Sunrun installed 65 megawatts of residential solar systems in the second quarter, a 69 percent jump that beat the PV installer and financier's forecast of 60 megawatts. Sunrun also beat the Street's expectations.

The company's stock price jumped 15 percent on the news.

Analysts had anticipated a loss, but instead Sunrun posted a Q2 net income of $32.6 million. The company performed similarly well on other metrics.

- Revenue grew to $122.5 million from $72.7 million a year before, besting the Street consensus of $112 million

- Bookings of 74 megawatts were up 21 percent year-over-year

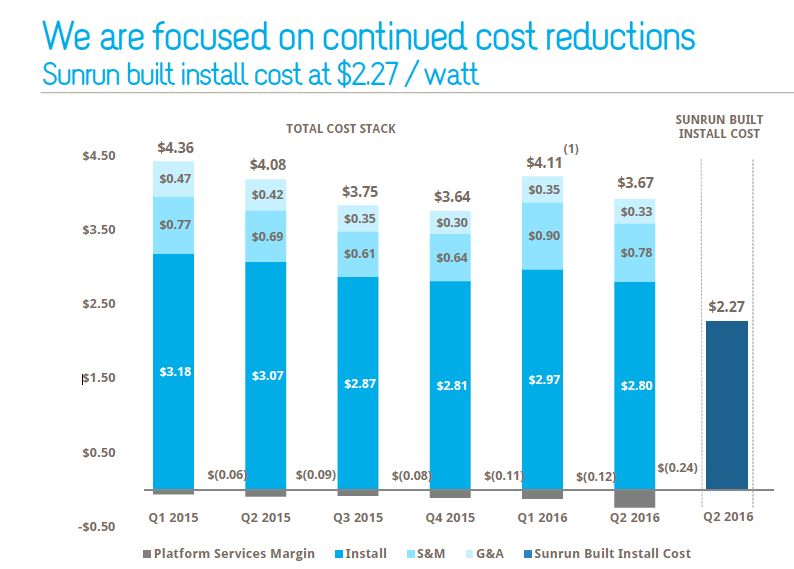

- Sunrun's "Total creation cost per watt" was $3.67, with install cost at $2.80 per watt, sales at $0.78 per watt, G&A at $0.33 per watt, "and platform services margin of $0.24 per watt." Competitor Vivint's total blended cost per watt was $2.94, down from $3.34 in the first quarter, with install cost at $2.13 per watt, sales at $0.56 per watt, and G&A at $0.25 per watt, according to its most recent earnings call.

- Sunrun has deployed a cumulative 721 megawatts, while SolarCity has cumulative installations of 2,360 megawatts

Oppenheimer Equities sees Sunrun "benefiting from several structural advantages. First, we view the multi-channel approach to deal sourcing, particularly leveraging its distribution business, as critical to its industry-leading NPV/W performance. Second, we believe its history as a finance entity has led to discipline around unit economics ahead of peers, which we believe will drive investor returns."

The investment analysts added, "Balance-sheet management continues to run ahead of residential solar peers."

2016 guidance

Sunrun is projecting Q3 deployments of 72 megawatts and cumulative 2016 deployments in the range of 270 to 280 megawatts, approximately 35 percent more than 2015 and slightly down from its previous 285-megawatt guidance.

Additionally, the company is focused on "delivering NPV of above $1/watt in the second half of this year." Net present value, or NPV, is one way to measure the profitability of its PV installs. Sunrun reported NPV of 94 cents per watt in the second quarter.

In the earnings call, Executive Chairman Ed Fenster said, "As we've stressed throughout all our earnings call, we will operate the business to cash flow and cost metrics required to optimize NPV for our shareholders, and not just deployment."

Some words from CEO Lynn Jurich and Chairman Ed Fenster

CEO Lynn Jurich noted during the earnings call, "Our industry is now approximately twice as large it was only 18 months ago. Part of this exceptional growth was created by aggressive customer acquisition across the industry to capture customers ahead of the expected ITC expiration. Growth was further boosted by market openings like Nevada." She continued, "In the month of July, we are seeing a 40 percent year-over-year increase in the number of unique homeowners who are interested and qualified for solar in the state of California."

Fenster said, "Because we've stayed focused on what our customers want and we see continued demand for leases, we have not seen our lease versus loan mix change materially. We continue to plan to use our strong capitalization to ensure that we can provide the product that homeowners want."

"In addition, our access to project capital remains strong," Fenster continued. "Principally, this is because our assets continue to perform excellently and our transactions perform as well. Over our nine-year operating history, we continue to collect $0.99 for every dollar billed. We had thousands of homeowners move, and we have, on average, retained over 99 percent of contract value in that process, even when including challenging assignments such as foreclosures and bankruptcies. Homeowners who move into these homes need electricity, and we can provide it to them at a discount."

Jurich added, "We continue to believe that the long-term growth rate for the residential solar is 20 percent to 30 percent. Having been in this business for almost a decade, we have seen significant quarterly and even annual fluctuations above and below this range, but the macrodrivers sustaining this level of growth are powerful and persist. We think that the reactions to recent results are too severe and are not appreciating the longer-term attractiveness of rooftop solar to consumers and its important role in building a modern energy infrastructure."

***

Thanks to SA for the transcript.