The red tape of solar permitting can constitute a bigger part of the price of installing a rooftop solar system than the hardware itself. But it gets worse. Bureaucratic complexities can prevent people who want and can afford solar from getting a solar system.

That’s one of the big findings in a report entitled Nationwide Analysis of Solar Permitting and the Implications for Soft Costs by Clean Power Finance (CPF) Senior Policy Director James Tong, produced as part of CPF’s Department of Energy-funded effort to drive down the non-hardware (soft) costs of residential solar.

This is particularly disconcerting because falling module prices and third-party-ownership financing models are quickly eliminating other financial barriers to residential solar.

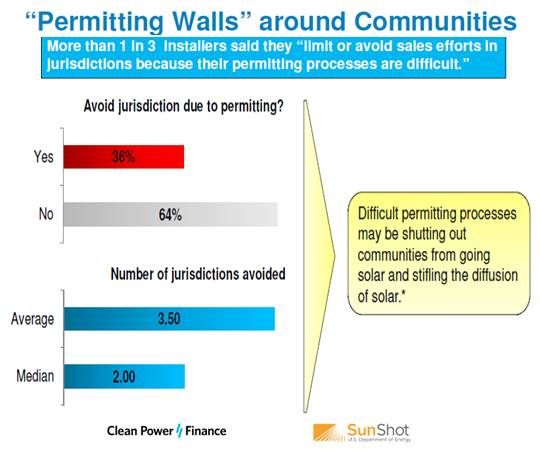

The national survey of 273 residential installers and 546 solar installations covered “90 percent of the residential solar market.” Its first and possibly most serious conclusion: One-third of installers will avoid selling solar where the Authorities Having Jurisdiction (AHJs) over permitting make the process too costly and time-consuming.

“Permitting processes are limiting the adoption of solar,” the analysis concluded. This can drive up costs. “Installer unwillingness to expand to new territories,” the survey suggested, reduces competition and leads to “market inefficiencies and potentially higher costs.”

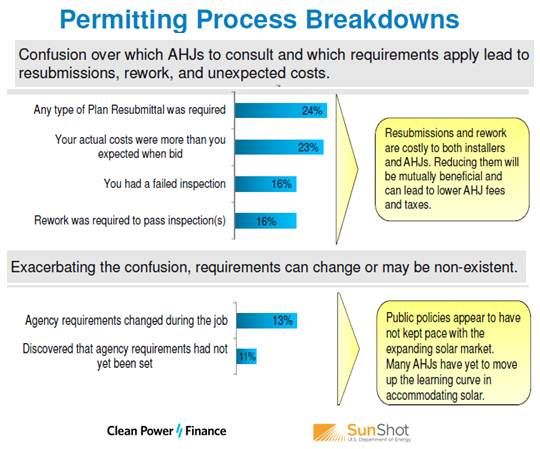

Permitting, the survey found, typically involves two to five agencies. The more agencies are involved, “the more likely there are to be mixed messages and/or different rules that result in delays and increased costs.”

More than one in ten installations (11 percent) are still in places where there are no established permitting requirements for solar.

Installers can get through the average amount of red tape in approximately 14.25 hours, that is, just under two working days. But AHJs require an average of nearly eight weeks to process an application, potentially delaying thousands of dollars of vital returns on installers’ investments in finding and closing customers and securing hardware, “both of which can impede installer profitability or force them to pass on additional costs to consumers.”

The report does not simply accuse AHJs of intentional obstruction. Flawed paperwork submitted by installers is also part of the problem, as are under-budgeted, overworked, and less-than-knowledgeable AHJs that are new to rooftop solar but serious about building safety. What is needed, the study suggested, is a channel of communication between AHJs and installers.

“Perhaps a fifth of submittal packages are poorly organized and may require hours of red-lining,” one AHJ told CPF. “This is matter of safety, not red tape,” said another.

But AHJs can do better, the survey found. “I find myself having to educate the city staff on their own requirements,” an installer complained. Authorities must be more consistent, installers reported. “AHJs can change their interpretation of existing codes and you only find out after you are about to submit your paperwork.”

The new survey is an early step toward CPF’s larger goal of creating a National Solar Permitting Database (NSPD), which it and the DOE hope will allow installers and AHJs to work together to streamline the process. Policies that will do that, Tong said, fall into three categories: (1) raising awareness, (2) identifying areas that can be improved, and (3) offering solutions AHJs can readily adopt.

Such policies include having all permitting requirements spelled out on the record in the NSPD, which should eliminate inconsistencies in the permitting process.

As AHJs become more aware of solar, they are likely to improve their own procedures. A wider scope of permitting regimes may provide a basis for more flexible permitting fee systems that reward AHJs for better performance and allow installers to obtain the services they need.

If installers understand localized standards as necessary to local conditions and not arbitrary, they might also be more flexible. And seeing AHJs from the NSPD’s larger perspective could reduce recriminations and minimize friction.

The actual cost of permitting procedures, the report acknowledged, is not entirely clear. The “average personnel cost” of “permitting per installation” was calculated at $664 (or $0.11 per watt). But this number was reported in the “Areas for Further Research” section of the study and it was called “highly suspect.” Installers, the analysis said, are too inconsistent about staff remuneration make reliable calculations.

“NREL determined personnel cost associated with permitting and inspection to be $0.13 per watt and the average fees to be $0.09 per watt for a total of $0.22 per watt,” Tong said. A recent LBNL study put it at $0.27 per watt, he added.

But there are second-order costs such as losing customers in the permitting process, having to compensate customers for a bad experience, and the potentially large cost of holding inventory longer than necessary, Tong explained. “These factors can add an additional $0.10 per watt or even more.”

“Navigating the regulatory red tape constitutes 25 percent to 30 percent of the total cost of solar installation in the United States, according to data from the National Renewable Energy Laboratory,” wrote NRG Energy (NYSE:NRG) President David Crane and Robert F. Kennedy, Jr., in a recent New York Times editorial. “It can take as little as eight days to license and install a solar system on a house in Germany.” As a result, they wrote, “more than one million Germans have installed solar panels on their roofs.”

Rooftop solar and “rational, market-based rules,” Crane and Kennedy wrote, “could turn every American into an energy entrepreneur.”