, which grew 60 percent in 2015 to exceed 2 gigawatts (AC) shipped. The market has been driven by many factors, including safety requirements in the U.S., but it has primarily grown as a result of the increasing cost-competitiveness of MLPE products, performance characteristics of MLPE systems, and associated benefits to BOS costs and system design."

Moskowitz continued, "For SMA, this strategic partnership comes largely in response to the rapid growth of DC optimizer and inverter solutions provider SolarEdge, which not only controls over 60 percent of the MLPE market, but is also the leading inverter solutions provider to the U.S. residential market, according to GTM Research's U.S. PV Leaderboard. The partnership with Tigo, the second-largest global DC optimizer vendor and fourth-largest MLPE vendor overall, will enable SMA to more fully compete with SolarEdge."

An investor close to the deal suggests, "Clearly the $80M+ valuation isn't driven by potential earnings but likely access to some interesting IP. It's a costly but smart move to invest rather than acquire. SMA gets what it needs without assuming the accrued liabilities of Tigo's past operations (warranty and prepaid software support) with right-of-first-refusal and lots of knowledge of what Tigo is really worth down the road. It's the same reason why no one will acquire Enphase. The CEO has done a nice job in growing the value of Tigo back to about half of its Series D valuation."

Moskowitz adds, "Tigo's near-term exclusivity with SMA is a shift from its previous strategy of building a broad network of partners. However, working with the world's largest PV inverter supplier by revenue gives Tigo the credibility it needs to more strongly compete in the MLPE and inverter space and also allows Tigo to continue focusing on its integrated module offerings, which is a larger portion of its business and for which it is the leading OEM provider of MLPE."

FIGURE: Currently Marketed Integrated Module Partnerships

Source: Smart and AC PV Modules 2015-2020