When Chinese-European solar trade relations escalated in a bad way last year, cooler heads prevailed, and rather than imposing tariffs, a negotiated settlement was reached.

In the current SolarWorld/U.S.-China solar trade case, it would appear we are still stuck in the anger and blame stage -- and yet to reach the bargaining stage. But there are hints of a thaw.

In January, SolarWorld announced that it had filed new anti-dumping and anti-subsidy cases against China and Taiwan with the U.S. International Trade Commission and the U.S. Department of Commerce. The new filing looks to close "a loophole" in a ruling issued in late 2012, allowing Chinese solar module firms to evade a tariff of up to a 31 percent by using solar cells manufactured outside of China.

"We're finishing the job of presenting the facts to our trade regulators to prevent China from further damaging yet another manufacturing industry and another rich base of employment," said Mukesh Dulani, president of SolarWorld Industries America, in a statement.

Recently, as part of the blame phase of this claim, CASE called on SolarWorld to explain its investment from state-supported Qatar Solar Technologies, which purchased a 29 percent stake in the struggling German SolarWorld. Jigar Shah, President of the Coalition for Affordable Solar Energy, said the company's "only leverage in the market is a complaint that has the potential to cripple the U.S. solar industry."

Shah asks, "Is this a Qatar-China trade dispute, or is there some other reason why QSTec is putting capital toward slowing the growth of the U.S. solar industry?"

In an open letter to President Obama, on behalf of CASE, Shah wrote:

“U.S. solar jobs grew by more than 20,000 in 2013, with American homeowners responding to solar’s growing affordability and the opportunity to adopt cleaner energy that saves them money on their monthly electric bills. This is the type of economic opportunity that comes once in a generation, and it is now at risk due to the reckless self-interest of one German-owned solar panel manufacturer, SolarWorld.”

SolarWorld is seeking higher tariffs in a case with the U.S. International Trade Commission that would raise solar prices for consumers, destroy demand and cripple a growing industry. The success of the U.S. solar industry and the sector’s unprecedented job growth are direct results of solar energy’s increased affordability. If successful, SolarWorld’s petition would trade thousands of U.S. solar jobs -- which are growing at a rate ten times higher than national job creation -- for the well-being of one foreign-owned company."

Last week, the ITA announced that it needed additional time to examine alleged unlawful subsidies provided to the Chinese c-Si PV (CSPV) manufacturing industry by the Chinese government. According to a note from law firm Stoel Rives, "ITA stated that the complexity of the case justified moving the case from the 'normal' investigation track for a countervailing duty (CVD) case to the 'complicated' case track under relevant law and regulations."

This pushes out the date of the ITA’s initial CVD decision to about June 2, 2014.

PV Tech reported today that "the U.S. and China are close to opening formal negotiations based on the Solar Energy Industries Association’s (SEIA) draft settlement of the ongoing solar trade dispute between the two countries, according to officials from both sides." The report quoted John Smirnow, VP of trade and competitiveness at SEIA, as saying, “We have an open dialogue with SolarWorld about trying to get a negotiation started. SolarWorld has signaled that it is open to negotiations,” adding that the SEIA's Chinese members had contributed to the proposal as well. Smirnow also said consultations with China’s Chamber of Commerce Import and Export of Machinery and Electronic Products (CCCME) were ongoing. A CCCME official was quoted as saying, "If SolarWorld has any ideas, they can communicate them to our industry."

And here's a comment from Ben Santarris, the Strategic Affairs Director at SolarWorld Industries America: “SolarWorld has always said it was open to solutions that hold China and its solar producers accountable to rules enabling fair trade. We have not seen such a proposal from them, but we remain open to possibilities. As such, we have not engaged with Chinese producers in talks."

The original draft recommendation of a U.S.-China agreement from SEIA calls for the establishment of a "U.S. solar manufacturing settlement fund" and a U.S. Solar Development Institute as well as the revocation of existing tariffs.**

GTM Research SVP Shayle Kann made this comment:

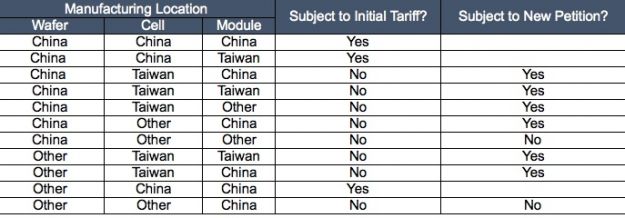

At a minimum, SolarWorld seeks import duties on Taiwanese cells, which would eliminate the Taiwan tolling strategy currently employed by most Chinese suppliers. In addition, in order to prevent Chinese manufacturers from simply shifting their cell tolling to another country, the petition also seeks tariffs on modules that use Chinese ingots or wafers, regardless of where the cell manufacturing takes place. There is one point of confusion here: the language in the last sentence is not clear on whether the module itself must be assembled in China in order for the product to be subject to the tariff. To help clarify, here is our interpretation of the petition scope:

Source: GTM Research

Kann concludes:

Of course, this could all be rendered moot if the U.S. and China were to reach a negotiated solution. This was the result in Europe and might well be the result here as well (in fact, that would be my bet). But in the meantime, we would caution not to make the mistake of taking this petition lightly -- it is likely to reshape the U.S. solar market in one way or another.

Read more of Kann's analysis of the case here.

We'll report back in June -- unless there's a move toward a settlement before that time.

***

Shayle Kann is the Senior Vice President of Research at Greentech Media, where he leads GTM Research. GTM Research clients have access to the analyst team’s ongoing coverage and analysis of the AD/CVD petition and its likely market impacts. For more information, contact Justin Freedman at [email protected].