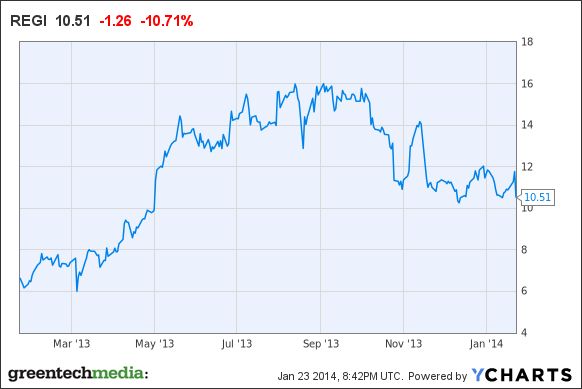

Renewable Energy Group (REGI) acquired renewable chemical technology company LS9 for what could amount to $61.5 million in cash and stock.

Renewable Energy Group is the largest biodiesel producer in the U.S. and is greatly dependent on the Renewable Fuel Standard, a biomass-based diesel mandate. REGI went public in 2012, and according to its IPO filing, "Our strategy is to optimize and grow our core biodiesel business, to diversify into renewable chemicals and additional advanced biofuels." REGI grew by acquiring smaller regional biofuel processors and now runs six biodiesel plants, with a total nameplate production capacity of 257 million gallons per year. Feedstocks at REGI include inedible animal fat, used cooking oil and inedible corn oil.

LS9 uses genetically modified E. coli to produce a variety of green chemical alternates to petroleum-derived chemicals "for large, diverse markets such as detergents and personal care, as well as renewable fuels," according to a release, which added, "LS9 is a cornerstone investment for REG Life Sciences, which also plans to develop adjacent and complementary fermentation technologies."

LS9's initial chemical products are a group of fatty alcohol and specialty esters, according to its website. In an earlier report, we covered a team of LS9 scientists that had identified genes that, when expressed in E. coli, produce alkanes, the hydrocarbons that make up gasoline, diesel and jet fuel. This discovery is the first example of a single-step conversion of sugar to fuel‐grade alkanes by a "designer" microorganism, according to the company.

A source close to the deal said that LS9 was "underhyped" compared to the other entrants in the biochem filed, adding that the firm had a flexible platform that had been focused on chemicals rather than fuel for a long time. The source viewed the deal as good for REGI, which needs to diversify out of first-generation biofuels, and good for LS9, which gets access to REGI's balance sheet and supply channels.

The acquisition was not that good for the VC investors in LS9.

LS9 was founded in 2005 and has received more than $75 million in funding from Chevron Technology Ventures, Flagship Ventures, Khosla Ventures, and Lightspeed Venture Partners. (Peter Nieh at Lightspeed gets to record another venture exit; last week it was Nest.)

In the last decade, a crowd of next-generation biofuel firms including Algenol, Amyris, Aurora, Bard, Cobalt, Codexis, Gevo, Joule, Qteros, Sapphire Energy, Solazyme, Synthetic Genomics, Terrabon, UOP, and Virent promised to coax fuel from bacteria, algae, or by other means. Most of the firms have had to pivot away from fuels to focus on chemicals, catalysts, or creatures. Most of the firms that made it through the IPO window remain thinly traded development-stage companies with low visibility into profitability.