Fuel cells were first demonstrated in the 1830s. It took another 50 years until the physics of the flow of electrical current in the fuel cell was understood. It might take another hundred years or so until the physics of making them a volume-scale and profitable commercial business can be fully understood.

Every fuel cell start-up from MTI (recently de-listed from Nasqaq) to Protonex all the way to multi-nationals like Toshiba have promised commercial fuel-cell product for at least a decade, but few have managed to reach that goal. Toshiba and MTI have promised portable methanol fuel cells for laptops and portable electronics, not industrial-scale fuel cells like those made by Bloom Energy and Panasonic.

Maybe fuel cell vendor Neah Power Systems can alter that pattern.

I spoke with Neah Power's CEO, Dr. Chris D'Couto. D'Couto joined the firm in 2007 as Chief Operating Officer and became the CEO in 2008. Neah, originally venture-funded by Intel and Novellus, became a public firm traded on the OTCBB via a reverse merger in 2006. The firm has also received funding from the Office of Naval Research (ONR).

Neah is developing power solutions for military, industrial and consumer applications using a silicon-based design for its micro fuel cells that provides benefits such as higher power densities, lower cost and compact size. The company's micro fuel cell system can run in aerobic and anaerobic modes and is built using a manufacturing process that takes advantage of established silicon and electronic packaging methods.

Without a doubt, there are some applications for which fuel cells make perfect sense, such as premium power for the military, remote sites, construction industry, travel, etc.

However, rather than trying to do everything at once, the CEO reports that the company will be "going after specialized markets," adding that fuel cells "are never going to compete with the grid."

Neah has managed to capture a number of customers in the portable power market, including notables such as Hobie Cat, the marine craft company, and Indian scooter manufacturer Eko Vehicles. D'Couto spoke of going after "pragmatic applications" such as portable devices in regions with unreliable grids and high-end videography equipment, which often use big batteries and diesel generators for power.

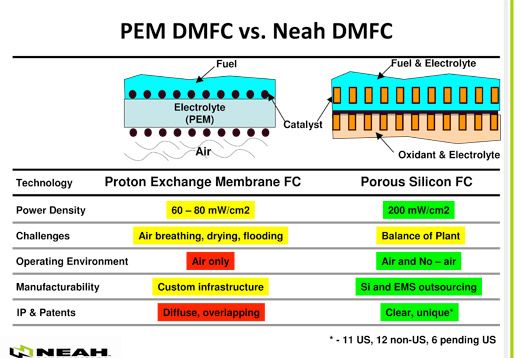

Neah's product is a Direct Methanol Fuel Cell, but instead of using a PEM (proton exchange membrane), Neah uses porous silicon with a metalized surface. The porous silicon allows for a forty-fold increase in surface area and a potentially significant increase in power density.

PEM-based fuel cells are expensive, and have low power density, short lifetimes, and ongoing reliability issues. D'Couto said, "These are the issues PEM has confronted for 30 years." According to the CEO, Neah's porous silicon alternative has demonstrated more than 2,000 hours of operation.

One of the factors driving fuel cell cost is the expensive catalyst material, which is typically platinum or palladium. Neah's thin-film deposition techniques reduce the amounts of these materials needed in the final product.

Still, it comes down to execution and cost. D'Couto believes that fuel cell pricing must be in the $1.00 to $1.50 range for widespread consumer adoption. In recent months, D'Couto has streamlined the firm, hired a skilled crew of number-crunchers, and attempted to leverage the semiconductor foundry model with which he is most familiar. Last week, Neah purchased CyVolt Energy Systems, a lithium-ion battery charger maker.

D'Couto hopes to list on the the American Exchange this year.

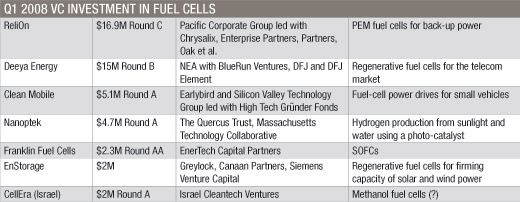

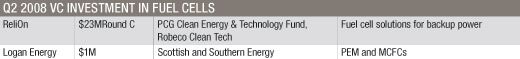

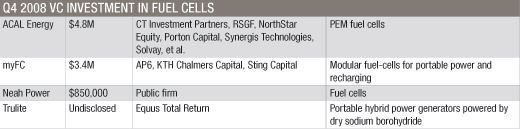

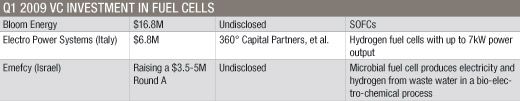

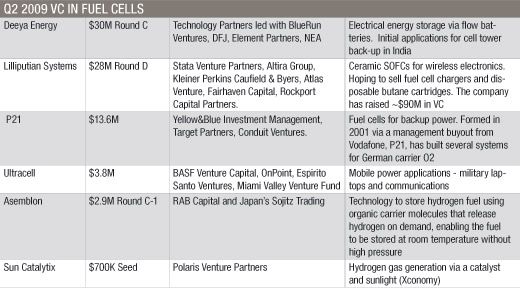

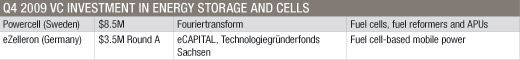

The promise of fuel cell technology remains. Take a look at the list of fuel cell companies funded by venture capital firms in 2008 and 2009:

![]()

We've seen at least one VC investment in fuel cells in 2010: ClearEdge Power builds a fuel cell that converts natural gas into heat and electricity. The start-up raised $26 million according to SEC filings -- $15 million last year and $11 million more added this year. Investors include Applied Ventures, Big Basin Ventures and Kohlberg Ventures.

Ceres Power in England has close to $75 million in the bank, and it will soon release a household fuel cell for use by utilities in the UK and Ireland that can, in part, be built from diesel engine components, according to Imperial College London professor and co-founder Nigel Brandon. Panasonic already sells 1 kilowatt fuel cells to homes in the Osaka region.